In the intricate dance of global financial markets, the 10-year Government Securities (G-Sec) spreads between the United States and India have emerged as a key metric, guiding investors and shaping the landscape of Foreign Portfolio Investor (FPI) debt investments. A notable trend has surfaced over the past two years, challenging conventional wisdom and inviting a closer examination of the complex interplay between G-Sec spreads and FPI behaviour.

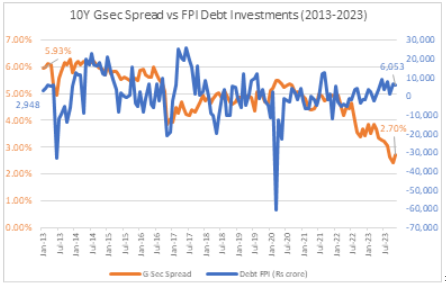

A deep dive into the data spanning from January 2013 to November 2023 reveals a fascinating narrative. Amidst fluctuating G-Sec spreads, FPI debt investments in India have exhibited a resilient trajectory. Notably, a pattern has emerged wherein decreasing G-Sec spreads coincide with an upswing in FPI debt investments.

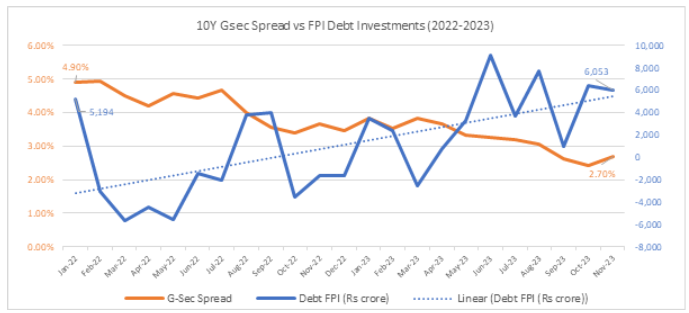

In recent years, the 10-year G-Sec spread between the USA and India has narrowed significantly. As of November 13, 2023, the spread stands at 270 basis points (bps).

The US Federal Reserve (Fed) has been raising interest rates aggressively in an effort to combat inflation. This has led to a rise in US Treasury yields.

The Reserve Bank of India (RBI) has been more cautious about raising interest rates, given the concerns about economic growth. This has led to a relatively slower rise in Indian G-Sec yields.

Source- Investing.com.

Over the past two years, a peculiar trend has emerged. Contrary to historical norms, as the 10-year G-Sec spreads between the U.S. and India have narrowed, FPI debt investments in India have experienced a pronounced surge. To unravel this enigma, a nuanced analysis is warranted.

However, increased foreign flows will also make the bond and currency markets more volatile and could push the government and central bank to intervene more actively. In navigating this complex terrain, a keen awareness of global economic shifts becomes paramount for investors seeking to decode the intricacies of contemporary financial markets.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 13, 2023, 3:28 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates