Today, the broader indices, NSE Nifty50, and BSE Sensex, ended the day in the red. The Nifty50 index opened the day at 19,027, which was 95 points lower than the previous day’s closing level of 19,122. During the intraday session, it reached an intraday high of 19,042 and a low of 18,838, ultimately concluding the day at 18,857. This represented a decrease of 265 points from the previous day’s closing level. On the other hand, the BSE Sensex index also closed the day at 63,148, marking a 900-point drop or a 1.4% decrease from its previous day’s closing level.

Among the fifty stocks, forty-six closed the session in the red, while the remaining four closed in the green. Despite the bearishness in the broader market, sixteen stocks reached their 52-week high levels among all the listed stocks on the NSE.

In this article, we will delve into the stocks that reached their 52-week highs, surged at least 10%, and hit the upper circuit, all despite the bearish sentiment prevailing in the overall market. We will also include their stock price charts in a weekly time frame.

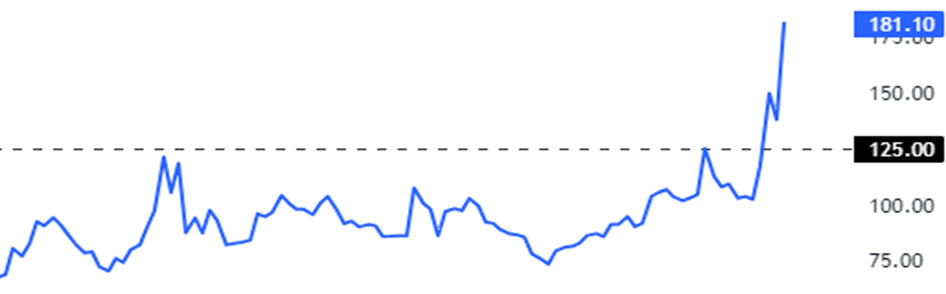

Premier Polyfilm Limited, incorporated in 1992, is actively involved in the production, export, and marketing of various products, including Calendared PVC films, Flexible Vinyl Flooring, Sheeting, and Leather cloth.

In today’s trading session, the stock opened at Rs 158.55 per share, experienced a remarkable rally of 19.99% throughout the day, and ultimately closed at Rs 181.25 per share. Notably, the stock not only reached a 52-week high but also triggered the upper circuit price limit of 20%. As a result, the company’s current market capitalisation now stands at Rs 379 crore. Furthermore, the stock has exhibited outstanding performance over the last six months, generating an impressive return of 120%.

Somi Conveyor Belting Limited is a player in the industry specializing in the manufacturing of industrial conveyor belts constructed from rubber and steel. The company was incorporated in the year 2000.

In today’s trading session, the stock opened at Rs 72.45 per share, underwent a remarkable surge of 19.99% throughout the day and ultimately closed at Rs 85.64 per share. Remarkably, the stock not only achieved a 52-week high but also triggered the upper circuit price limit of 20%. Consequently, the company’s current market capitalisation now amounts to Rs 100 crore. Additionally, the stock has displayed significant performance over the past year, delivering an impressive return of 94%.

Kapston Facilities Management Limited is actively engaged in delivering a range of services encompassing security, training, facility management, as well as housekeeping and cleaning services.

In today’s trading activity, the stock commenced the day at Rs 195 per share, witnessed a noteworthy increase of 9.99% during the day, and ultimately concluded at Rs 195.40 per share. Notably, the stock not only attained a 52-week high but also triggered the upper circuit price limit of 10%. Consequently, the company’s present market capitalisation stands at Rs 198 crore. Moreover, the stock has demonstrated remarkable performance over the past year, yielding an impressive return of 47%.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 26, 2023, 6:42 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates