Traction towards small-cap stocks has been increasing since the rally started in the Indian market, and it is evident why investors are keen to track them. Small-cap stocks have demonstrated a proven rally, outperformed other categories, and delivered impressive returns over the period.

Finding stocks on the verge of a breakout is a challenge, given the numerous stocks listed on the NSE and BSE. Identifying the right stocks at the opportune time is crucial for entering and riding the momentum. Stocks that experience multiyear breakouts typically undergo a substantial rally post-breakout, making them attractive investment opportunities. Investors can consider parking their money in these stocks to ride the ensuing rally.

In this article, we will explore three small-cap stocks that are on the verge of a breakout and could surpass their multiyear peaks any day.

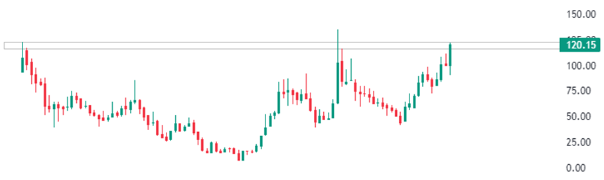

Kellton Tech Solutions Ltd provides a range of services in digital transformation, ERP, and various other IT services. The company operates across the United States, Europe, India, and the Asia-Pacific region, boasting a team of approximately 1,500 employees.

As we observe the price action on the chart, the stock is currently trading at previous peak levels, initially formed in the year 2016. Subsequently, it revisited these levels in the year 2022. Now, in February 2024, it is attempting to surpass these historical levels. This analysis is based on a monthly chart.

Considering the historical price movements, if the stock successfully breaks out of these levels, there is the potential for a substantial upward movement. The range suggests that the stock could provide returns in the range of 50% to 60% in the upcoming days only after a successful breakout from these levels. Investors and traders may find this an opportune moment to monitor the stock closely for potential trading or investment opportunities.

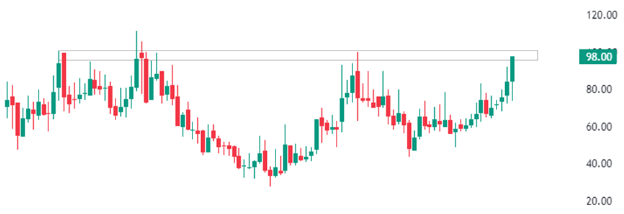

Incorporated in 1994, Umang Dairies is engaged in the manufacturing and sale of dairy products. The company is part of the J.K. Organisation and promoted by Bengal and Assam Company Limited.

Umang Dairies focuses on the procurement and processing of cow milk, utilising it to manufacture a variety of value-added products. These include cheese, butter, ghee, fresh cream, milk powder, flavoured milk, lassi, and curd.

As we observe the current stock chart of Umang Dairies and compare it to the previous company’s stock chart, a similar price action pattern is evident and it is on the verge of a breakout. Umang Dairies seems to be encountering resistance in surpassing its multiyear levels. However, a closer look at the current month’s price action suggests that the stock is showing signs of overcoming this hurdle.

The current indications imply that the stock has the potential to break through the resistance this time, paving the way for a potential rally of around 50% to 60% in the future. Investors and traders may want to closely monitor the stock for any decisive moves and consider this as a possible opportunity for favourable returns in the coming days.

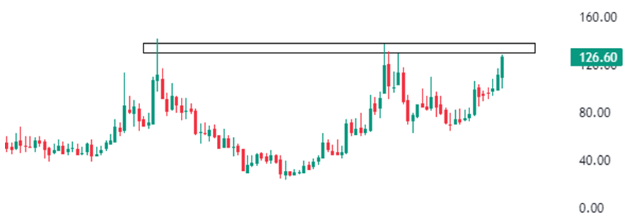

Incorporated in 1978, TT Limited engages in yarn manufacturing, knitting, and the cutting and sewing of textile products. TT Limited is a part of the TT Group, a vertically integrated textile producer and garment manufacturer.

The company’s stock is currently at its previous peak levels and is about to attempt to break the previous peak. In January and February 2022, it tried to break the previous peak but was unsuccessful. Looking at the current month’s candle, it indicates that it may break this barrier within the upcoming month, potentially leading to a rally of around 50% to 60% in the future.

Conclusion

These three stocks have been in a consolidation phase for a long time and could give a breakout any day and give a good rally. The only things investors should be aware of are the fundamentals of the company, the company’s previous financial performance, the management review, any litigation, the business model, market share among competitors, and so on.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 27, 2024, 5:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates