The Raksha Bandhan festival signifies the essence of the siblings’ bond, where sisters tie Rakhi on the wrist of brothers to protect and keep them safe from danger. With the festival just a week away, consider gifting your sisters investments and insurance that provide them with financial security. Here is a list of financial tokens you can gift your sister this festival.

1. Monthly Investments with a Systematic Investment Plan (SIP)

SIP is a way by which you can invest in your desired mutual fund. SIP investments can help your sister in achieving her ambitions, like travelling to some exotic location, having a dream home, establishing a business, her children’s education, etc. Through SIP, your sister would have benefits like disciplined investments, flexibility, diversification in the portfolio, long-term growth, etc.

2. Buy Her Digital or Paper Gold

Instead of gifting gold jewellery, such as bracelets, chains, and rings, as gifts on the occasion of Raksha Bandhan, consider giving her digital or paper gold. Physical gold not only has a significant holding cost but is also at the risk of theft. Therefore, digital alternatives prove to be safe. You could choose a gold ETF. They are open-ended funds that follow gold prices, and each unit of gold you can purchase in the fund is equivalent to 1 gram of gold. However, you must have a Demat account to buy or sell them because they are listed on the stock exchange.

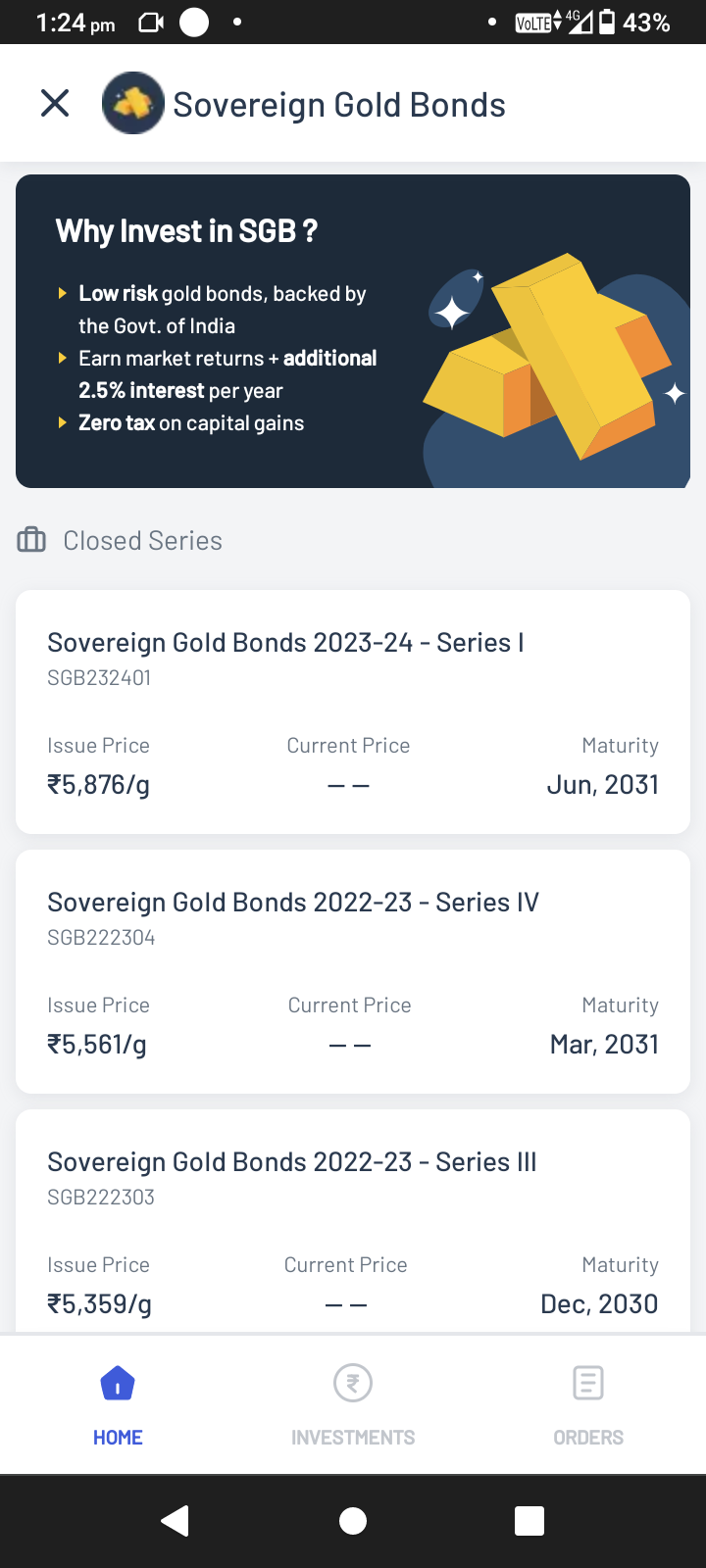

In addition, you can also opt for a Sovereign Gold Bond (SGB), which lets you buy gold on paper. SGBs come with various benefits like hassle-free storage, exemption of capital gains tax on redemption, tradability and transferability. Here is the SGB buying feature of Angel One that could help you meaningfully.

3. Push for Investments in Stocks

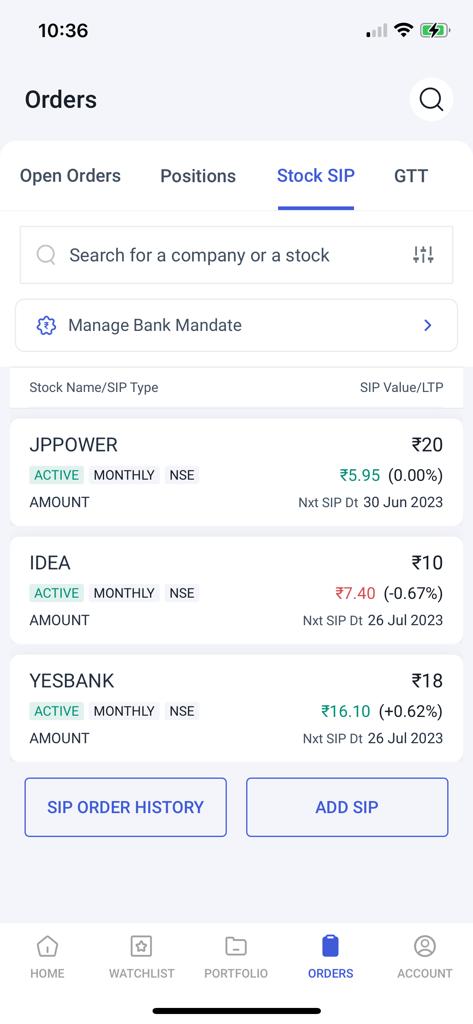

Encourage your sister to invest in the stock market to enjoy sustainable wealth over the long term. The investments in the stocks would help her outperform inflation, reach financial goals, retirement corpus, and the list goes on. In addition, stock SIP would also prove to be a cherry on the cake, with benefits like pocket-friendly investing, a disciplined way of compounding wealth, price averaging, and skipping the hassle of timing the market. The stock SIP feature at Angel One is user-friendly and seamless.

4. Investments in Bond

You can help your sister in her journey for financial security via gifting her an investment in bonds, as it will help her in making her portfolio diversified. An investment in bonds offers a stream of easy-to-predictable income, and in many situations, bonds pay interest twice a year. Since the investor receives the entire principal amount if the bond is held until maturity, these are regarded as the best strategy to protect one’s capital.

Bonds can also reduce a person’s exposure to extremely volatile stock ownership. Government bonds, corporate bonds, tax-saving bonds, and bank and PSU bonds, among other types of bonds, are all possible suitable gifts.

5. Buy Her a Health Insurance Policy

Along with emergency reserves, health insurance is a must, especially in light of the escalating expense of healthcare. Make sure she remembers that having a health insurance plan with enough coverage lowers the danger brought on by increasing medical expenses. Bless your sister with suitable health insurance this Raksha Bandhan, as it will cover all the major expenses like admission, ICU, and other charges.

Let’s push our sisters to maintain a reserve fund for their dire financial situation this Raksha Bandhan, as the past uncertain years have highlighted the importance of emergency funds. Apart from the gifts mentioned above, you can also go for some government schemes applicable to women only, such as the Mahila Samman Bachat Patra Yojana and Mahila Samman Saving Certificate Scheme. In addition, on the conservative front, Fixed Deposits, Recurring deposits, and other traditional investment methods could be gifted.

Published on: Aug 28, 2023, 5:46 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates