Stocks trading with high volumes should be kept on the radar. This not only signifies investor participation but also, if the delivery volumes increase during any period, say a week or a month, it gives more confidence to track those stocks as it indicates the money inflow in those stocks.

The Indian market has undoubtedly showcased an impressive performance during recent periods and is trading almost at its all-time highs. However, today, the market has shown a slight weakness and is trading lower than its Friday closing levels.

In this article, we are going to explore stocks priced under Rs 100 that also registered robust volumes in both trading and delivery volumes during the last week.

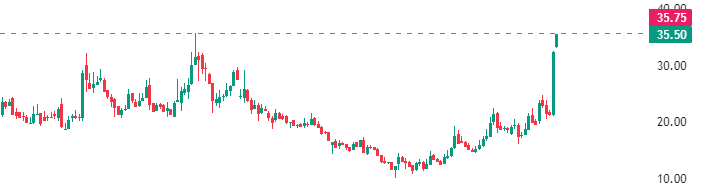

Alok Industries is a textile company with a presence in the cotton and polyester segments. The company is engaged in the manufacturing of textiles, including mending, and packing activities, as well as leather and other apparel products.

During the last week, the company’s stocks surged over 66%, and the trading volumes increased over 5 times compared to the prior week. Additionally, the delivery volumes spiked by 5 times when compared to the average of the past five weeks.

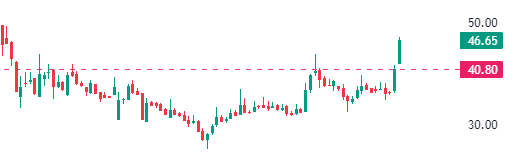

Incorporated in 1990, Trident Ltd manufactures, trades, and sells yarn, terry towels, bed sheets, and paper and chemicals.

During the last week, the company’s stocks surged over 27.6%, and the trading volumes increased over 5.11 times compared to the prior week. Additionally, the delivery volumes spiked by 3.7 times when compared to the average delivery volumes of the past five weeks.

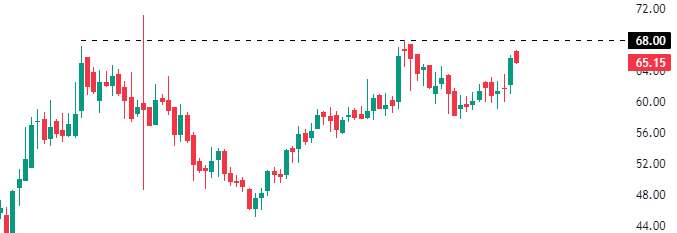

Motherson Sumi Wiring India Limited

Motherson Sumi Wiring India, a joint venture between Sumitomo Wiring Systems and Motherson Group, holds a dominant position as a market leader in the Indian wiring harness industry, boasting a market share of over 40% as per the recent update.

During the last week, the company’s stocks surged over 4%, and the trading volumes increased by around 2.75 times compared to the prior week. Additionally, the delivery volumes spiked by 2.54 times when compared to the average delivery volumes of the past five weeks.

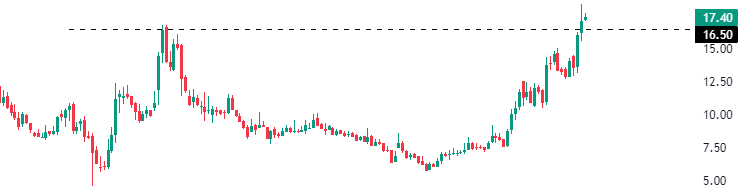

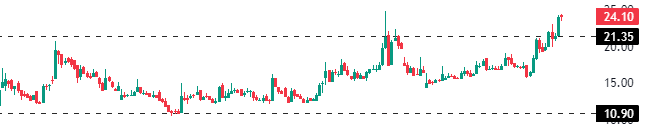

Vodafone Idea is among the prominent telecom service providers in India. The company is primarily engaged in offering Mobility and Long-Distance services, as well as trading handsets and data cards.

During the last week, the company’s stocks surged by around 1.4%, and the trading volumes increased by around 3.02 times compared to the prior week. Additionally, the delivery volumes spiked by 2.02 times when compared to the average delivery volumes of the past five weeks.

Yes Bank is engaged in providing a wide range of banking and financial services in India. During the last week, the company’s stocks surged by around 4.10%, and the trading volumes increased by around 1.90 times compared to the prior week. Additionally, the delivery volumes spiked by 1.87 times when compared to the average delivery volumes of the past five weeks.

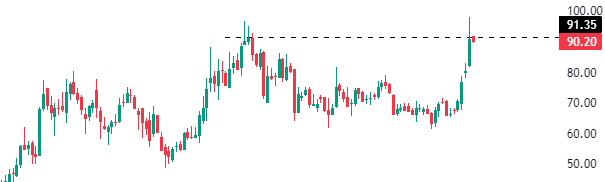

Allcargo Logistics provides integrated logistics solutions and specializes in a wide range of logistics services. These services include multimodal transport operations, inland container depot operations, container freight station operations, contract logistics operations, and project and engineering solutions.

During the last week, the company’s stocks surged over 9%, and the trading volumes increased by around 3.23 times compared to the prior week. Additionally, the delivery volumes spiked by 1.87 times when compared to the average delivery volumes of the past five weeks.

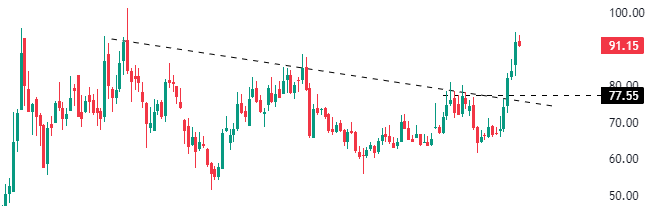

HFCL Ltd (Himachal Futuristic Communications Limited) is a diverse telecom infrastructure enabler with active interests across various sectors. Its activities include telecom infrastructure development, system integration, and the manufacturing and supply of high-end telecom equipment, optical fibre, and optic fiber cable (OFC).

During the last week, the company’s stocks surged over 8%, and the trading volumes increased by around 1.75 times compared to the prior week. Additionally, the delivery volumes spiked by 1.82 times when compared to the average delivery volumes of the past five weeks.

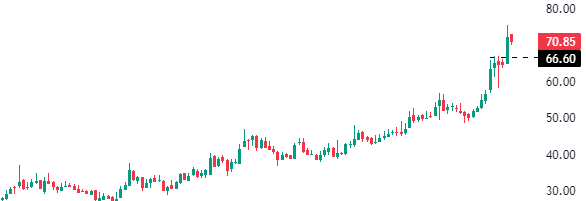

NHPC serves as the Government of India’s flagship hydroelectric generation company. The company is primarily engaged in the generation and sale of bulk power to various power utilities. Additionally, NHPC conducts other business activities such as providing project management, construction contracts, consultancy assignment services, and power trading.

During the last week, the company’s stocks surged over 6%, and the trading volumes increased by around 1.72 times compared to the prior week. Additionally, the delivery volumes spiked by 1.78 times when compared to the average delivery volumes of the past five weeks.

The company offers a comprehensive range of travel-related products and services under the flagship brand ”Ease My Trip”. It provides end-to-end travel solutions encompassing airline tickets, hotels, holiday packages, rail tickets, bus tickets, and taxis. Additionally, the company offers ancillary value-added services like travel insurance, visa processing, and tickets for activities and attractions.

During the last week, the company’s stocks surged over 7%, and the trading volumes increased by around 1.60 times compared to the prior week. Additionally, the delivery volumes spiked by 1.53 times when compared to the average delivery volumes of the past five weeks.

| Stock Name | Sector Name | CMP Rs | M Cap Rs Cr | Delivered Qty this Week | Delv Times (x) | Avg Delv Qty (5 Weeks) | Traded Qty this Week | Traded Times (x) | Avg Traded Qty (5 Weeks) |

| Alok Industries Ltd. | Textile | 35.68 | 17,715 | 196040701 | 4.98 | 129790246.2 | 727448707 | 5.60 | 39393853.8 |

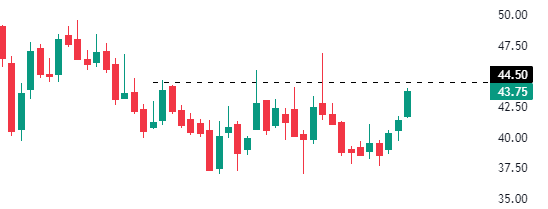

| Trident Ltd. | Textile | 46.15 | 23655.43 | 73215376 | 3.66 | 47062576.4 | 240638664 | 5.11 | 19999420.8 |

| Motherson Sumi Wiring India Ltd. | Iron & Steel | 65.39 | 28909.62 | 48891312 | 2.54 | 31658760.4 | 86964756 | 2.75 | 19232313.4 |

| Vodafone Idea Ltd. | Telecom | 17.37 | 84556.62 | 810031843 | 2.02 | 1558780119 | 4700450723 | 3.02 | 401681054.2 |

| Yes Bank Ltd. | Banking | 23.79 | 68423.79 | 646555858 | 1.87 | 1264462559 | 2406776989 | 1.90 | 346407600 |

| Allcargo Logistics Ltd. | Logistics | 90.3 | 8874.52 | 12124251 | 1.84 | 19218025.6 | 62129503 | 3.23 | 6594020 |

| HFCL Ltd. | Telecom | 91.7 | 13101.85 | 70190306 | 1.82 | 145911332.2 | 255117492 | 1.75 | 38495901.8 |

| NHPC Ltd. | Power | 70.52 | 70837.59 | 113863513 | 1.78 | 155141536 | 267612921 | 1.72 | 63834580 |

| Easy Trip Planners Ltd. | Hospitality | 42.91 | 7603.83 | 59636111 | 1.53 | 83377521.2 | 133726677 | 1.60 | 38877354.6 |

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 8, 2024, 3:36 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates