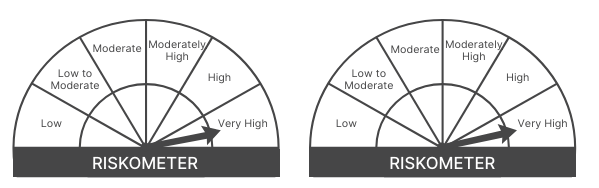

Aditya Birla Sun Life Quant Fund is an open-ended equity scheme that invests in equity and equity-linked instruments based on a quantitative model for long-term capital appreciation. The scheme comes with a risk profile similar to the Nifty 200 TRI index. Investors unsure about the suitability of this product for their goals should consult a financial advisor. The risk profile assigned is based on initial assessment and may vary once the actual investments are made. The fund offers units of Rs. 10 each during the New Fund Offer (June 10th – June 24th, 2024) and will subsequently re-open for continuous offer at net asset-based prices within 5 business days from the allotment date.

The investment objective of the Aditya Birla Sun Life Quant Fund is to generate long-term capital appreciation by investing in equity and equity-related securities based on a quant model theme. The Scheme does not guarantee/indicate any returns. There is no assurance that the investment objective of the Scheme will be achieved.

This NFO of Aditya Birla Sun Life Quant Fund is suitable for investors who are seeking to generate medium to long-term capital appreciation and investments in equity and equity-related instruments selected based on a proprietary quantitative investment framework

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity & Equity related instruments# based on quant model theme | 80 | 100 |

| Equity & Equity related instruments# other than quant model theme | 0 | 20 |

| Debt and Money Market Instruments | 0 | 20 |

| Units issued by REITs & InvITs | 0 | 10 |

The NIFTY 200 Index is designed to reflect the behavior and performance of large and mid-market capitalization companies. NIFTY 200 includes all companies forming part of NIFTY 100 and NIFTY Full Midcap 100 index. This Index is suitable for the benchmarking of funds in Quant Theme.

Fund Managers

Mr. Harish Krishnan, aged 43, holds a B.E. from Government College, Trichur, and is a Chartered Financial Analyst with a PGDBM from IIM Kozhikode. He brings over 20 years of extensive experience in the asset management industry, both domestically and internationally. Prior to joining Aditya Birla Sun Life AMC Limited (ABSLAMC), he spent more than a decade at Kotak Mutual Fund as a Senior Fund Manager – Equity. During his tenure at Kotak Mahindra (UK) Limited, he managed offshore funds based out of Singapore and Dubai, showcasing his capability in handling diverse and complex investment portfolios on a global scale.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | Since Launch Ret (%) |

| quant Quantamental Fund | 2173.52 | 2 | 64.95 | 33.21 |

| 360 One Quant Fund | 175.14 | 1.83 | 58.44 | 27.42 |

| Nippon India Quant Fund | 63.00 | 0.98 | 42.72 | 10.17 |

| ICICI Pru Quant Fund | 76.80 | 1.23 | 35.21 | 23.24 |

| Axis Quant Fund | 1062.73 | 2.18 | 33.5 | 16.81 |

| Tata Quant Fund | 57.67 | 2.38 | 27.21 | 9.13 |

| DSP Quant Fund | 1179.23 | 1.26 | 21.54 | 15.16 |

| Kotak Quant Fund | 683.50 | 1.26 | – | 47.73 |

| Category Average | – | – | 40.51 | 22.86 |

| NIFTY 500 TRI | – | – | 35.85 | 12.67 |

Data as of June 7, 2024

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 10, 2024, 6:13 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates