AGS Transact Technologies Ltd, one of India’s leading integrated omni-channel payment solutions providers, has announced a major order win worth Rs 1,100 crore over seven years from the State Bank of India (SBI), India’s largest public sector bank, to deploy 2,500+ ATMs under its Outsourced/Managed Services portfolio.

This significant order win further strengthens AGS Transact’s position as a leading ATM outsourcing player in India. The company will deploy these ATMs on a transaction fee basis under the Total Outsourcing Model, commencing the deployment process in the next calendar year.

As of 12:00 pm on November 17, 2023, the stocks of AGS Transact Technologies Ltd are being traded at Rs 85.95, marking a 9.7% increase for the day. This suggests a significant upswing in buying activities following the release of the news.

With a robust track record of delivering exceptional service and innovation, AGS Transact has established itself as a trusted partner for banks and corporate clients across India. The company has installed, managed, or maintained 77,658 ATMs/CRMs across 2,200 cities and towns in India as of September 30, 2023.

AGS Transact’s comprehensive suite of payment solutions encompasses ATM, transaction processing, prepaid cards, POS terminals at petroleum outlets, and a wide range of ATM/CRM, currency technology solutions, and self-service kiosks.

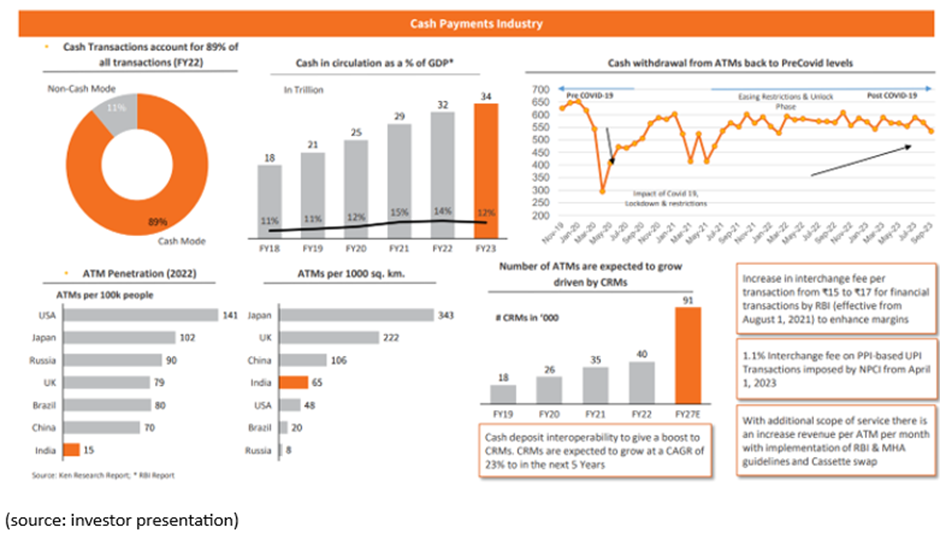

India’s payments landscape is undergoing a rapid transformation, with a growing emphasis on digital payment solutions. While digital payments have gained significant traction, cash remains an integral part of the Indian economy.

AGS Transact is well-positioned to capitalize on both the growth of digital payments and the continued reliance on cash transactions. The company’s revenue mix reflects this balance, with cash payment solutions accounting for 68% of sales in H1FY24, while digital payment solutions contributed 19%.

Despite the growth of cashless transactions, India’s cash payments industry is expected to remain stable, driven by factors such as the large unbanked and underbanked population, the prevalence of cash in rural areas, and the use of cash for small-value transactions.

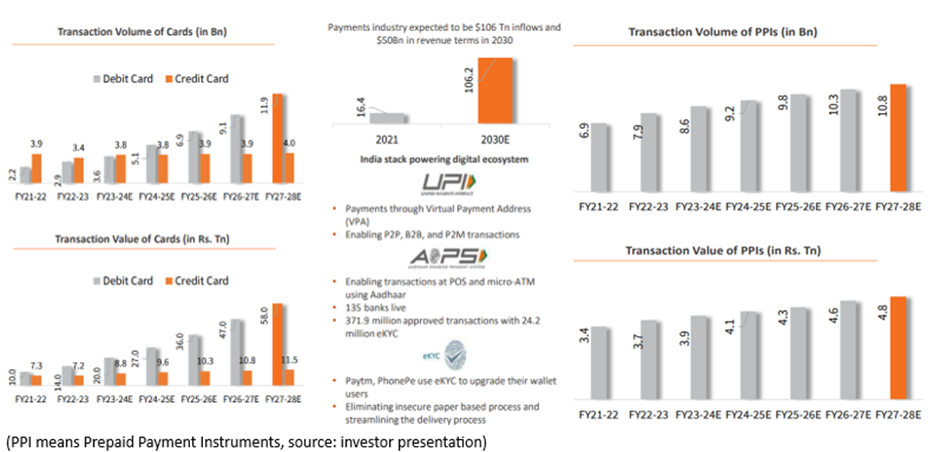

On the digital payments front, the momentum is expected to continue, fuelled by factors such as government initiatives, increasing smartphone penetration, and the growing adoption of e-commerce.

AGS Transact is well-positioned to benefit from these trends, with its strong track record, diverse product offerings, and commitment to innovation. The company is confident in its ability to continue delivering strong financial performance and maintain its leadership position in India’s payments landscape.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 17, 2023, 1:18 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates