Over the past year, public sector undertaking (PSU) stocks have witnessed a significant surge, with remarkable performances seen in recent IPOs such as IREDA. The IPO, issued at Rs 32, listed at Rs 50, experiencing over a 100% increase in just a month. Similar trends have been observed in other PSU stocks like REC Ltd, which has seen its price skyrocket from Rs 110 to above Rs 400, resulting in gains exceeding 250% over the last year.

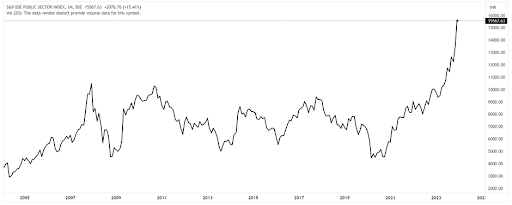

This positive momentum is not limited to specific stocks but is reflective of a broader trend seen in the BSE PSU index, which has demonstrated a sharp rally, generating gains of around 200% since 2021.

S&P BSE PSU Index

Analyzing the financial performance of key PSU entities, it becomes evident that while revenues have remained relatively stable, profits have surged significantly. For instance, the State Bank of India exhibits a single-digit compound annual growth rate (CAGR) in sales at 9%, yet its profit CAGR is an impressive 76% over the past five years. LIC India, with a sales CAGR of around 8%, boasts an even more remarkable profit CAGR of 138% over the last three years. Similar trends can be observed in NTPC, ONGC, and Coal India, where profits have seen substantial growth despite modest or stable revenue figures.

The question arises: Why are profits increasing in the absence of substantial revenue growth? The answer lies in government initiatives and policies. From 2019 onwards, the government has prioritized divestment, leading to increased efficiency and profitability in PSUs. Notably, similar trends were witnessed in the 2002-2007 period when a 10x rally occurred due to a budgetary focus on divestment, making PSUs more profitable.

A red flag emerges when considering the absence of concurrent revenue growth. While efficiency has peaked and profits have soared, sustained profit upscaling in the future may depend on revenue growth. The upcoming 3-4 years may reveal whether companies can achieve this, as the government’s focus on divestment continues to make operations more efficient and strengthen PSU fundamentals.

Investors remain bullish on the PSU sector, anticipating further positive developments. The government’s commitment to divestment, coupled with recent electoral victories, instils confidence that this trend will persist. The upcoming budget, especially preceding an election, is expected to be favourable for PSUs, further boosting investor sentiment. Historical data suggests that during periods of anticipation for a ruling NDA government, stock markets tend to remain buoyant, dispelling concerns of an imminent correction in PSU stocks.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Dec 29, 2023, 6:11 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates