Studying the investment portfolios of successful investors is a valuable practice for aspiring investors. Examining the strategies and choices of successful investors provides insights into their decision-making process, risk management techniques, and overall investment philosophy.

In this article, we will analyse Ashish Dhawan’s portfolio to understand his investment style and how you can also invest like him.

India has many successful investors, and among them, Ashish Dhawan has carved a niche for himself. The 54-year-old private equity investor is also the founder and chairman of the Central Square Foundation (CSF).

Dhawan was born in 1969 in New Delhi. He attended Yale University for graduation and later went to Harvard for an MBA. He started his career in 1992 by joining a boutique Wall Street bank, Wasserstein Perella and Company. Later, he worked for Goldman Sachs in New York.

Dhawan returned to India in 1999 and started ChrysCapital when the concept of a private equity firm was still new in India. He turned the venture into a success, and within a span of 5–6 years, ChrysCapital became one of India’s largest private equity firms, managing an AUM of US$1 billion.

Dhawan is now one of India’s richest investors, with a net worth of over Rs. 2,920 crore. His portfolio consists of several quality stocks. Let us now look at Ashish Dhawan’s shareholdings in different companies.

| Company Name | Holding Value (Rs. in crore) | March 2023 holding % | December 2023 holding % | Holding % change |

| Equitas Small Finance Bank Ltd | 355.9 | 3.6 | – | New |

| Glenmark Pharmaceuticals Ltd | 446.4 | 2.6 | 2.5 | 0.1% |

| Dish TV India | 40.1 | 1.6 | 1.6 | – |

| AGI Greenpac Ltd | 184.0 | 4.8 | 4.8 | – |

| IDFC Ltd | 567.3 | 3.5 | 3.5 | – |

| Birlasoft Ltd | 98.3 | 1.0 | 1.0 | – |

| Mahindra & Mahindra Financial Services Ltd | 430.0 | 1.2 | 1.2 | – |

| Zensar Technologies | 94.3 | 1.1 | 1.1 | – |

| Greenlam Industries | 178.1 | 3.8 | 3.8 | – |

| Palred Technologies Ltd | 9.2 | 5.5 | 5.5 | – |

| RPSG Ventures Ltd | 56.3 | 4.2 | 4.2 | – |

| Arvind Fashions Ltd | 199.3 | 4.9 | 4.9 | – |

| Quess Corp. Ltd | 245.9 | 4.0 | 4.0 | – |

Note: The data mentioned here is as of 6th June 2023

According to the data available on the internet, Ashish Dhawan publicly holds 13 stocks. Analysing Ashish Dhawan’s portfolio, we can identify some significant changes from December 2022 to March 2023.

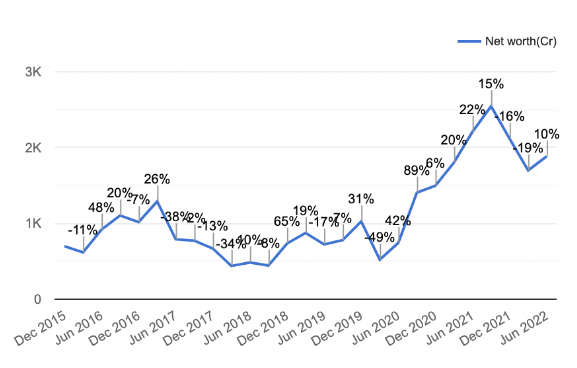

According to the latest data available on the internet, Ashish Dhawan has a net worth of Rs. 2,920.0 crore. His net worth graph between December 2015 and June 2022 looks like the following.

Ashish Dhawan is one of the most successful equity investors. Keeping an eye on his investment moves can teach you great lessons on how to select stocks and make sound investment decisions. You can also start your investment journey with Angel One. Open a free Demat account today!

Published on: Jun 20, 2023, 9:42 AM IST

Team Angel One

We're Live on WhatsApp! Join our channel for market insights & updates