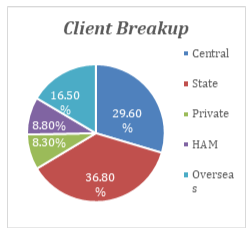

Ashoka Buildcon Limited is a well-established construction company with a strong track record of executing EPC (Engineering, Procurement, and Construction) contracts and BOT (Build-Operate-Transfer) road projects. The company has over two decades of experience and has established strong relationships with state government departments, NHAI, and the Ministry of Road Transport and Highways. ABL has a robust total order book worth approx. Rs 17,500 crore.

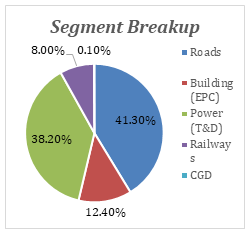

The company is also expecting some of the international projects to be executed. The company is shifting its focus from bidding for BOT and HAM (Hybrid Annuity Model) projects to EPC projects to become an all-sector EPC player over the medium term which offers higher margins and profitability. EPC contracts are a type of contract where the contractor is responsible for all aspects of a project, from design and engineering to procurement and construction. The company is involved in various other segments such as City gas distribution, Building construction, Power (Transmission & Distribution) and Railway construction.

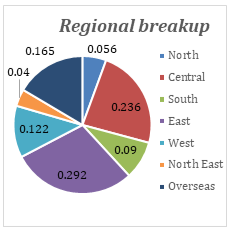

Ashoka Buildcon has a well-diversified geographic footprint, with operations in all regions of India and overseas.

The East and Central regions of India account for the most operations, followed by the operations overseas. The North, Northeast, and South region accounts for the least operations as of now.

The total income of Ashoka Buildcon Limited for Q1 FY2024 stood at Rs 1557 crore as compared to Rs 1510 crore in the corresponding quarter last year, registering a growth of 3%. EBITDA for the quarter was Rs 96 crore with an EBITDA margin of 6.1%. EBITDA margins have been impacted and subdued mainly due to inflationary pressures. The reported PBT came in at Rs 22 crore and PAT at Rs 16 crore.

Management of the company is expecting the EBITDA margins would be in the range of 8 to 8.5% and post 2024, 2025 then it will go back to numbers like 10- 10.5%.

Infrastructure companies require expensive, advanced equipment, which they often finance with debt. Ashoka Buildcon’s borrowings were Rs 192.12 crore in FY23, down from Rs 364.4 crore in FY22.

Below is a table comparing Ashoka Buildcon’s debt-to-equity (D/E) ratio and net debt with those of other top infrastructure companies.

An important takeaway is that Ashoka Buildcon’s D/E ratio is 0.30, which is in line with the industry average.

| Name | Mar Cap (Rs.Crore) | Debt-to-Equity | Net Debt (Rs.Crore) |

| Ashoka Buildcon | 3,434.65 | 0.30 | 94.13 |

| Larsen & Toubro | 424,981.95 | 0.30 | 101,586.00 |

| Adani Ports | 178,243.87 | 1.09 | 45,491.50 |

| GMR Airports Inf | 35,944.05 | 0.13 | 25,403.00 |

| IRB Infra.Devl. | 19,083.24 | 0.99 | 16,557.00 |

| Ircon Intl. | 13,623.37 | 0.00 | -3,616.50* |

| Rites | 11,834.87 | 0.00 | -3,448.50* |

| G R Infraproject | 11,674.23 | 0.92 | 975.00 |

Net debt is calculated by deducting Cash and cash equivalents from the company Borrowings. All figures as of the year ended 2022-2023.

Execution of orders for the Ministry of Road Transport and Highways Is expected to increase by 16-21% to 12,000–12,500 km (~33-34 km/day) in FY2024. According to Anurag Jain (Secretary, MoRTH), The MoRTH has increased the target for road construction awards in FY24 to 13000-14,000 km. This is further supported by the higher budgetary allocation for roads in the Union Budget – 2023-24. Since the majority of these projects would be awarded under the EPC and HAM models, road construction companies will be the major beneficiaries of the government’s infrastructure spending. Additionally, the softening of commodity prices is expected to improve profitability.

As India continues to develop, Ashoka Buildcon can be riding the wave of government infrastructure spending, which is expected to drive strong revenue growth and margin expansion in the coming years.

Disclaimer: The above information is for educational purposes only. It is based on several secondary sources on the internet and is subject to changes. Ashoka Buildcon is not a recommendation to buy or sell. Please consult with a financial advisor before making any investment decisions.

Published on: Oct 3, 2023, 10:08 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates