Aster DM Healthcare has announced the separation of its India and GCC businesses in order to unlock value for shareholders and allow each business to adopt a market-focused strategy. A consortium led by Fajr Capital will acquire a 65% stake in the ownership of the GCC business, with the Moopen family retaining a 35% stake.

The GCC business will be valued at an enterprise value of US$ 1.7 billion and an equity value of US$ 1.0 billion. Existing shareholders will remain with the listed Indian entity, Aster DM Healthcare Ltd. Dr Azad Moopen will continue as Founder & Chairman, overseeing both India and GCC businesses, while Alisha Moopen will be promoted to Managing Director and Group CEO of the GCC business. Dr Nitish Shetty will continue as CEO of the Aster business in India.

Aster DM Healthcare Limited, a multinational healthcare conglomerate, will split into two entities following segregation. The India business will be held by a focused listed entity, while the GCC business will be separated to create Aster GCC. Shareholders will have exposure to both the pure-play India business and the GCC business, allowing them to participate in the growth stories of both regions.

Aster DM Healthcare has the second largest hospital network in South India and has expanded its facilities from 10 hospitals and 7 clinics in FY18 to 19 hospitals, 13 clinics, 226 pharmacies, and 251 labs currently. The network’s bed capacity has also increased from 3,007 in FY18 to 4,855 currently. Additionally, the network’s EBITDA margins have improved from 10% in FY18 to 19.1% in H1FY24, and its ARPOB has improved from Rs 23,700 in FY18 to Rs 39,000 currently. For last 5 years the revenue has been rising with a compounded annual growth rate (CAGR) of 20%.

Aster DM Healthcare is the 2nd largest network in South India with significant capacity beds in southern states with 4,624 beds. It is the leader in the Kerala region with a maximum capacity of 2,385 beds and second highest capacity beds in Andhra Pradesh with 889 beds and 3rd highest capacity beds in Karnataka with 1,192 beds

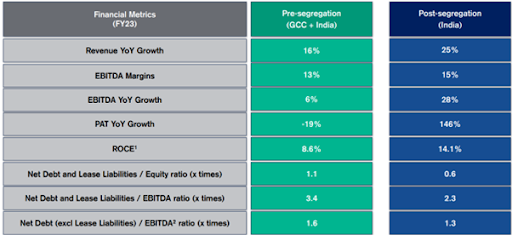

The company believes post segregation the entities will have substantial benefits.

AsterDM Healthcare India, a leading healthcare provider in India, will invest under its capex plan to increase its bed capacity to 6,334 beds by FY27. This will be funded by internal accruals.

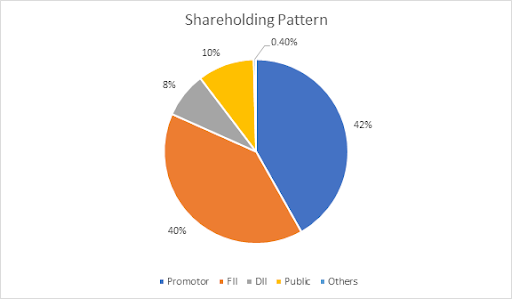

There will be no change in shareholding in India listed entity due to segregation. The promoters will maintain their 42% stake in the India listed entity and will hold 35% stake in the GCC entity. For more details on the Aster Shareholders and the buyer group, please see the shareholding pattern :

India’s vast population and increasing healthcare expenditure provides significant headroom for growth. Health insurance coverage is expected to expand to 46% by FY25 from 38% in FY21. Medical tourists are projected to grow to 3 million by 2030 from 0.7 million in 2019. The mix of population in 60+ age group is expected to grow to 13% by 2026, up from 10% in 2021

Aster India produced a great success in its core hospital business in FY23 while aggressively expanding its other new businesses.

| Business | % of Revenue | Revenue | Revenue Growth (YoY) | Operating Profit | Operating Profit Margin |

| Hospitals and Clinics | 93% | 2,851 | 20% | 514 | 18% |

| Labs and Pharmacies | 7% | 217 | 72% | -28 | -13% |

| India Overall | 100% | 2,983 | 25% | 453 | 15% |

The core Hospital business has improved significantly and consistently across all operational criteria.

| Particulars | FY18 | FY19 | FY20 | FY21 | FY22 | Current |

| No. of Capacity Beds | 3,007 | 3,460 | 3,693 | 3,757 | 3,905 | 4,855 |

| No. of Hospitals | 10 | 12 | 13 | 14 | 14 | 19 |

| Patient Volumes (in Mn) | 1.8 | 1.8 | 2.2 | 1.5 | 2.2 | 2.9 |

| Occupancy (In %) | 65% | 63% | 61% | 56% | 66% | 67% |

| ARPOB (In INR ‘000) | 23.7 | 26.1 | 27.7 | 30.1 | 33.5 | 39 |

| ALOS (Number of Days) | 3.6 | 3.6 | 3.5 | 3.9 | 3.7 | 3.4 |

Aster India has shown consistent growth in its healthcare infrastructure over the fiscal years FY18 to the current period. The number of capacity beds has steadily increased from 3,007 to 4,855, accompanied by a proportional rise in the number of hospitals, expanding from 10 to 19. Despite a slight dip in patient volumes in FY21, the subsequent year witnessed a notable increase to 2.9 million.

The occupancy rate has generally been robust, reaching 67% in the current period. The Average Revenue Per Occupied Bed (ARPOB) has exhibited a continuous upward trend, reaching 39,000 INR, indicating improved revenue per patient. Additionally, the Average Length of Stay (ALOS) has demonstrated efficiency, decreasing from 3.6 days in FY18 to 3.4 days in the current period, suggesting enhanced operational effectiveness and patient management.

The company’s top line increased by 17.77% year-over-year, but it reported a loss of Rs 30.79 crore. This is in contrast to the profit of Rs 46.21 crore that the company declared in the same period of the previous fiscal year. As compared to the previous quarter, the revenue grew by 3.15%. The Selling, general & administrative expenses rose by 3.58% quarter-over-quarter and increased by 13.53% year-over-year. The operating income was down by 43.91% quarter-over-quarter and decreased by 26.29% year-over-year.

Currently, the shares of AsterDM Healthcare are trading at Rs 393, and on the news, it reacted marginally by surging more than 18% on Wednesday. The stock has given 66.02% returns in the last year to its investors.

Aster DM Healthcare Limited is one of the largest integrated private healthcare service providers operating in GCC (Gulf Cooperation Council) countries and an emerging player in India. With an inherent emphasis on clinical excellence, it is one of the few entities in the world with a strong presence across primary, secondary, tertiary and quaternary healthcare.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 30, 2023, 2:06 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates