Avadh Sugar and Energy Ltd. is primarily engaged in the manufacture and sale of sugar and its by-products, including spirits such as ethanol and power. The stock surged more than 8% on Wednesday to reach Rs. 739 on an intraday basis. On March 28, 2023, Avadh Sugar’s stock price hit a low of Rs. 392, and since then, it has rallied to the 52-week high on October 25, 2023, at Rs. 739 on an intraday basis. According to technical charts, the stock has logged nearly an 84.42% gain since its last low.

On September 4, 2023, the Uttar Pradesh government was expected to announce an increase in the State Advisory Price (SAP) for sugarcane, projecting an increase of Rs 25 per quintal for the 2023-2024 season. This news is favourable for sugar companies like Avadh Sugar & Energy, as it indicates higher revenues and profits. This has generated positive sentiments among investors and traders, driving the stock’s impressive performance.

The rise in crude oil prices is also contributing to the increase in sugar stock prices. Higher crude oil prices can lead to greater demand for ethanol, which is often blended with gasoline. Sugar companies, including Avadh Sugar, are expected to benefit from this increased demand. The Indian government has set a target of achieving a 20% ethanol blend in fuel by 2025. Meeting this goal will directly impact the production and sales of the company. The weakening Indian rupee is increasing import costs, making domestically produced ethanol more cost-effective compared to the international market. As crude oil prices rise due to supply constraints, it promotes the adoption of alternative energy sources like ethanol, further boosting sugar stock prices.

The rise of Avadh Sugar & Energy stock is attributed to several factors, including the expected increase in SAP, the strong performance of the sugar industry, the company’s 52-week high prices, the rise in crude oil prices, the government’s ethanol blend target, the weakening rupee, and global crude oil market dynamics favouring ethanol use.

The provided charts display the price movement of Avadh Sugar in two timeframes. The weekly chart on the right and the daily chart on the left. From a technical perspective, the price appears to be in an uptrend, consistently finding support above the 50-day EMA (High & Low) on a daily basis. The weekly chart reveals a clear Flag chart pattern, indicating a strong uptrend followed by consolidation. Any breakout from this consolidation range may result in an upward rally towards Rs. 885, as the chart suggests. Previously, the chart found support at the level of Rs. 393.11, which now acts as a strong support, while the level of Rs. 611.76 has become a broken resistance that may serve as a support level in the future.

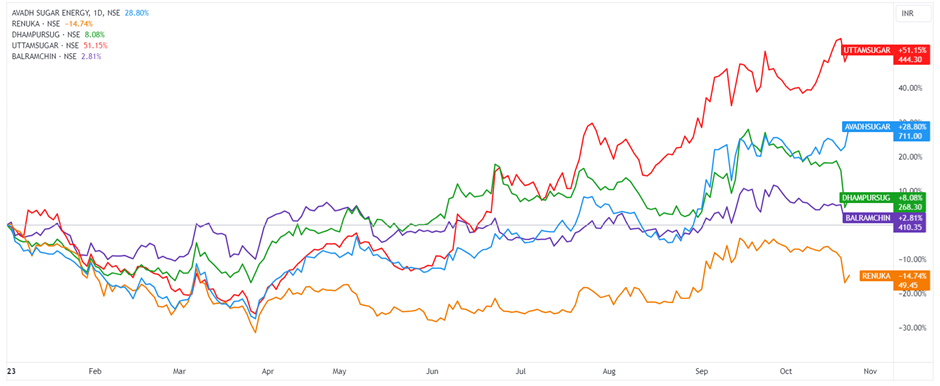

The chart above compares the share price performance year-to-date. Avadh Sugar managed to yield returns of approximately 28% thus far. Uttam Sugar leads the sugar sector with the highest returns, exceeding 50% on a year-to-date basis.

| Avadh Sugar & Energy Ltd. | Uttam Sugar Mills Ltd. | Dhampur Sugar Mills Ltd. | Balrampur Chini Mills Ltd. | Shree Renuka Sugars Ltd. | |

| 1 Week | 3.10% | 0.07% | -8.26% | -3.26% | -8.01% |

| 1 Month | 1.91% | 0.33% | -14.70% | -6.88% | -11.00% |

| 3 Months | 19.19% | 17.36% | -5.00% | 2.63% | 4.22% |

| YTD | 29.47% | 54.34% | 8.19% | 3.33% | -15.13% |

| 1 Year | 45.56% | 77.59% | 31.88% | 23.48% | -13.80% |

| 3 Year | 268.97% | 399.16% | 81.32% | 157.67% | 393.50% |

Avadh Sugar & Energy Ltd. is performing exceptionally well compared to other sugar companies. In the past week, its stock has increased by 3.10%, whereas its closest competitor, Uttam Sugar Mills, has only seen a 0.07% increase. Over the year, Avadh Sugar has experienced a 29.47% increase in its stock price, surpassing most other companies. Over the past three years, Avadh Sugar’s stock has shown impressive growth, rising by 268.97%. This solid performance makes Avadh Sugar an attractive choice for investors in the sugar industry. It has consistently outperformed its competitors and demonstrated robust growth over time.

Disclaimer: This blog is written exclusively for educational purposes. The mentioned securities are provided as examples and not as recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult an expert before making any related decisions.

Published on: Oct 25, 2023, 3:04 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates