Shares of both Axis Bank Ltd and ICICI Bank Ltd are trading very close to the significant level of Rs 1000. The shares of Axis Bank are trading at Rs 980, whereas ICICI Bank Ltd is around Rs 935, which is Rs 65 less than the Rs 1000 mark on BSE.

Today, the stock of Axis Bank opened at Rs 974.95, almost flat opening from its previous day’s closing price of Rs 978.30. Currently, the stock is trading just Rs 9.5 below its 52-week high of Rs 989.5. The current market capitalisation is Rs 3,02,749 Crore.

The stock of ICICI Bank opened at Rs 940, a flat opening from its previous day’s closing price of Rs 937.45. Currently, the stock is trading just Rs 24 below its 52-week high of Rs 958. The current market capitalisation is Rs 6,53,144 Crore.

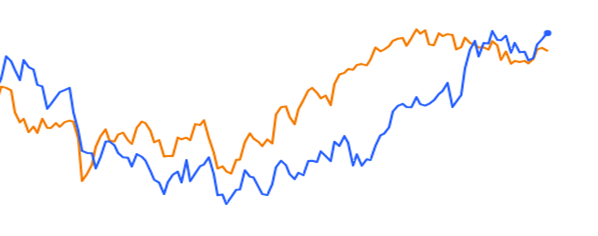

If we compare their stock performance, then Axis Bank has delivered a return of 16.5%, whereas ICICI Bank has generated a return of 9.7% in the last three months. Furthermore, over the past year then they have generated a return of 53.6% and 31.4%.

Below is the comparison of both stocks Blue color depicts Axis Bank and Orange is ICICI Bank.

|

Index / Stock |

1 Month | 3 Months | 1 Year | 3 Year |

| Nifty Bank | 0.5% | 8.6% | 32.6% | 109.0% |

| Axis Bank | 6.9% | 16.5% | 53.6% | 143.0% |

| ICICI Bank | -1.2% | 9.7% | 31.4% |

165.0% |

Upon analysing the aforementioned returns, Axis Bank has demonstrated superior performance compared to both the Nifty Bank Index and ICICI Bank across all time frames except three-year returns. On the other hand, ICICI Bank has faced challenges in delivering higher returns over the given period and managing to achieve a return of 165% only in the last three years. This is the sole time frame in which ICICI Bank has managed to outperform the index returns as well as the Axis Bank’s return.

| Particulars | Axis Bank | ICICI Bank |

| Net Interest Income (Rs Cr) | 42946.0 | 62129.0 |

| NII Growth | 30.0% | 30.9% |

| NII Margin | 4.2% | 4.5% |

| CASA Ratio | 47.0% | 43.6% |

| CASA Growth | 13.0% | 4.4% |

| Loan Growth | 19.0% | 18.7% |

| Return on Asset | 1.8% | 2.2% |

| Return on Equity | 18.8% | 17.3% |

| Gross Non-Performing Asset (GNPA) | 2.0% | 2.8% |

| Net Non-Performing Asset (NPA) | 0.4% | 0.5% |

| Book value (Rs) | 406.0 | 287.4 |

| Price to Book Value (times) | 2.41 | 3.25 |

| Net Profit (Rs Cr) | 21933.0 | 31896.0 |

The overall trend of the Indian market is positive and bullish, with key indices such as Sensex, Nifty50, and Nifty Bank reaching record highs. Both of the mentioned banks are reputable and successful companies in India. When examining the financial data of these banks, they are quite similar overall, with slight variations across various metrics.

For instance, Axis Bank’s net interest income stands at Rs 42,946 Crore, whereas ICICI Bank has a higher net interest income of Rs 62,129 Crore, indicating better performance in this aspect. Similarly, ICICI Bank’s net profit of Rs 31,896 Crore surpasses Axis Bank’s net profit of Rs 21,933 Crore. In terms of price-to-book value, ICICI Bank is trading slightly higher in the market compared to Axis Bank.

We should patiently observe which of the two banks will be the first to surpass the Rs 1000 mark, as they both possess strong financials and have the potential for further growth in the future.

Published on: Jun 30, 2023, 4:44 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates