Bajaj Finserv Asset Management Limited is pleased to announce the launch of the Bajaj Finserv Balanced Advantage Fund (BFBAF), an open-ended dynamic asset allocation fund. The fund will invest in a diversified mix of equity and fixed income securities, with the aim of providing investors with long-term capital appreciation while mitigating risk. The NFO for BFBAF will open on November 24, 2023, and close on December 8, 2023.

Investors engaging in the New Fund Offer (NFO) should note that the minimum lump sum application is set at Rs. 500, with the flexibility to invest in multiples of Re. 1. Systematic Investment Plan (SIP) commitments ranging from Rs. 500 to Rs. 1,000 require a minimum of 60 installments, while amounts exceeding Rs. 1,000 necessitate a minimum commitment of 6 installments.

For those participating in the ongoing offer, the minimum fresh subscription stands at Rs. 500, with subsequent increments in multiples of Re. 1. Additional applications require a minimum of Rs. 100, again in multiples of Re. 1. SIP commitments mirror those of the NFO. Additionally, for switch-in transactions, investors are advised to adhere to a minimum of Rs. 500, with multiples of Re. 1 accepted. These guidelines are crafted to provide investors with flexibility and accessibility based on their investment preferences and capacities.

The fund manager employs a sophisticated risk management strategy, adapting to market conditions for debt and equity investments. Responding to market risk in debt, allocations are dynamically adjusted based on interest rate expectations, favouring money market securities during rising rates and longer maturity debt in falling rates. Liquidity risk is addressed by investing in liquid securities, acknowledging challenges in medium to long-term corporate bonds. For credit risk, a SWOT analysis ensures securitized debt instruments have ample asset backing. The manager strategically uses derivatives for hedging and employs a proactive, diversified, and compliance-driven approach to risk management.

The investment objective of the scheme is to capitalize on the potential upside of equities while attempting to limit the downside by dynamically managing the portfolio through investment in equity & equity related instruments and active use of debt, money market instruments and derivatives.

The scheme outlines its asset allocation strategy, indicating a maximum of 90% and a minimum of 65% for equity and equity-related instruments, reflecting a very high-risk profile. In the fixed income domain, allocations range from 35% to 10%, portraying a low to moderate risk profile. The gross equity exposure is set between 65%-100%, with the flexibility to employ derivative strategies for net exposure adjustments. Derivatives usage is capped at 50% for equity assets and 10% for fixed income assets. Securitized debt can constitute up to 25% of fixed income assets. The scheme may engage in securities lending up to 20%, limiting exposure to repo transactions in corporate debt securities to 10%. Foreign securities and overseas ETFs can collectively comprise up to 35% of net assets, adhering to SEBI and RBI guidelines. The Scheme has the potential to invest up to US $100 million in foreign securities, following specified regulatory limits.

The primary equity strategy focuses on building a portfolio of high-growth companies with robust business models, sustainable competitive advantages, and superior return ratios. Following the INQUBE philosophy framework, the investment process considers business fundamentals, management quality, and valuation. To mitigate concentration risk, the fund has flexibility across market capitalizations and may explore arbitrage opportunities. In addition to equities, the scheme allocates funds to debt securities, aiming to capture term and credit spreads while maintaining a balance between safety, liquidity, and returns. The investment approach integrates top-down analysis of interest rate trends with a bottom-up selection of securities, considering various economic factors and global market developments.

During unfavourable market conditions, the scheme allows the Fund Manager to temporarily shift up to 100% of assets to defensive positions, such as cash, cash equivalents, or high-quality short-term investments. This defensive stance may involve permitted money market instruments and TREPS/reverse repo. Such adjustments are short-term and defensive, intending to be rebalanced within 30 calendar days, aligning with SEBI circulars. This flexibility aims to safeguard investor interests by responding swiftly to challenging economic climates while ensuring adherence to regulatory guidelines.

The fund’s investment philosophy combines first principles thinking with a multi-faceted approach, considering both fundamental and behavioural factors influencing the equities market, notably the Nifty 50. Fundamental analysis incorporates economic variables and corporate aggregates, while behavioural elements encompass investor sentiment and biases. The intrinsic value of the Nifty 50 guides core equity allocation, augmented by a sentiment indicator capturing market trends. The fund’s INQUBE philosophy integrates informational, quantitative, and behavioural edges, shaping its stock selection and allocation decisions. The fund manager’s discretion aligns with investment objectives, recognizing the inherent volatility in equity and debt investments.

This section outlines the annual recurring expenses as a percentage of daily net assets. It encompasses various components, including Investment Management and Advisory Fees capped at 2.25%, Trustee Fees, Audit Fees, Custodian Fees, Registrar & Transfer Agent Fees, Marketing & Selling expenses with agent commissions, and costs related to investor communications and statutory advertisements. Additionally, it includes expenses for fund transfers, account statements, and Income Distribution cum Capital Withdrawal. Goods & Services Tax applies to specified expenses. The total allowable under Maximum Total Expense Ratio (TER) is 2.25%, with an extra 0.05% for specified additional expenses and up to 0.30% for inflows from specified cities.

Bajaj Finserv Asset Management boasts a skilled team of fund managers, each contributing unique strengths:

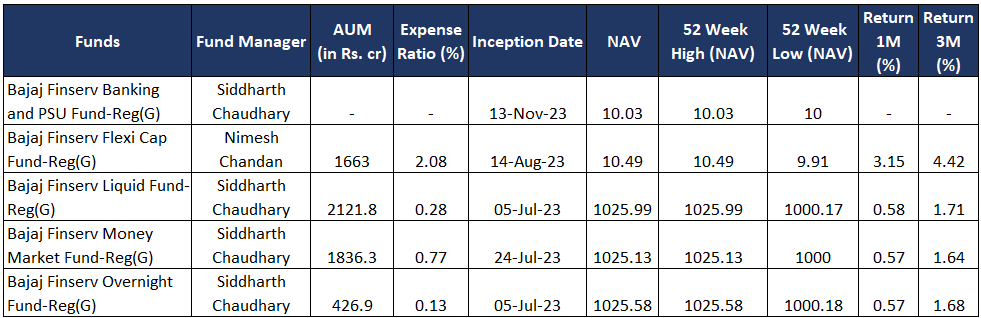

Following is the data available on the funds managed by respective Fund managers:

This skilled team brings decades of collective experience, contributing expertise in equities and fixed income to strategically manage Bajaj Finserv funds.

BFBAF offers investors a well-rounded investment opportunity, combining equity potential with risk mitigation strategies. The skilled fund management team and comprehensive risk management approach enhance the fund’s potential for long-term capital appreciation. Investors should carefully consider the minimum application guidelines, risk management strategies, and the expertise of the fund management team before making investment decisions.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 24, 2023, 12:53 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates