Balmer Lawrie & Company is a central public-sector undertaking company engaged in various businesses including Industrial Packaging, Greases and lubricants, Leather Chemicals, Logistic Services and Infrastructure, Refinery and oil Fields, and Travel & Vacation Services in India. It has been under the administrative control of the Ministry of Petroleum and Natural Gas, Government of India, since 1972. The company’s shares have registered a significant surge today.

At the start of the day’s trading session, the stock opened at Rs 189.95 per share, marking an approximate 1.4% increase compared to the previous day’s closing figure of Rs 187.45 per share on the BSE.

Today, the company reached a significant milestone of Rs 200 per share. Back in the year 2000, the company’s shares were available at around Rs 2 per share. From that price, the company has exhibited a remarkable surge of over 100x or 9,900%, hitting an all-time high price of Rs 223.45 per share today. As of the time of writing this article, the shares are trading at Rs 216.75 per share on the BSE. An investment of just Rs 2,000 when the stock price was Rs 2 per share would now be valued at Rs 2.16 lakh based on the current market price.

The company’s current market capitalisation stands at Rs 3706 crore, and the stock has generated an impressive return of 40% in a month and around 82% return in the past year.

In the second quarter of FY24, the company reported revenues of Rs 586 crore, reflecting a moderate growth of 6.2% YoY compared to the same quarter in the previous year, when the revenue stood at Rs 551 crore. The company posted an operating profit of Rs 75 crore for the quarter, in contrast to an operating profit of Rs 39 crore in the corresponding quarter of the previous year.

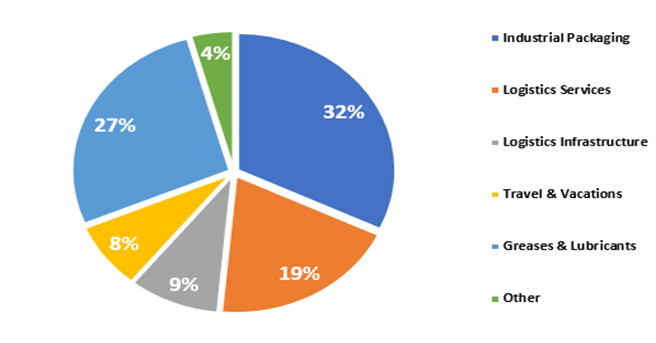

Furthermore, the company reported a net profit of Rs 63 crore, compared to a net profit of Rs 34 crore in the same period last year. The company’s net profit has significantly grown around 85% YoY this quarter. Let’s delve into the company’s revenue segments and determine the percentage of the company’s total revenue that comes from each segment.

The company’s ROCE and ROE ratios are 10.1% and 10.2% respectively, while the stock is trading at a PE of 19 times in the market.

In terms of ownership, the public holds 95.66%, the government holds 0.02%, while Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) hold 1.82% and 2.48%, respectively, as per the most recent update.

Balmer Lawrie and Company Limited is an India-based company engaged in the manufacturing of steel barrels, industrial greases, speciality lubricants, corporate travel, and logistics services. The company also operates in other sectors, including chemicals, logistics infrastructure, etc. It comprises eight business units: Industrial Packaging, Greases and lubricants, Chemicals, Travel and vacations, Logistics Infrastructure, Logistics Services, Cold Chain, and Refinery and Oil Field Services.

The Industrial Packaging unit manufactures various types of drums, such as MS plain drums, internally coated drums, composite drums, tall drums, necked-in drums, conical drums, GI drums, and open-headed drums. The Greases & Lubricants unit is divided into three segments: Channel Sales (Automotive and industrial), Direct B2B, and Contract Manufacturing. Furthermore, the Travel & Vacations unit provides comprehensive domestic and international travel services, encompassing ticketing, tourism, meetings, incentives, conferences, and exhibition-related services for its clients.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 22, 2023, 4:06 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates