India’s GDP growth is among the fastest in the world, and the potential for future growth is immense. With a rising per capita income and a young, dynamic population, the country’s consumption patterns are set to expand significantly over the coming decades. This long-term trend presents a unique investment opportunity for those looking to capitalize on India’s consumption boom. One such avenue is the Baroda BNP Paribas India Consumption Fund, a thematic mutual fund designed to tap into this growth story.

As India continues to develop, several factors are contributing to the rise in consumption. Higher income levels, an increasing working-age population, digitalization, and urbanization are just a few of the drivers behind this surge. Additionally, policy reforms and the financialization of the economy are creating a more favorable environment for businesses to grow and thrive. The Baroda BNP Paribas India Consumption Fund is uniquely positioned to benefit from these secular growth stories by focusing on companies that directly interact with consumers through a B2C (business-to-consumer) model.

The fund adopts a pure bottom-up stock-picking strategy, zeroing in on companies with strong competitive advantages and high earnings visibility over the long run. By investing in businesses with stable and healthy cash flows, the fund aims to provide consistent returns to its investors. The portfolio is diversified across market capitalizations, with a mix of large-cap companies (63%) and mid to small-cap companies (32%). This balanced approach allows the fund to capture the growth potential of smaller companies while benefiting from the stability of larger, well-established firms.

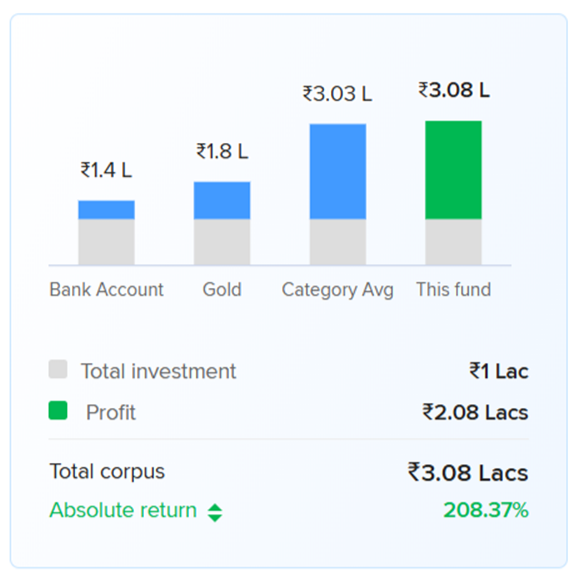

The Baroda BNP Paribas India Consumption Fund has outperformed its peers, delivering an impressive 208.37% absolute return over the last five years. This means that a lumpsum investment of Rs 1 lakh made five years ago would have grown to Rs 3.08 lakhs today. This performance not only surpasses the category average but also underscores the fund’s ability to capitalize on India’s consumption-driven growth.

Elevate your savings strategy with our easy-to-use Angel One SIP Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 20, 2024, 3:24 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates