A Stock Systematic Investment Plan (SIP) is a method of investing in the stock market wherein investors systematically allocate a fixed amount of money at regular intervals, typically monthly. Stock SIPs enable investors to accumulate shares of individual stocks over time. This approach provides the benefit of rupee-cost averaging and diversification and reduces the impact of market volatility. Stock SIPs provide a disciplined way for investors to invest in the equity market, aligning with their long-term wealth creation goals.

In this article, explore the best stocks for SIPs and know their benefits.

| Name | Market Cap (₹ in crore) | Close Price (₹) | 5Y CAGR (%) | 1Y Return (%) |

| Tata Power Company Ltd | 1,14,313.27 | 357.75 | 36.68 | 73.92 |

| Tata Motors Ltd | 2,98,951.33 | 816.45 | 35.27 | 98.05 |

| Sun Pharmaceutical Industries Ltd | 3,18,139.82 | 1,325.95 | 24.44 | 28.38 |

| Reliance Industries Ltd | 18,54,777.91 | 2,741.45 | 22.42 | 22.18 |

| Bajaj Auto Ltd | 2,06,776.44 | 7,301.95 | 21.83 | 104.52 |

| ICICI Bank Ltd | 7,03,964.54 | 1,003.5 | 21.53 | 16.60 |

| Larsen & Toubro Ltd | 4,90,548.80 | 3,568.8 | 21.11 | 65.24 |

| Infosys Ltd | 6,67,499.27 | 1,612.75 | 18.73 | 8.93 |

| NMDC Ltd | 61,938.35 | 211.35 | 18.05 | 64.47 |

| Mahindra and Mahindra Ltd | 1,94,505.51 | 1,624.45 | 17.42 | 23.07 |

Note: The list of the best stocks for SIPs is as of January 15, 2024 and is sorted based on the 5-year CAGR.

Tata Power is from the Tata Group. It is an integrated power company involved in the generation, transmission, distribution and trading of electricity. It is also involved in the mining and trading of coal.

Tata Motors Limited is another company that comes under the Indian conglomerate Tata Group. It is an automobile company that is involved in the manufacturing of motor vehicles.

This is a pharmaceutical company that offers generics, branded generics, over-the-counter products, speciality products, APIs and more.

Reliance Industries Limited is involved in the refining and manufacturing of refined petroleum products and petrochemicals. They also manufacture basic chemicals, nitrogen compounds, fertilisers, and more.

Bajaj Auto Limited from the Bajaj Group is involved in the manufacturing of motorcycles, three-wheelers and auto-related parts.

This company offers a wide range of banking and financial services, such as retail banking, commercial banking, corporate finance, investment banking, insurance and more.

Larsen & Toubro Limited is an engineering, technology, construction, financial services and manufacturing company.

This company is involved in consulting, technology, outsourcing and next-generation services. They are a global leader in next-generation digital services and consulting. They help their clients in digital transformation.

NMDC Limited is involved in the mining of iron ore and other minerals and services. The company is under the administrative control of the Ministry of Steel.

Mahindra and Mahindra Limited is involved in the manufacturing of commercial vehicles, passenger cars and tractors. The Group began as a steel trading business about 70 years ago and established into a global brand.

Investing in equity stocks has always been a popular choice for individuals seeking to grow their wealth over time. When it comes to investing in equity stocks, investors have two options. They can choose to invest in a particular stock by investing regularly at fixed intervals, such as daily, weekly, monthly, or at any time during market hours. The second option is a lump sum investment, where the entire amount is invested at once. Each strategy has its own set of advantages and considerations.

If an investor chooses to invest regularly in a particular company, it can offer several benefits. As retail or salaried investors, they can invest small amounts from their salary rather than investing a large sum at once. Given the inherent uncertainty of the market, if someone invests a substantial amount in one go and unfortunate news arrives, the potential for incurring significant losses is higher compared to investing regularly with smaller amounts.

Another advantage is that investors can increase their investment amount when they believe a particular stock is available at a significant discount, allowing them to take advantage of low prices. On the other hand, with lump sum investing, the investor has already allocated a substantial investment, leaving little opportunity to consider adding more funds to the same stock.

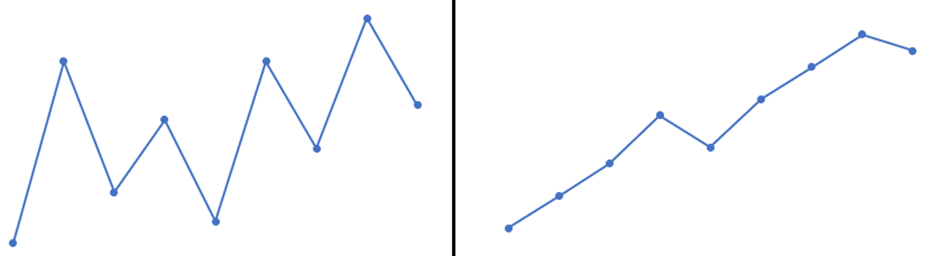

Below is the chart presentation, which shows the market behaviour in the short run versus the long run.

Furthermore, note that investing in stock as SIP is a long-term strategy that requires patience and consistency. The way you follow discipline in investing a small amount via SIP, the more you attract the compounding benefit and can potentially achieve a significant return on your investment.

One of the great things about investing in stocks through SIP is that it helps you spread out your investments over time. This can protect you from the ups and downs of the stock market. Let us consider an example to understand this better.

Suppose you went to a shop to buy tennis balls for your store. You found that the balls were available at ₹50 each, and you wanted to buy 100 pieces. However, the shop owner had only 40 balls in stock, so you bought those 40 balls at a price of ₹50 each, totalling ₹2,000.

Then, you went to another shop to buy the remaining balls you needed. The second shop had 30 pieces available, priced at ₹45 each. You bought all 30 balls and paid ₹1,350.

Finally, you went to a third shop and purchased the remaining 30 balls at ₹40 each, totalling ₹1,200. In total, you spent ₹4,550 for all 100 balls, which means each ball cost you ₹45.5 on average. If you had bought all 100 balls from the first shop at ₹50 each, it would have cost you ₹5,000 in total.

This example illustrates that when you buy stocks at different prices over time, you can achieve a better average stock price in the long run; as shown on the left-hand side of the chart, the market is more volatile in the short run, but in the long run, it is less volatile.

Stock SIPs offer a strategic and disciplined approach for investors to navigate the stock market, fostering long-term wealth creation. To embark on your stock SIP journey, consider opening a Demat Account with Angel One, providing a seamless platform to manage your investments and access a diverse range of stocks. Happy investing!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 5, 2023, 6:09 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates