Bharat Dynamics (BDL) is a Government of India Enterprise engaged in the manufacturing of guided missiles and allied defence equipment. Today, the company experienced a significant surge in its share price.

At the start of the day’s trading session, the stock opened at Rs 1,399.95 per share, indicating an approximate 1% increase compared to the previous day’s closing figure of Rs 1,391.25 per share on the BSE. As of this article’s writing, the shares are currently at Rs 1,552 per share on the BSE.

Furthermore, the company’s shares hit Rs 1,500 apiece today for the first time since listing. Moreover, the company’s stock has surged from Rs 500 to Rs 1,500 within just 687 days, representing an impressive 200% return during this period. Today, there is a significant spurt in volume, more than 2.95 times its average volumes on the BSE. The company’s current market capitalisation stands at Rs 28,445 crore, and the stock has generated an impressive return of 70% during the past one year and around 350% return in the past three years.

Stock Price Chart (Weekly)

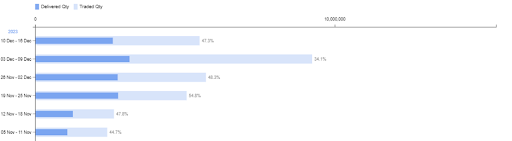

Trading and Delivery Volume (Weekly)

Significant delivery volumes have been consistently observed weekly, as depicted in the image above. Over the last four weeks, the delivery volumes have notably increased compared to previous levels.

Company’s Order Book:

The company’s order book remained robust over the last two quarters, as indicated by the company’s update in the investor presentation, with a total order book of Rs 20,766 crore as of Q2 FY24. Throughout the Q1 and Q2 of FY24, the company secured a substantial order worth Rs 1659 crore, marking a growth of over 8%. During FY23, the order book stands at Rs 20,054 crore.

Financial Performance

In the second quarter of FY24, the company reported revenues of Rs 616 crore, reflecting a growth of 15.15% compared to the same quarter in the previous year, when the revenue stood at Rs 535 crore. The company posted an operating profit of Rs 134 crore for the quarter, in contrast to an operating profit of Rs 94 crore in the corresponding quarter of the previous year. Furthermore, the company reported a net profit of Rs 147 crore, compared to a net profit of Rs 76 crore in the same period last year. The company achieved a net profit growth of around 93% YoY during the quarter.

The company’s ROCE and ROE ratios are 15.6% and 11.3%, respectively, while the stock is trading at a PE of 67.5 times in the market.

In terms of ownership, the Promoter holds 74.93%, while Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) hold 3.09% and 12.81%, respectively. The remaining 9.17% is held by public investors, as per the most recent update.

Investors must keep this stock on their radar.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 18, 2023, 4:42 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates