With price volume support, Kwality Pharmaceuticals and Life Insurance Corporation of India have strong bullish breakout potential. The stock prices have displayed inverse head & shoulder and a consolidation breakout and are presently trading at Rs 471 and Rs 893. The breakout corresponds to the RSI, ADX, and other technical analysis indicators.

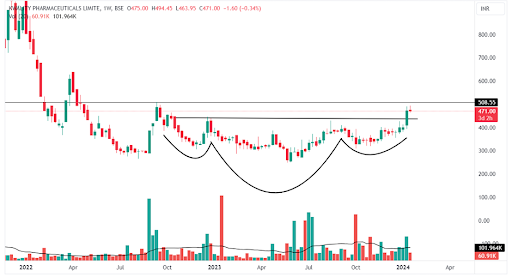

Weekly chart of Kwality Pharmaceuticals Ltd

Kwality Pharmaceuticals is currently exhibiting a sustained bullish momentum on the weekly chart, marked by a compelling inverted head & shoulder breakout. This pattern is confirmed by the last week’s close, supported by a strong bullish candle. Buyers are actively participating in the stock, evident from Thursday’s substantial daily volume, providing ample strength for the breakout sustainability.

The Tuesday trading session opened at Rs 474 and surged to a day high of Rs 494. After 15 months of pattern formation, the stock has convincingly breached the neckline of the pattern, signalling a potential trend reversal.

The stock’s current price surpassed a 52-week high, propelled by an increase in volume during the breakout. This breakout positions Kwality Pharmaceuticals for a positive trend shift, with accumulated volume suggesting further growth in the near future. The bounce from the 200-day EMA underscores the stock’s effort to establish new highs. The relative strength index entering the 65-80 range and a robust ADX at 22 on the daily chart indicate a medium directional strength favouring a continued uptrend.

In case of a retracement, key support levels to monitor include the level of Rs 430. The minor upper resistance is at Rs 510, the overall favourable structure, as the stock consistently trades above crucial moving averages, indicating a sustained long-term upward trend.

Kwality Pharmaceuticals Ltd is engaged in the manufacture of pharmaceutical formulations in dosage form.

Daily chart of Life Insurance Corporation of India

Life Insurance Corporation of India’s stock is currently characterized by a strong green daily candle, confirming a breakout from the consolidation accompanied by a notable volume spike. Opening at Rs 856 on Tuesday, the stock reached an intraday high of Rs 900. This breakout follows a couple of weeks of consolidation, suggesting a resumption of the bullish trend.

The confirmation of the breakout, marked by a strong upthrust in the daily candle, indicates a continuation of the bullish momentum. Trading above its 52-week high, the stock may experience a rapid ascent following today’s sustained levels. The breakout is further supported by a price volume surge exceeding ordinary trading day volume.

The relative strength index just entered within the 65-80 range hints at a potential sharp rise in the stock price, especially as it trades in the same range. The ADX, rising at 47, has very high directional strength. The level of Rs 845 serves as a fundamental support level during corrective movements, with the overall structure favouring traders as the stock consistently trades above major moving averages.

Life Insurance Corporation of India engages in the provision of insurance plans.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jan 16, 2024, 3:51 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates