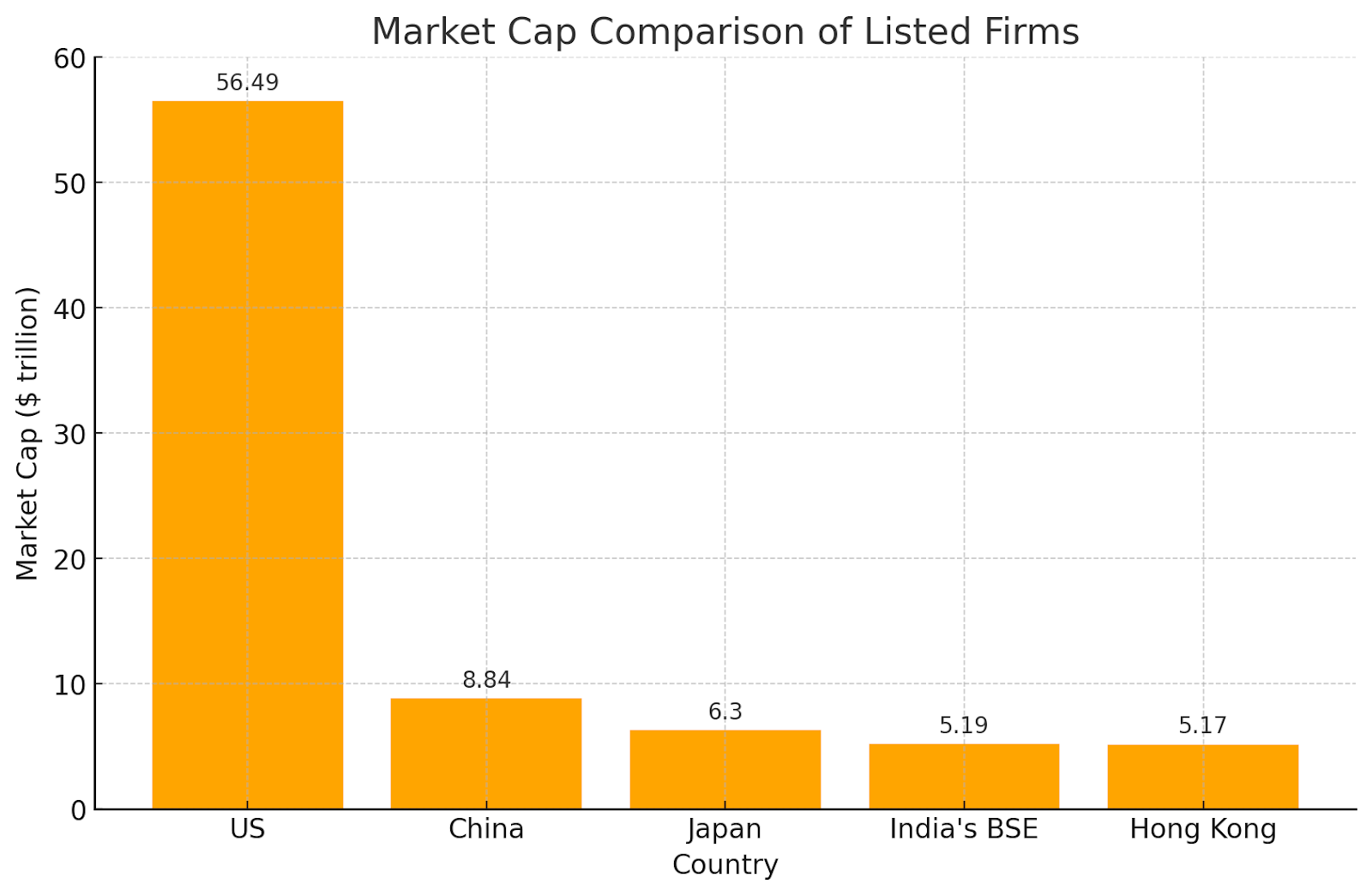

In a notable development, the total market capitalization of all companies listed on the Bombay Stock Exchange (BSE) has once again surpassed Hong Kong, making India’s BSE the fourth largest equity market globally.

The market cap of BSE-listed companies stands at $5.19 trillion, slightly edging out Hong Kong’s $5.17 trillion. This positions India just behind the United States, China, and Japan in the global rankings.

India first surpassed Hong Kong on January 23rd. However, Hong Kong quickly reclaimed its position. Recent market movements have seen BSE regain its advantage.

Hong Kong’s Hang Seng Index has shown significant resilience. Since April, it surged over 12%, marking a nearly 20% rise from its January low. This rally was driven by:

These factors have helped Hong Kong recover from prolonged losses due to China’s economic concerns and geopolitical tensions.

Indian markets have experienced considerable volatility recently, especially around election results. For instance, on June 4th, the market dropped by over 6%, but swiftly rebounded, achieving record highs. The market cap of all BSE-listed companies increased by over Rs 32 lakh crore, reaching Rs 432 lakh crore ($5.19 trillion).

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jun 14, 2024, 5:47 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates