The Bombay Stock Exchange (BSE), an institution with a rich history as the oldest stock exchange in Asia, has recently achieved a feat that has garnered global attention. Surpassing all other global equity exchanges, BSE has emerged as the world’s most valuable stock. This astonishing achievement can be attributed to a significant surge in BSE’s stock price over the past six months, driven by a strategic revision in transaction charges.

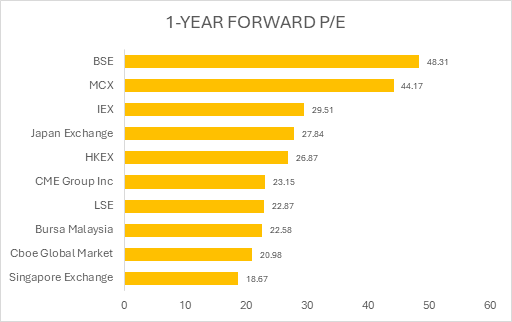

In the span of just half a year, BSE has experienced a remarkable 262% rally, making it a standout performer in the financial world. This extraordinary surge has propelled BSE’s price-to-earnings (P/E) ratio to an impressive 48.31 times its one-year forward earnings.

What truly sets BSE apart is its P/E ratio, which significantly surpasses that of other renowned global exchanges. To put things in perspective, MCX boasts a ratio of 44.2x, Japan Exchange stands at 27.8x, and the London Stock Exchange is at 22.9x.

While BSE continues to soar, other global exchanges have witnessed diverse fortunes. For instance, Japan Exchange Group’s stock recorded a noteworthy 38% surge during the same six-month period, whereas Germany’s Deutsche Borse faced a significant decline of 17%. Similarly, exchanges like Hong Kong Exchanges, Nasdaq, and Euronext experienced declines ranging from 11% to 14%.

BSE’s rise to the top can be primarily attributed to its strategic decision to increase transaction charges in the equity derivatives segment, effective from November 1. These changes have had a significant impact, particularly on S&P BSE Sensex Options, including the nearest expiry contracts.

Analysts at IIFL Securities predict that the increased equity option tariffs, which range from 3-6.5x (with an estimated blended increase of 5x), are likely to result in a substantial 25-35% upgrade in FY25-26 earnings per share (EPS). BSE’s tariffs still remain 25-40% lower than those of its key competitor, NSE, leaving room for further potential growth.

BSE currently accounts for 10% of India’s Option turnover (3.6% of premium turnover). With the expected improvement in Bankex volumes (representing less than one percent of Sensex volumes), BSE’s market share is poised for expansion.

Based on Bloomberg consensus estimates, BSE is projected to achieve a net profit of ₹567 crore in the fiscal year 2024, a significant increase compared to the previous year. This notable turnaround in BSE’s fortunes is especially striking when considering that, apart from 2020 and 2021, BSE’s stock had ended in the red every year since its listing in 2017.

BSE’s phenomenal journey from financial underperformance to global prominence underscores the pivotal role of strategic decisions, such as transaction charge revisions, in shaping the fortunes of stock exchanges. BSE’s remarkable rally serves as a testament to the dynamism of financial markets and their ability to surprise and inspire.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 26, 2023, 6:35 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates