Canara Robeco Balanced Advantage Fund is a new open-ended balanced advantage fund launched by Canara Robeco Mutual Fund. The scheme generates long-term capital appreciation with income generation by dynamically investing in equity, equity-related, debt, and money market instruments.

The new fund offer will be open for subscription from July 12, 2024, to July 26, 2024. The minimum investment amount is Rs 1000. There is no entry load. An exit load of 1% will be charged if you redeem or switch out more than 12% of your allotted units within 365 days from the date of allotment. No exit load will be charged if you redeem or switch out up to 12% of your allotted units within 365 days or after 365 days from the date of allotment.

Canara Robeco Balanced Advantage Fund aims to generate long-term capital appreciation with income generation by dynamically investing in equity and equity-related instruments and debt and money market instruments. However, there can be no assurance that the scheme’s investment objective will be realised.

This NFO of Canara Robeco Balanced Advantage Fund is suitable for investors who are seeking long-term capital appreciation and Investment in a dynamically managed portfolio of equity & equity-related instruments and debt & money market securities.

| Instruments | Indicative allocations (% of total assets) |

| Equity and Equity-related Instruments | 100 – 65 |

| Debt and Money Market Instruments | 35 – 0 |

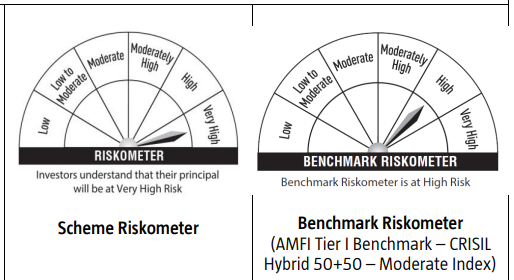

The performance of the Canara Robeco Balanced Advantage Fund will be benchmarked to the performance of the CRISIL Hybrid 50+50 – Moderate Index.

Shridatta Bhandwaldar has 14 years of experience in equities, serving as the Head of Equities. He was a Fund Manager at Canara Robeco Asset Management Company Ltd. from July 2016 to September 2019, Head of Research/Portfolio Manager at SBI Pension Funds Pvt. Ltd. from July 2012 to June 2016, Senior Equity Analyst at Heritage India Advisory Pvt. Ltd. from October 2009 to June 2012, Research Analyst at Motilal Oswal Securities from January 2008 to September 2009, and Research Associate at MF Global Securities from April 2006 to December 2008.

Ennette Fernandes, aged 36, holds a PGDBM in Finance and has 12 years of experience in equities. She worked at Tata Asset Management Ltd. as an Assistant Fund Manager from April 2018 to September 2021 and as a Research Analyst from January 2014 to March 2018. She also worked at Phillip Capital (India) Pvt. Ltd. as a Research Analyst from April 2011 to December 2013 and as a Research Associate from April 2009 to March 2011.

Suman Prasad, an MBA (Finance) graduate from SDM Institute for Management Development, Mysore, India, has 16 years of experience in asset management with a focus on fixed income. He is the Fund Manager for Gilt Advantage and Co-Fund Manager for various other funds at Canara Robeco, where he has been employed since May 1997.

Amit Kadam, aged 41, holds a BE in Electronics and an MMS in Finance, with over 15 years of experience in equities and overseas investments. He is currently the Fund Manager – Equities at Canara Robeco Asset Management Company Ltd. since April 2024. Prior to this, he was the Assistant Fund Manager – Equities from October 2021 to April 2024, a Research Analyst from September 2018 to September 2021 at the same company, a Research Analyst at LIC Mutual Fund Asset Management Ltd. from June 2013 to September 2018, and a Research Analyst at Sykes and Ray Equities (I) Ltd. from June 2010 to June 2013.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Week Returns (%) | 1 Month Returns (%) | 3 Months Returns (%) | 6 Months Returns (%) | Since Launch Ret (%) |

| 360 ONE Balanced Hybrid Fund | 706.85 | 2.02 | -0.17 | 3.54 | 9.67 | 13.7 | 21.33 |

| WhiteOak Capital Balanced Hybrid Fund | 110.89 | 2.13 | 0.42 | 3.71 | 6.97 | 11.7 | 20.37 |

| Category Average | – | – | 0.12 | 3.62 | 8.32 | 12.7 | 20.85 |

Data As of July 10, 2024

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 12, 2024, 6:33 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates