The financial year 2023-2024 (FY 2024) was a dynamic one for the Indian mutual fund industry. While some categories witnessed stellar growth, others experienced subdued returns. We explore the top 5 performers, unveiling the equity mutual fund categories that delivered exceptional returns for investors throughout FY 2024.

| Category Name | 6-Months Ret (%) | 1-Year Ret (%) | 3-Yrs Ret (%) | 5-Yrs Ret (%) | 10-Yrs Ret (%) | Since Launch Ret (%) |

| Equity: Thematic-PSU | 40.71 | 88.15 | 39.06 | 23.82 | 16.46 | 19.8 |

| Equity: Sectoral-Infrastructure | 27.3 | 65.57 | 32.32 | 23.39 | 18.75 | 12.81 |

| Equity: Thematic-Manufacturing | 26.39 | 58.98 | 30.2 | 23.77 | 0 | 20.51 |

| Equity: Sectoral-Pharma and Healthcare | 23.18 | 56.56 | 19.08 | 22.96 | 15.69 | 17.54 |

| Equity: Mid Cap | 16.61 | 52.44 | 23.82 | 21.31 | 20.01 | 20.18 |

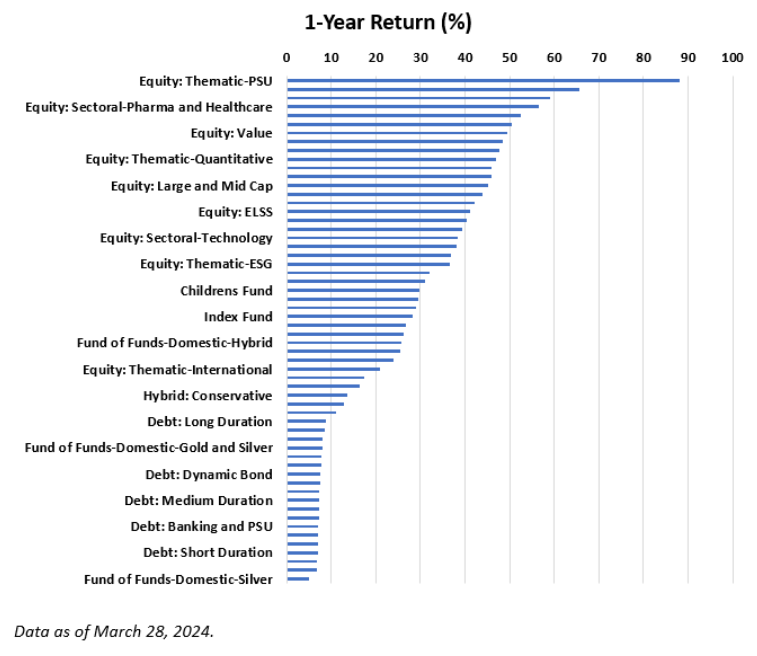

Data as of March 28, 2024.

A Thematic-PSU Mutual Fund is an equity mutual fund that focuses on investing in stocks related to a PSU that logged 88.15% returns in the last year. In this category, CPSE ETF has gained maximum returns in a year timeframe which is around 103%, and manages an AUM of Rs 36,377 crore.

A Sectoral-Infrastructure Mutual Fund is a type of equity fund that focuses its investments solely on the infrastructure sector while the category has logged 65.57% returns in the last year. In this category, HDFC Infrastructure Funds has gained maximum returns in a year which is around 84.25%, and manages an AUM of Rs 1,607 crore.

A Thematic-Manufacturing Mutual Fund is an equity mutual fund that focuses on investing in stocks related to a manufacturing sector that logged 58.98% returns in the last year. In this category, ICICI Prudential Nifty Auto ETF has gained maximum returns in a year timeframe which is around 76.60%, and manages an AUM of Rs 45 crore.

A Sectoral-Pharma and Healthcare Mutual Fund is a type of equity fund that focuses its investments solely on the Sectoral-Pharma and Healthcare sector while the category has logged 56.56% returns in the last year. In this category, Aditya Birla Sun Life Pharma & Healthcare Fund has gained maximum returns in a year which is around 63.83%, and manages an AUM of Rs 692 crore.

Mid Cap funds invest in equity and equity-related instruments of Mid Cap companies. According to the Securities and Exchange Board of India (SEBI), mid-cap companies are those that are ranked between 101 and 250 in the list of companies according to market capitalization. This category has logged 52.44% returns in the year FY 2024. In this category, Edelweiss Nifty Midcap150 Momentum 50 Index Fund has gained maximum returns in a year which is around 73.01%, and manages an AUM of Rs 194 crore.

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Mar 28, 2024, 2:28 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates