Central Depository Services Limited (CDSL) made a groundbreaking announcement on Wednesday, November 22, solidifying its position as the foremost depository in India.

As detailed in the press release, the company surpassed the 10-crore mark for active demat accounts on its platform. In a statement, the depository celebrated this achievement as “another milestone,” with over 10 crore demat accounts now registered with CDSL.

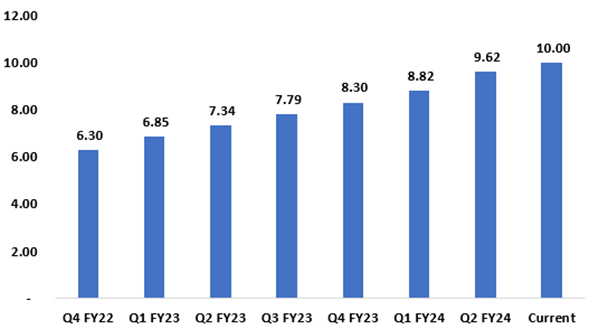

Reflecting on historical data from 2020, the company reached the 3-crore mark, establishing itself as the first depository to surpass this significant milestone in terms of demat accounts. In Q4 FY23, the company reported a surge in demat accounts from 3 crore to 8 crore, marking a 166% increase within that time period. The most recent update highlights that the platform has now reached a significant milestone of 10 crore active demat accounts.

Today, the CDSL shares commenced trading at Rs 1,740 per share on the NSE, marking a 1.22% increase from the previous day’s closing price of Rs 1,719 per share. Its 52-week high and low are Rs 1,897 and Rs 880.90, respectively. As of composing this article, the company’s shares are trading at Rs 1,799 per share. The company’s current market capitalization stands at Rs 18,803 crore, with the stock having generated an impressive return of 48% during the past year.

In the second quarter of FY24, the company reported revenues of Rs 207 crore. This represents a 39% YoY increase compared to the same quarter in the previous year when the revenue was Rs 149 crore. The company’s operating profit for the quarter stood at Rs 128 crore, compared to Rs 91 crore in the same quarter of the previous year. The operating profit margin for the company during this quarter was 62%.

Shifting our attention to the company’s net profit, it amounted to Rs 109 crore, compared to a net profit of Rs 80 crore in the same period last year. Whether we consider the top line or the bottom line, the company’s financial performance has improved.

The company’s Return on Capital Employed (ROCE) and Return on Equity (ROE) stand at 30.3% and 23.8%, respectively, indicating strong financial performance. Additionally, the company’s stocks are currently trading at a Price-to-Earnings (PE) ratio of 59 times in the market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 23, 2023, 12:17 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates