In what was long anticipated to happen, Morgan Stanley Capital International (MSCI) which is the world’s largest provider of tradable indices has decided to add China also to its list of countries. Over the past few years, China has been pitching for inclusion in the MSCI-EM index, but they had been kept out due to the lack of transparency and high levels of government ownership in Chinese stocks. In June 2017, that anomaly was finally rectified with the MSCI including China-A shares in its list of stocks for the purpose of EM index tracking. But firstly, what is this MSCI Index for emerging markets and why is it so critical…

How is the MSCI-EM index currently structured?

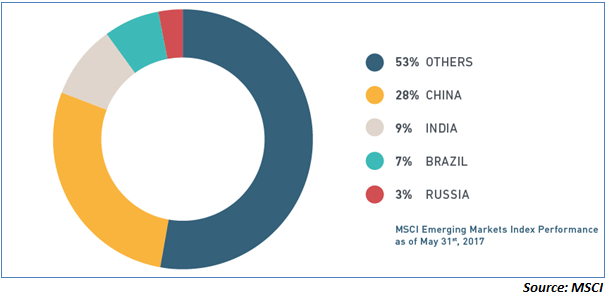

The MSCI-EM is virtually the global benchmark for global fund allocations. The MSCI-EM index allocates weightage to each stock included in the index and also allocates an overall national index weightage. The chart below captures the share of the key emerging markets in the overall MSCI allocation.

The above graph captures the weightage allocated to key economies. The “Others” category includes all the other EM nations and include Taiwan, South Korea, Indonesia, Turkey, Middle East, Argentina, South Africa, Nigeria and a host of other nations. The BRICS continue to dominate the MSCI EM index with nearly half the total EM share. One thing needs to be noted here. The China share above is before the admission of A-Shares into the index. These refer to Chinese shares that are traded on the Hong Kong Stock Exchange and other US exchanges. These include marquee names like Tencent and Alibaba but do not include the traditional companies from Mainland China that are typically predominantly government owned. That is what will get covered when the A-Shares are also included in the MSCI EM index.

Why the MSCI-EM index plays a pivotal role…

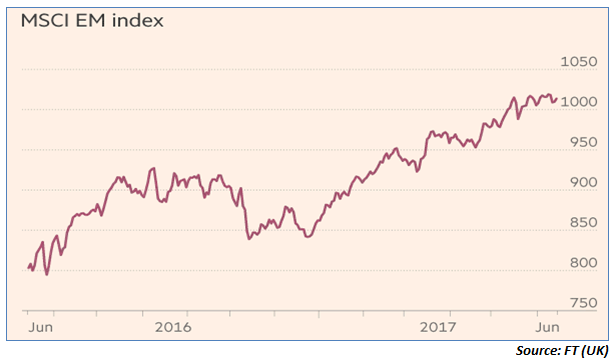

The MSCI EM plays an important role in asset allocation. A chunk of the money allocated to emerging markets like India is passive money which is allocated by index funds and large Exchange Traded Funds (ETFs). These passive funds allocate money to emerging markets based on the MSCI-EM index. The weightage of markets and specific stocks is determined by the weightage allocated by the MSCI index. An increase in weightage will lead to higher allocations and a reduction in weightage will lead to lower allocations by global funds. But why is there so much of a focus on the emerging market indices? Consider the chart below which captures the performance of the index over the last one year…

As the chart above indicates, the EM as an asset class has given healthy returns in excess of over 25% over the last 1 year making it one of the best performing asset classes. Most active and passive investors across the world do rely on the MSCI EM index as the benchmark for diversifying their risk and for generating alpha on their portfolio. The dependence on the MSCI EM index is either direct or indirect. For example, passive funds investing in emerging markets actually index their allocations to EMs based on the MSCI index. On the other hand, there are other active investors who still rely on the MSCI EM index for deciding their broad macro and sectoral allocations. Either ways, the index is pivotal to the flow of funds and is therefore an important indicator for markets.

What does this mean for India?

The inclusion of China-A shares will, prima facie, increase the allocation of funds to China by about $500-600 billion. To that extent the outflows will happen from other EMs like India, Taiwan, Korea and Brazil which will compensate for the higher allocations to China. So, Indian markets will have to be prepared for outflows from equities. The good news may, however, be that the outflows from India may not really have too much to worry about. Here is why…

The moral of the story is that India does not have to be overly worried about this re-allocation. Firstly, India continues to be an attractive emerging markets story. Secondly, India has developed its own defence in the form of a strong base of MF and insurance investors who can take care of bridging outflows. The MSCI-EM re-allocation favouring China may not really be a worry for Indian markets!

Published on: Jul 12, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates