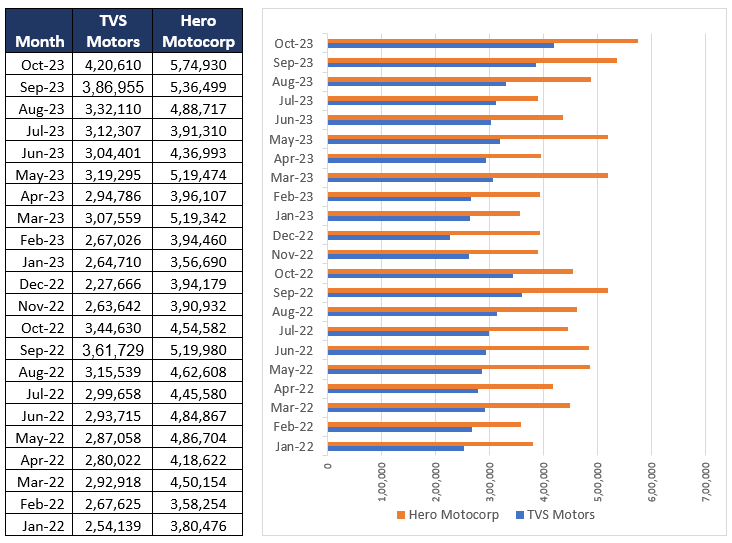

In the dynamic landscape of the two-wheeler industry, the period from January 2022 to October 2023 witnessed a spectacle of soaring sales volumes. TVS Motors notched an impressive 65.50% growth, mirroring the commendable 51.11% surge experienced by its industry counterpart, Hero Motocorp. However, the intriguing twist in this tale lies in the starkly different trajectories of their respective stock performances.

The surge in sales volumes for both TVS Motors and Hero Motocorp paints a picture of robust consumer demand, favourable economic conditions, or perhaps a subtle shift in consumer preferences. The sales numbers, depicted in the table, narrate a story of resilience and adaptability in the face of industry dynamics.

During the period spanning January 2022 to October 2023, TVS Motors demonstrated a remarkable sales volume growth of 65.50%. Similarly, Hero Motocorp, the leading player in the two-wheeler industry, experienced a noteworthy sales volume growth of 51.11% during the same period.

The surge in sales volumes for both TVS Motors and Hero Motocorp could also be indicative of a broader trend within the two-wheeler industry, reflecting increased consumer demand, favourable economic conditions, or shifts in consumer preferences.

While both TVS Motors and Hero Motocorp exhibited impressive sales volume growth from January 2022 to October 2023, the financial performance of their respective stocks tells a divergent story. Despite registering similar volume growth figures, Hero Motocorp did not witness a commensurate appreciation in its stock price compared to the notable surge experienced by TVS Motors. The stock performance data from January 3, 2022, to November 21, 2023, reveals that TVS Motors demonstrated a substantial stock price appreciation of 176.94%, outshining Hero Motocorp, which experienced a more modest growth of 37.09%.

Despite the seemingly parallel sales growth, the stock market narrative takes an unexpected turn. TVS Motors emerges as the star, boasting a remarkable stock price appreciation of 176.94%. In stark contrast, Hero Motocorp, with a sales growth on par with TVS Motors, experienced a more modest stock growth of 37.09%. The question arises: What elements contribute to such a significant difference?

The disparity finds its roots in the strategic emphasis on Electric Vehicles (EVs). According to the Concall analysis of both companies, for Hero Motocorp EVs are not yet profitable, but the focus remains on the nascent stage and building the category. In contrast, TVS Motors celebrates its iQube EV as a positive contributor. The company’s focus extends beyond immediate profits, prioritizing the growth of the top line, product diversification, and the pursuit of sustainable growth along with EBITDA margins. The patient investment in EV technology positions TVS Motors optimistically for future results.

The perplexing difference in stock price appreciation between TVS Motors and Hero Motocorp, despite seemingly similar sales growth, underscores the importance of diving into the intricacies of financial dynamics. As both companies navigate the evolving landscape, investors are left to ponder the multifaceted factors that shape stock market destinies, offering a lesson in the nuanced dance of financial metrics within the two-wheeler industry.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 28, 2023, 5:04 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates