In the world of finance, having information is crucial. Through this analysis, we unveil the financial sector’s intricate tapestry, revealing the stars and outliers. By dissecting sector-specific data, we aim to provide valuable insights and a comprehensive overview of how various sectors have fared in recent times. Join us on this journey as we explore the winners, losers, and trends shaping today’s market.

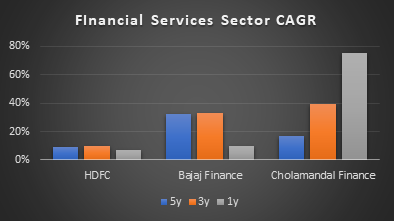

Financial Services, accounting for 35.95% weightage in the NIFTY50 Index, spotlighting HDFC, Bajaj Finance, and Cholamandal Finance: A CAGR Comparison.

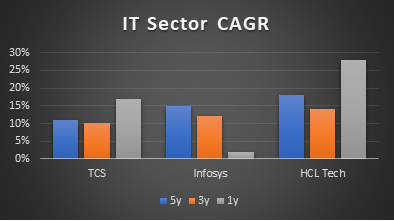

The Information Technology sector holds a 13.77% share within the NIFTY 50 index. We delve into the stock price Compound Annual Growth Rates (CAGR) of three IT giants: TCS, Infosys, and HCL Tech, providing a focused analysis of their performance.

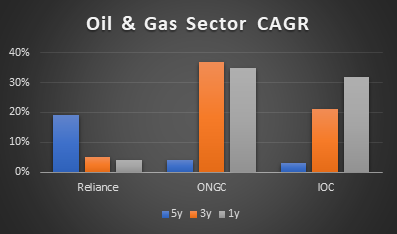

The Oil, Gas and consumable Fuels sector carries an 11.24% weight in the Nifty 50 index. This analysis zooms in on the stock price Compound Annual Growth Rates (CAGR) of three major players within this sector: Reliance, ONGC, and IOC, offering a precise assessment of their performance.

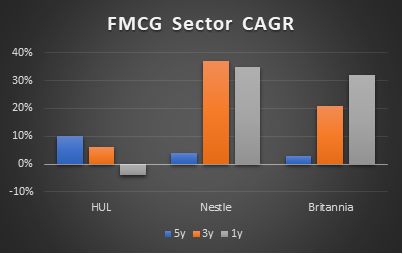

The FMCG (Fast-Moving Consumer Goods) sector holds a 9.29% share in the Nifty 50 index. In this analysis, we closely examine the stock price Compound Annual Growth Rates (CAGR) of three FMCG giants: HUL, Nestle, and Britannia, providing a detailed perspective on their market performance.

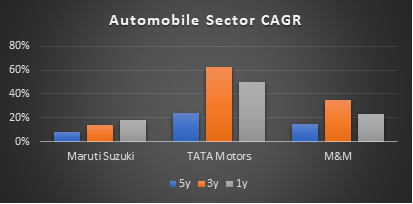

The Automobile and Auto Components sector comprises 6.21% of the Nifty 50 index. We explore the stock price Compound Annual Growth Rates (CAGR) of three industry leaders: Maruti Suzuki, TATA Motors, and M&M, providing insights into their performance within this sector.

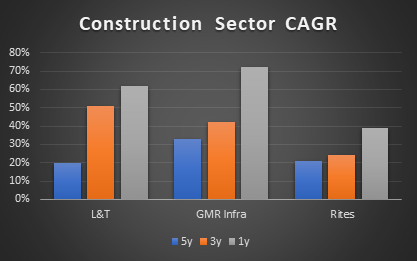

The Construction Sector accounts for 4.24% of the Nifty 50 index. In this analysis, we scrutinize the stock price Compound Annual Growth Rates (CAGR) of three prominent players: L&T, GMR Infra, and RITES, offering a detailed assessment of their performance within this sector.

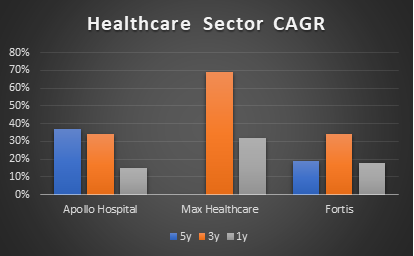

The Healthcare Sector commands a 4.12% share in the Nifty 50 index. Let’s examine the stock price Compound Annual Growth Rates (CAGR) of three prominent healthcare giants: Apollo Hospitals, Max Healthcare, and Fortis, providing valuable insights into their performance within this sector.

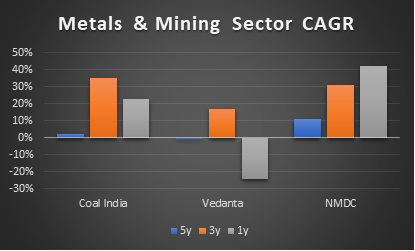

The Metals & Mining Sector, with a weightage of 3.81% in the Nifty 50 index. We delve into the stock price Compound Annual Growth Rates (CAGR) of three key players:Coal India, Vedanta, and NMDC, delivering comprehensive insights into their performance within this sector.

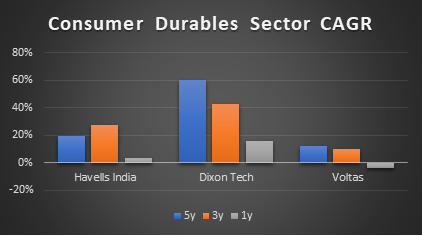

The Consumer Durables Sector, accounting for 3.18% of the Nifty index, comes under the microscope in our analysis. We delve into the stock price Compound Annual Growth Rates (CAGR) of three prominent players: Havells India, Dixon Technologies, and Voltas, shedding light on their performance within this sector.

Analysis of the Nifty 50 index’s key sectors has offered a snapshot of their performance. From the robust growth of the IT sector to the stability of FMCG and the potential of emerging players in Construction, Healthcare, and Metals and mining, each sector presents distinct opportunities and challenges for investors. As market dynamics evolve, staying informed about sectoral trends will be crucial for making informed investment decisions and seizing growth prospects in India’s ever-changing financial landscape.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 9, 2023, 12:31 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates