When we think of Bajaj, the iconic tagline from their advertisements, “Hamara Bajaj,” often springs to mind. Yet, when the conversation shifts to the stocks within the Bajaj Group, one name takes centre stage: Bajaj Finance. It’s not merely due to the persistent loan offers from their eager executives, but rather the colossal returns it has bestowed upon its shareholders over the years. However, in this blog, we embark on a fascinating journey into a sibling rivalry of sorts – a comparison between the Bajaj Twins, namely Bajaj Finance and Bajaj Finserv. Prepare to uncover the nuances, distinctions, and investment potential of these financial giants as we delve into their financial arena.

Bajaj Group is a diversified Indian multinational conglomerate with interests in a broad range of industries, including automobiles, consumer goods, financial services, energy, and engineering. The group’s flagship companies include Bajaj Auto, Bajaj Consumer Care, Bajaj Finance, Bajaj Finserv, Bajaj Energy, Bajaj Electricals, and Bajaj Hindusthan.

In this article, we are going to deep dive into the business of Bajaj Finance and Bajaj Finserv, their financials

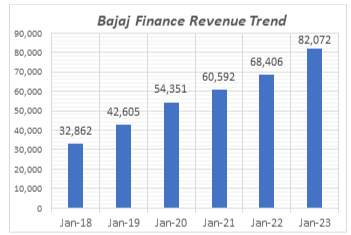

Bajaj Finance Limited, a subsidiary of Bajaj Finserv Limited, one of the leading financial services companies in India, is a leading non-banking financial company (NBFC) offering a diversified portfolio of products and services to individuals, small and medium-sized enterprises (SMEs), and commercial customers. Bajaj Finance Limited focuses on consumer finance, business loans, personal loans, home loans, investment products, and insurance. It is known for its innovative product offerings, competitive pricing, and customer-centric approach.

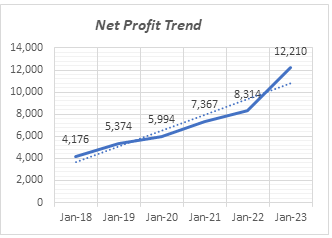

Bajaj Finance reported a strong Q1 FY24 earnings performance, with all key metrics improving over the previous year.

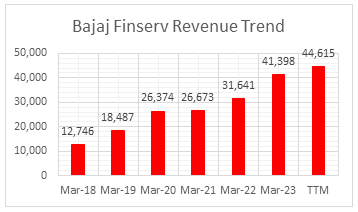

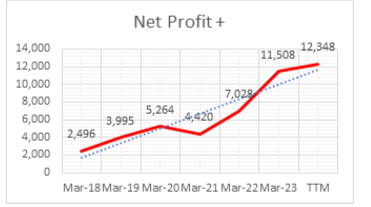

Bajaj Finserv is an unregistered core investment company (CIC) under RBI regulations 2020 and the holding company for the various financial services businesses under the Bajaj group. Its vision is to be a diversified financial services group with a pan-India presence and, thus, offer life-cycle financial solutions for its various customers. It offers a wide range of services such as insurance, asset management, lending and payments.

| Average price | Average price | ||||||

| Investment | October 8, 2018 | No of shares | October 6, 2023 | Investment value | ROI | Five-year CAGR | |

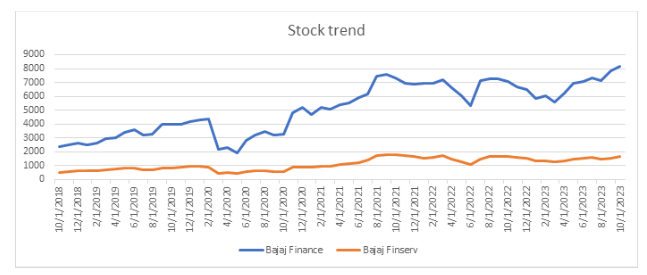

| 1. Bajaj Finance | Rs. 1,00,000.00 | Rs. 1,983.43 | 50 | 8009.27 | Rs. 4,03,810.08 | 404% | 32% |

| 2. Bajaj Finserv | Rs. 1,00,000.00 | Rs. 537.25 | 186 | 1597 | Rs. 2,97,254.54 | 297% | 24% |

In comparison, Bajaj Finserv is a more diversified financial services company with interests in insurance, investment management, and retail financing. While the insurance business has been a major growth driver for Bajaj Finserv, the other businesses have been relatively subdued.

From a financial perspective, Bajaj Finance has a higher return on equity (ROE) and return on assets (ROA) than Bajaj Finserv. This indicates that Bajaj Finance is more efficient at generating profits from its assets and equity.

Bajaj Finance and Bajaj Finserv are both leading financial services companies in India, with strong track records of growth and profitability. Bajaj Finance is a more focused company, with a focus on consumer finance, while Bajaj Finserv is more diversified, with interests in insurance, investment management, and retail financing.

Disclaimer: Above article is for educational purpose only. Securities mentioned are not recommendations.

Investment in securities market is subject to market risk. Please take advise from an expert before investing.

Published on: Jul 4, 2023, 2:11 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates