In the dynamic landscape of the Indian automotive industry, Mahindra & Mahindra (M&M) and Tata Motors emerge as key contenders, each navigating distinct paths in response to market challenges and opportunities. November 2023 witnessed contrasting sales performances, with M&M boasting a 32% surge in SUV sales while Tata Motors resiliently held ground amidst a marginal decline in total domestic sales.

The financial narrative further reveals intriguing stories – M&M’s impressive revenue growth juxtaposed with a dip in Profit After Tax, and Tata Motors’ remarkable surge in both revenue and profitability. As these automotive giants strategically position themselves for the electric vehicle revolution, their divergent approaches unfold, showcasing M&M’s investment in ICE leadership and Tata Motors’ ambitious EV-driven trajectory.

Amidst this, the Commercial Vehicle segment takes centre stage, reflecting Tata Motors’ strategic focus and M&M’s growth-oriented approach. This comparative analysis provides a snapshot of their journeys, emphasizing the pivotal role of strategic initiatives, market diversity, and financial resilience in shaping the future of M&M and Tata Motors.

In November 2023, M&M reported robust growth in its utility vehicles segment, achieving a 32% increase in domestic sales. With a total of 39,981 SUVs sold, the company’s growth trajectory remains impressive. Veejay Nakra, President, Automotive Division, attributed this success to the strong demand for their SUV portfolio.

On the other hand, Tata Motors faced a marginal decline of 1% in its total domestic sales for November 2023. The total passenger vehicle (PV) sales, including electric vehicles (EVs), remained stable, showcasing the resilience of Tata Motors in a challenging market.

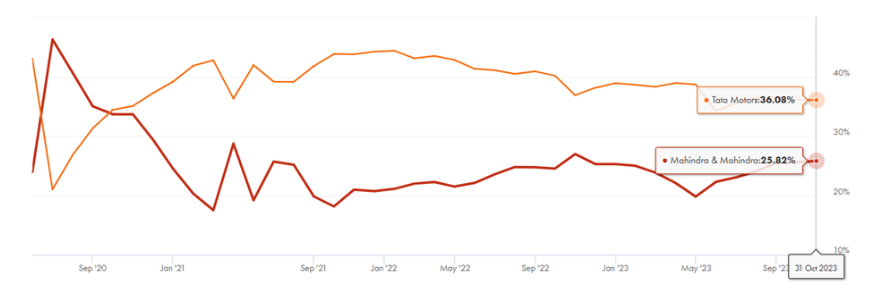

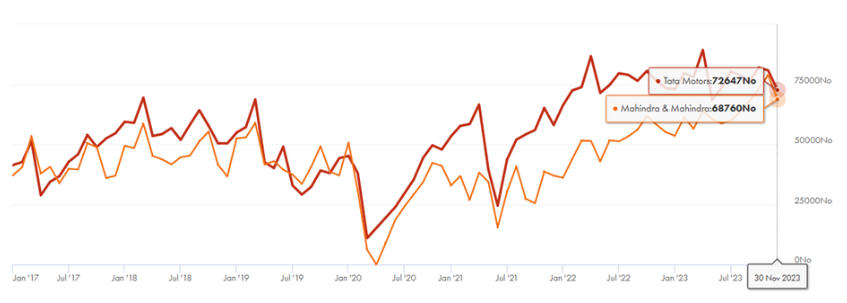

While M&M shines in the SUV domain, Tata Motors maintains a balanced approach, offering a wide range of commercial and passenger vehicles. The Commercial Vehicle (CV) segment, contributing 28,029 units, witnessed a 4% YoY decline. Tata Motors strategically focuses on diverse segments, including heavy commercial vehicles (HCV) trucks, intermediate and light commercial vehicles (ILMCV), and passenger carriers. These visual aids offer a comprehensive understanding of both companies market shares in both Commercial Vehicles (IMG 1) and Passenger Vehicles (IMG 2) segments.

In the second quarter of the fiscal year 2023 (Q2FY23), both Mahindra & Mahindra (M&M) and Tata Motors (Tata M) experienced noteworthy financial performance. However, in Q2FY24, the companies demonstrated distinct trends in their results.

Starting with M&M, the company’s revenue witnessed a substantial growth from Rs 29,870 crore in Q2FY23 to Rs 34,436 crore in Q2FY24, indicating an impressive increase. However, the Profit After Tax (PAT) for the same period saw a decline from Rs 3,021 crore to Rs 2,348 crore. This dip in PAT might raise questions about the company’s operational efficiency and cost management.

On the other hand, Tata Motors exhibited a remarkable surge in both revenue and profitability. The revenue surged from Rs 79,611 crore in Q2FY23 to a substantial Rs 1,05,128 crore in Q2FY24, showcasing a robust growth trajectory.

The Profit After Tax also experienced a positive shift, transitioning from a negative Rs 898 crore in Q2FY23 to a noteworthy Rs 3,832 crore in Q2FY24. This significant turnaround in profitability suggests effective strategic initiatives and operational improvements within Tata Motors.

Both companies are gearing up for the electric vehicle (EV) revolution, but their approaches differ. M&M plans to position Mahindra Electric Automotive as a separate entity for EVs, emphasizing a distinct showcase for EV and Internal Combustion Engine (ICE) portfolios. The company also focuses on investing in ICE to maintain leadership in the segment.

Tata Motors, meanwhile, underscores the importance of EVs in its portfolio, with over 4 million kilometres driven by Ace EVs and ambitious plans for the AVINYA EV series. The company remains steadfast in its guidance for double-digit margins by FY 2026.

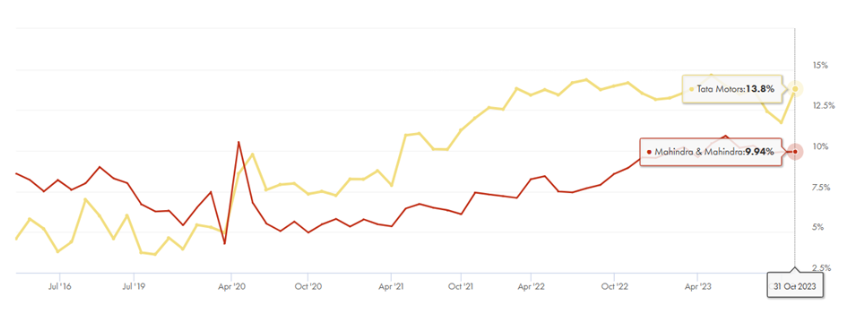

Tata Motors exhibits a strategic focus on the CV segment, with improvements in market share and profitability. Their emphasis on Small Commercial Vehicle (SCV) market shares and sustained improvements in Medium and Heavy Commercial Vehicle (M&HCV) market shares have paid off. Pricing discipline is maintained in the M&HCV segment, and the outlook for M&HCV growth in Q3 remains positive.

M&M, while achieving a significant 54% growth in the LCV < 2T category, is re-evaluating its capacity planning to meet the surging market demand for SUVs, including EV models. The company underscores the importance of ICE models, with plans for refreshes and updates.

Both companies project a positive outlook despite external challenges. M&M remains focused on meeting future growth targets and maintaining profitability. Tata Motors emphasizes the achievement of double-digit EBITDA for the entire year and a net debt target of sub 1 GBP billion in the next six months.

In conclusion, M&M’s dominance in the SUV market complements Tata Motors’ diversified portfolio. While M&M carves its path by investing in ICE and addressing supply challenges, Tata Motors strategically navigates the EV wave and sustains growth in diverse vehicle segments. The automotive journey for these giants involves meeting demand, embracing electric futures, and maintaining financial resilience in a dynamic market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions

Published on: Jul 7, 2023, 12:42 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates