Titagarh Rail Systems Ltd. (TTRL) and Jupiter Wagons Ltd. (JWL) are two of the leading railway wagon manufacturers in India. Both companies have a strong track record of growth and profitability. In this article, we will compare the two companies based on various factors, such as market capitalization, revenue, profit margins, and order book.

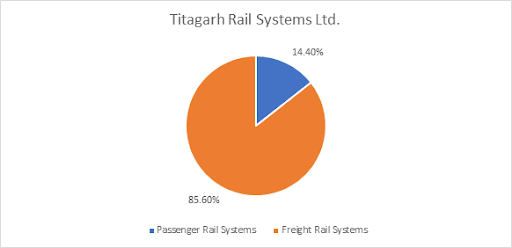

TTRL was incorporated in 1997 and is India’s largest private-sector manufacturer of railway passenger & freight rolling stock. The company also manufactures electric propulsion systems and various railway wagons like containers, tank wagons, etc.

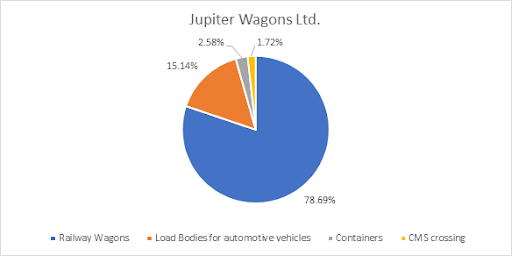

JWL was incorporated in 2006 and is primarily involved in the business of manufacturing metal fabrication comprising load bodies for commercial vehicles, rail freight wagons, and components.

| Metrics | Titagarh Rail Systems Ltd. | Jupiter Wagons Ltd. |

| Market Cap (Rs Cr) | 12,394 | 13,636 |

| CMP (Rs) | 975 | 341 |

| P/E Ratio | 58.54 | 58.7 |

| ROE (%) | 13.9 | 16.8 |

| Debt to Equity | 0.26 | 0.35 |

Titagarh Rail is a dominant player in the passenger rolling stock, with a strong track record of supplying metro trains and coaches to Indian Railways and other metro rail operators. Jupiter Wagons does not have a significant presence in this segment.

Titagarh Rail is the only company among the two with a presence in the shipbuilding and defence sector. The company’s shipyard has a proven capability of building warships, passenger vessels, tugs, and specialized vessels.

Jupiter Wagons has diversified into the manufacturing of brake systems and brake discs, complete track solutions, commercial electric vehicles, and containers. These diversifications provide the company with additional revenue streams and growth opportunities.

Titagarh Rail has four manufacturing facilities, two in Titagarh, one in Uttarpara, and one in Rajasthan, with an annual capacity of 8,400 wagons, 200 Metro coaches, 36 electric coaches, and 30,000 tonnes of steel casting. Jupiter Wagons has six manufacturing facilities in Central India, four in Jabalpur, and one each in Indore and Jamshedpur. In Q2FY24, the company manufactured 1,850 units of Railway Wagons, 126 units of CMS Crossing, 2,431 Commercial Vehicle Components, and 131 units of Containers.

Titagarh Rail has a total order book of Rs 28,212 crore, with 51% of it coming from freight rolling stocks and 49% from passenger rolling stocks. Jupiter Wagons has a total order book of Rs 5,952.65 crore, with 90% of it coming from wagon orders.

Titagarh Rail aims to reach a monthly production capacity of 1,000 wagons by the end of the current fiscal year, while Jupiter Wagons expects to increase its production run rate to 800 wagons per month by the end of FY23-24. These expansions will significantly boost the wagon manufacturing capacity in India and support the Indian Railways’ ambitious plans to expand its freight operations.

Titagarh Rail: Indian Railways & Maharashtra Metro Railway Corporation.

Jupiter Wagons: Railways & CV manufacturers such as Tata Motors, VE Commercial Vehicles, Ministry of Defence, Mahindra & Mahindra, Reliance Industries, Ministry of Indian Railways etc.

Titagarh Rail’s revenue has increased by 54% year-over-year to Rs 935 crore. Operating profit has increased by 117% to Rs 115 crore, and PAT has increased by 58% to Rs 71 crore. Jupiter Wagons’ revenue has increased by 111% year-over-year to Rs 879 crore. Operating profit has increased by 142% to Rs 121 crore, and PAT has increased by 228% to Rs 82 crore.

Titagarh Rail is targeting a 10% margin for its passenger rail systems business and a 10-11% EBITDA margin for its freight rolling stock business. It also expects to maintain 10% margins for Vande Bharat trains. The company plans a capex of Rs 80-100 crore for FY24.

Jupiter Wagons is expecting Rs 50 crore of topline in the brake disc business in the current financial year. It plans to increase its revenue to Rs 150 crore next year, with contributions from the export market. The company is expecting 2 to 3 tenders for LHB coach braking systems. Indian Railways has issued a tender for 20,000 wagons, likely expanding the company’s orders. Jupiter Wagons is also increasing its foundry capacity from 2,500 metric tons to 3,000 metric tons in its Kolkata unit.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Dec 6, 2023, 2:29 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates