Whenever we scrutinise stocks listed in the Indian stock market, we analyse their performance during the COVID-19 pandemic. We assess how these stocks behaved, and the extent of their decline, and calculate the returns from their lowest point to their peak values.

In this article, we will explore how various NSE indices performed during the same period, how much return they generated, and which index emerged as the champion in generating returns, and which index is currently standing strong during the current downfall.

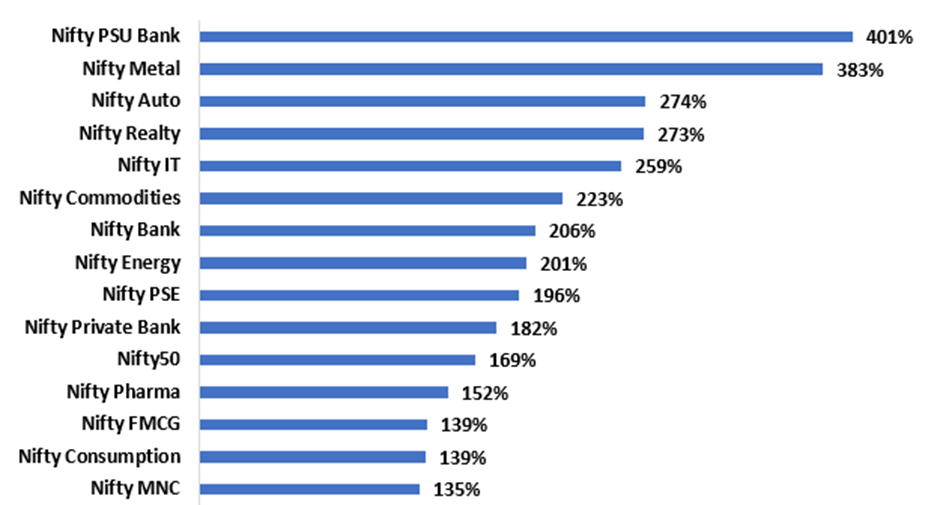

When we analyse the data, the Nifty PSU Bank index emerges as the top performer among various NSE indices. The Nifty PSU Bank index has delivered a multibagger return of 400%, calculated based on the low levels recorded during the COVID-19 breakdown and all-time high levels. If we calculate the return based on the current level compared to the COVID-19 lows, it still stands at an impressive 385%.

On the other hand, the index with the lowest return among all is the Nifty MNC index, which has generated a significant return of 135% when measured against the all-time high levels and 128% at the current levels. Even though this is the lowest return among the indices, it should be considered remarkable.

Turning our attention to the next category, we are comparing the performance of the indices not only by the return they generated but also by how quickly they reached their all-time highs.

According to this criterion, the Nifty IT index outperforms all other indices. It reached an all-time high of 39,447 on January 4, 2022, within just 656 days from the date it hit its COVID-19 low. During this period, it generated an impressive return of 201%.

On the other hand, the Nifty PSE index took the longest time to touch its all-time high, requiring 1,278 days to achieve this milestone. Nevertheless, it still generated an impressive return of 196%.

Now, it’s time to consider the third criterion we’ve chosen to determine the champion. As we know, after reaching their all-time high levels, almost all indices have experienced declines. So, the top performer in this context is the index which has fallen less compared to the others.

Two indices have emerged as the top performers, with only a slight difference in their performance. Both the Nifty Bank and Nifty Consumption indices have fallen by only 2%.

On the other hand, the Nifty IT and Nifty Energy indices reached their all-time high levels in 2022, but they are still struggling to regain those levels. Both indices are currently trading at a discount of 18% and 8%, respectively, from their all-time highs. Both indices have still demonstrated their performance by surpassing the all-time high levels of 2022.

There is one exception to note: the Nifty Media index. Despite generating a 134% return when comparing current levels to the COVID-19 lows, we did not include it in this analysis. This is because the index reached its all-time high of 3,676 in the pre-COVID year of 2018 and is currently trading 38% below its all-time high levels.

While the Nifty IT index and Nifty Energy Index reaching their all-time highs in 2022 is commendable in terms of speed, it becomes less impressive when we calculate the number of days elapsed. The IT index reached its high 641 days ago, and the Energy index achieved its high 526 days ago. This suggests a period of underperformance over an extended time.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 6, 2023, 5:04 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates