The shares of Indiabulls Housing Finance experienced a sharp rise today. The stock opened at Rs 128.95, which was 1.09% higher than the previous day’s closing price of Rs 127.55. During the intraday session, the stock surged by 8.43% with significant trading volume.

Upon analysing today’s share volumes, it is evident that there has been a substantial increase of more than 2.75 times in volumes on the BSE. As of the current moment, while writing this article, the shares of the company are up by Rs 10.75, trading at Rs 138.30 on the BSE.

The stock’s 52-week highs and lows are recorded at Rs 158.60 and Rs 91.80, respectively. With a market capitalisation of just Rs 6423.15 crore, the stock has displayed remarkable performance in recent times, especially when considering short-term durations, delivering a 12% return in just a week and an impressive 26% return in the last three months.

If we examine the company’s financials, in FY23, revenue from operations experienced a decline of 2.9% YoY, going from Rs 8983 crore to Rs 8719 crore. Interest income fell by 10.6% YoY, decreasing from Rs 8582 crore to Rs 7676 crore, while the interest expenses for the same period stood at Rs 5636 crore.

Furthermore, the net profit of the company amounts to Rs 1127 crore, which is a 4.3% YoY decline from the Rs 1177 crore recorded in FY22. The net profit margins stood at 11.36% in FY23.

The company’s return on capital employed (ROCE) and return on equity (ROE) are at 9.80% and 6.63%, respectively. The Book value of the company is Rs 368, whereas the Price to book value is only 0.37 times. Furthermore, the price-to-earnings ratio is 5.72 times.

Regarding ownership, the promoters do not hold any stakes in the company, while both foreign institutional investors (FIIs) and domestic institutional investors (DIIs) hold 18.53% and 16.12% in the company, respectively. Public Investors hold 60.47% of the company.

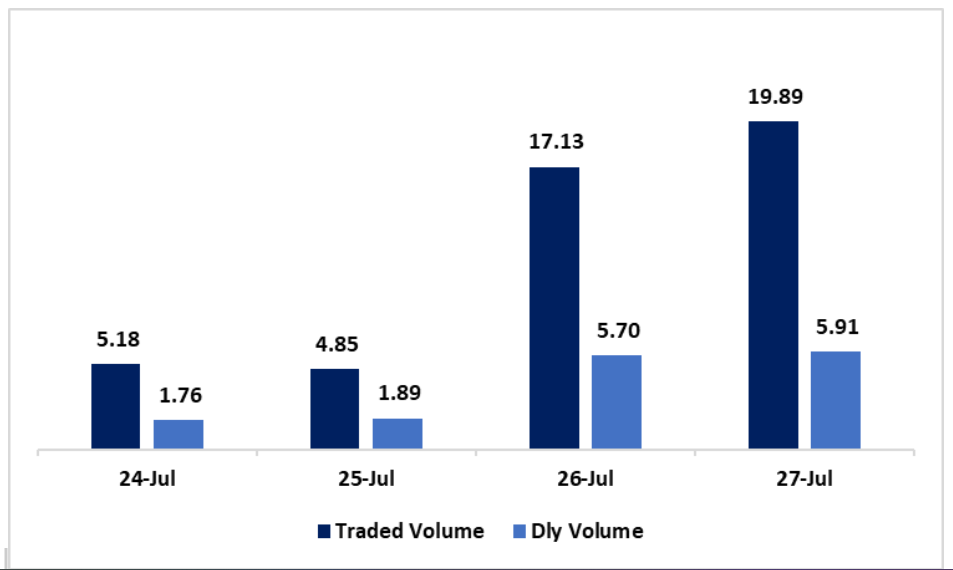

If we observe the trading volume and delivery volume for this week up to yesterday, the following are the findings:

| Date | Closing Price Rs | % Change | Traded Volume (Million) | Dly Volume (Million) | Dly % |

| 24-Jul | 122 | 0.30% | 5.18 | 1.76 | 34.08% |

| 25-Jul | 120 | -1.10% | 4.85 | 1.89 | 38.94% |

| 26-Jul | 126 | 4.50% | 17.13 | 5.70 | 33.25% |

| 27-Jul | 128 | 1.50% | 19.89 | 5.91 | 29.74% |

In the last two days, there has been a notable surge in trading volume, shifting from single-digit values to double-digits. On Monday, the volume stood at 5.18 million, and yesterday it reached 19.9 million.

Indiabulls Housing Finance Limited is a housing finance company based in India that provides a diverse range of financial services. These include home loans, home loan balance transfers, loans for micro, small, and medium enterprises (MSMEs), as well as a loan against property (LAP). It was established in 2005 and is a company authorized and supervised by the National Housing Bank (NHB).

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 28, 2023, 3:27 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates