Prakash Pipes Limited, a prominent player in the pipes industry engaged in the manufacturing of Polyvinyl chloride (PVC) Pipes, witnessed a significant surge in its shares today.

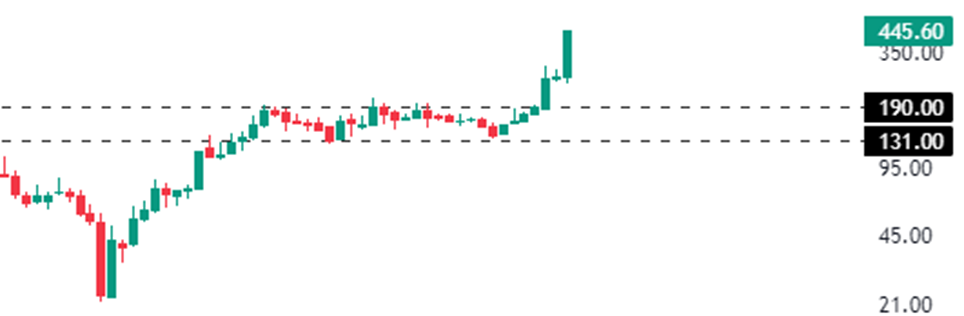

The stock opened trading at Rs 414.05 per share, reflecting a 2.22% increase compared to the previous day’s closing price of Rs 405 per share on the BSE. As of writing this article, the stock is trading at Rs 445.55 per share, marking an impressive gain of 10% from its previous closing price. It reached the upper circuit price limit of 10%, indicating strong demand, with no sellers willing to part with their shares.

Furthermore, the stock hit the upper circuit for the second consecutive day, with the only difference being that yesterday it locked in a 20% upper circuit price limit, and today it’s at 10%. Moreover, it reached a 52-week high price of Rs 445.55 per share today.

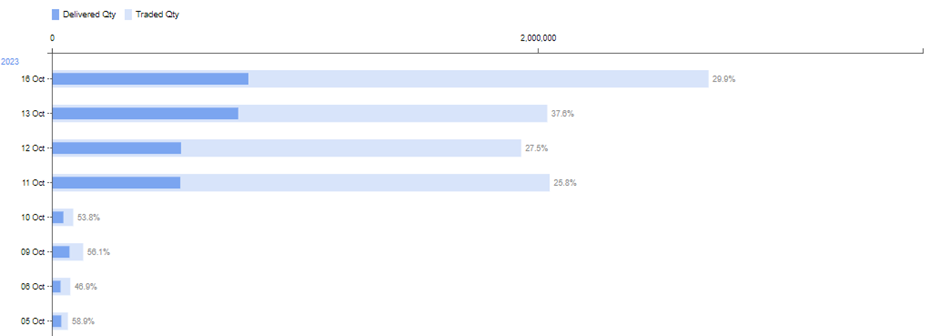

Additionally, there was a significant uptick in the trading volumes of the company’s stock today, which were 1.2 times higher than its average daily volumes.

The current market capitalization of the company stands at Rs 1066 crore, and the stock has exhibited exceptional performance in recent periods, delivering an impressive multibagger return of 564% over the past three years.

Prakash Pipes Limited is an India-based company specializing in the production of polyvinyl chloride (PVC) pipes and associated fittings. The company’s operations are divided into two main segments: PVC pipes & fittings and Flexible Packaging. Under the PVC pipes & fittings segment, they offer a wide range of products such as unplasticized polyvinyl chloride (uPVC) pipes, plumbing pipes, casing pipes, chlorinated polyvinyl chloride (CPVC) pipes, column pipes, garden pipes, soil, waste and rain (SWR) pipes in both selfit and ringfit varieties, plumbing uPVC pipes, fittings, and water tanks.

In its flexible packaging division, it serves various industries including fast-moving consumer goods (FMCG), food and beverages, infrastructure, and pharmaceutical products. Their flexible packaging offerings encompass multi-layer laminates, multi-layer pouches, blown PE film, printing cylinders, and printing inks.

In the June quarter of FY24, the company witnessed a decline in its revenue from operations, from Rs 192 crore to Rs 176 crore, marking an 8.5% decrease. The company reported an operating profit of Rs 23 crore, compared to Rs 22 crore in the corresponding quarter of the previous year. The operating profit margin stood at 13% during the June quarter.

Meanwhile, the company’s net profit for the quarter amounted to Rs 18 crore, a significant decline compared to the profit of Rs 25 crore in the corresponding quarter of the previous year. In the last quarter of FY23, the company reported a net profit of Rs 20 crore.

The ROCE (Return on Capital Employed) and ROE (Return on Equity) are 29% and 22.8%, respectively. The company’s shares are trading at a P/E (Price-to-Earnings) ratio of 26.5 times in the market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 17, 2023, 11:57 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates