Nucleus Software Exports Limited, a prominent player in the IT industry, experienced a significant increase in its share price today. The company is known for providing lending and transaction banking products to the financial services industry.

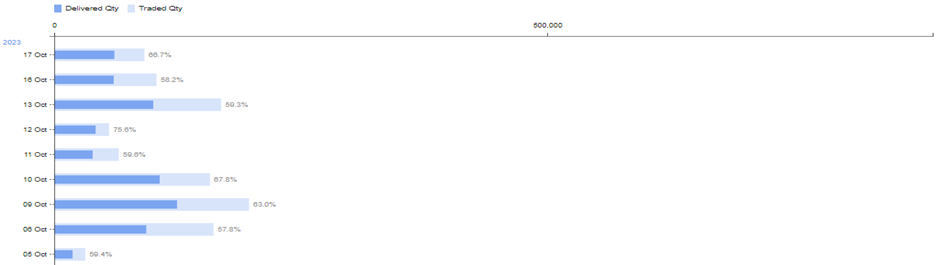

The stock opened trading at Rs 1,201 per share, opening almost flat compared to the previous day’s closing price of Rs 1,197.90 per share on the BSE. As of writing this article, the stock is trading at Rs 1,317.65 per share, marking an impressive gain of 10% from its previous closing price. It reached the upper circuit price limit of 10%, indicating strong demand, with no sellers willing to part with their shares.

Furthermore, it reached a 52-week high price of Rs 445.55 per share today. Additionally, there was a significant uptick in the trading volumes of the company’s stock today, which were 1.7 times higher than its average daily volumes.

The current market capitalization of the company stands at Rs 3,527 crore, and the stock has exhibited exceptional performance in recent periods, delivering an impressive multibagger return of 233% over the past year.

Nucleus Software Exports Limited provides lending and transaction banking solutions to the financial services industry. They develop and market software and services for businesses in banking and finance, with operations based in Noida, Uttar Pradesh. The company operates in seven geographic segments: India, Southeast Asia, Europe, the Middle East, Africa, and Australia. Their key products are FinnOne Neo for lending and FinnAxia for corporate banking transactions, including retail and corporate lending, digital channels, lending analytics, advisory services, and cash management.

The company has yet to declare the September quarter result. In the June quarter of FY24, the company witnessed a significant increase in its revenue from operations, rising from Rs 129 crore to Rs 207 crore, marking a 61% increase. The company reported an operating profit of Rs 63 crore, compared to Rs 15 crore in the corresponding quarter of the previous year. The operating profit margin stood at 30% during the June quarter.

Meanwhile, the company’s net profit for the quarter amounted to Rs 54 crore, a significant increase compared to the profit of Rs 11 crore in the corresponding quarter of the previous year. In the last quarter of FY23, the company reported a net profit of Rs 68 crore.

The ROCE (Return on Capital Employed) and ROE (Return on Equity) are 27% and 20%, respectively. The company’s shares are trading at a P/E (Price-to-Earnings) ratio of 19.7 times in the market. The book value of the company is Rs 228, and the stock is trading at 5.8 times in the market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 18, 2023, 11:56 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates