The Fertilizers and Chemicals Travancore Limited, a prominent player in the fertilizers space, engaged in the manufacturing of fertilizer and chemicals, witnessed a significant surge in its shares today.

The stock opened trading at Rs 546.65 per share, almost flat compared to the previous day’s closing price of Rs 548.40 per share on the BSE. As of writing this article, the stock is trading at Rs 658.05 per share, marking an impressive gain of 19.99% from its previous closing price. It reached the upper circuit price limit of 20%, indicating strong demand, with no sellers willing to part with their shares.

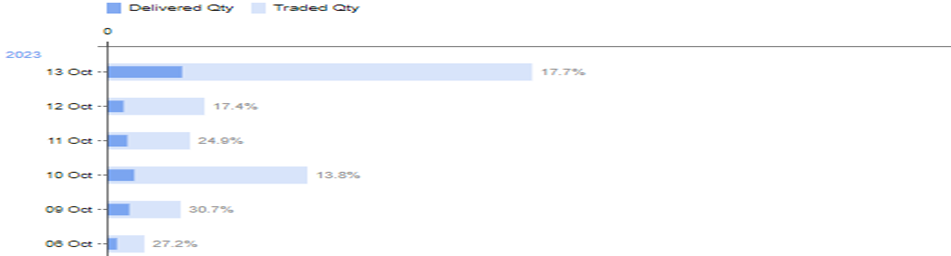

Additionally, there was a significant uptick in the trading volumes of the company’s stock today, which was 10.7 times higher than its average daily volumes.

The current market capitalization of the company stands at Rs 42,580 crore, and the stock has exhibited exceptional performance in recent periods, delivering an impressive multibagger return of 1450% over the past year.

The Fertilizers and Chemicals Travancore Limited is involved in the production of fertilizers and chemicals. It operates through two distinct segments: Fertilizer and Petrochemical. Within the fertilizer segment, the company manufactures products such as ammonium phosphate, ammonium sulphate, mixtures, and muriate of potash (MOP).

In the petrochemical segment, the company specializes in caprolactam. Their product range includes a variety of fertilizers like complex fertilizers, straight fertilizers, organic fertilizers, bio-fertilizers, imported fertilizers, and bagged gypsum. Caprolactam, a key product, is derived from raw materials such as benzene, sulphur, ammonia, and carbon dioxide, and by-products like anhydrous ammonia, nitric acid (55%), soda ash (off-grade), gypsum, sulfuric acid, and oleum.

The Cochin division boasts a production facility with a capacity of over 485,000 tons per annum (TPA) for complex fertilizer, approximately 330,000 TPA for sulfuric acid, and more than 115,200 TPA for phosphoric acid. Meanwhile, the Udyogamandal Plants have an installed capacity of approximately 76,050 tons of nitrogen.

In the June quarter of FY24, the company witnessed a decline in its revenue from operations, from Rs 1292 crore to Rs 1233 crore, marking a 4.7% decrease. The company reported an operating profit of Rs 147 crore, compared to Rs 183 crore in the corresponding quarter of the previous year. The operating profit margin stood at 12% during the June quarter.

Meanwhile, the company’s net profit for the quarter amounted to Rs 72 crore, a significant decline compared to the profit of Rs 137 crore in the corresponding quarter of the previous year. In the last quarter of FY23, the company reported a net profit of Rs 166 crore.

The ROCE (Return on Capital Employed) and ROE (Return on Equity) are 33.5% and 83.8%, respectively. The company’s shares are trading at a P/E (Price-to-Earnings) ratio of 65.6 times in the market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 16, 2023, 4:30 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates