The shares of Ind-Swift Laboratories Limited witnessed a significant surge today. The stock commenced trading at Rs 103.55, 0.70% up from the previous day’s closing price of Rs 102.85.

The stock’s 52-week high and low are Rs 123.40 and Rs 53 respectively. Possessing a market capitalization of Rs 729.13 crore, the stock has showcased outstanding performance in recent periods, yielding a 72% return in the last three months.

Upon scrutinizing today’s share volumes, it becomes apparent that there has been a substantial increase of over 4.32 times in trading volumes compared to its average volumes on the BSE. Finally, the shares of the company closed at Rs 123.40 each on the BSE.

Established in 1995, Ind-Swift Laboratories Ltd specializes in the production of Active Pharmaceutical Ingredients (APIs) and Advanced Intermediates, in addition to offering Contract Research and Manufacturing Services (CRAMS).

Financial Performance

In the June quarter of FY24, the company’s revenue from operations experienced a significant increase of 10.8% YoY, going from Rs 280 crore to Rs 310 crore. The operating profit of the company increased from Rs 53 crore to Rs 60 crore, and on a sequential basis, it decreased from Rs 64 crore to Rs 60 crore. The operating profit margin stood at 19% in the recent quarter.

Meanwhile, the net profit of the company amounts to Rs 17 crore, against a loss of Rs 25 crore in the last March quarter of FY23.

The company’s return on capital employed (ROCE) and return on equity (ROE) are at 13.2% and 10.4%, respectively. The book value of the company is Rs 109, which means the stock is trading at a price-to-book value of 1.13 times in the market, whereas the price-to-earnings ratio is 23.9 times.

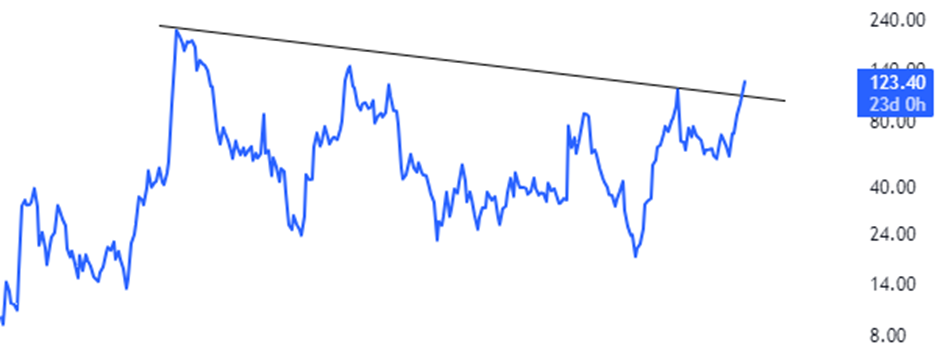

Here is the chart presentation of the company’s shares on the monthly time frame:

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 6, 2023, 5:56 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates