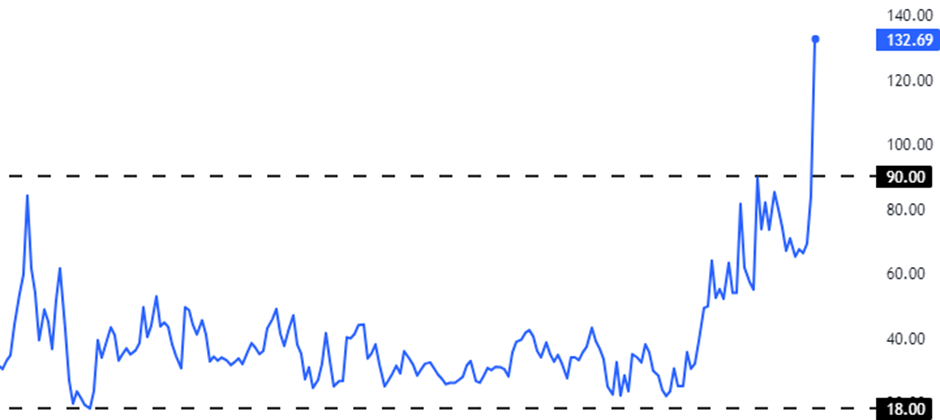

Shares of Nagpur Power and Industries Limited witnessed a significant surge today. The stock opened trading at Rs 112.02 per share, marking a moderate increase of 1.3% compared to the previous day’s closing price of Rs 110.58 per share.

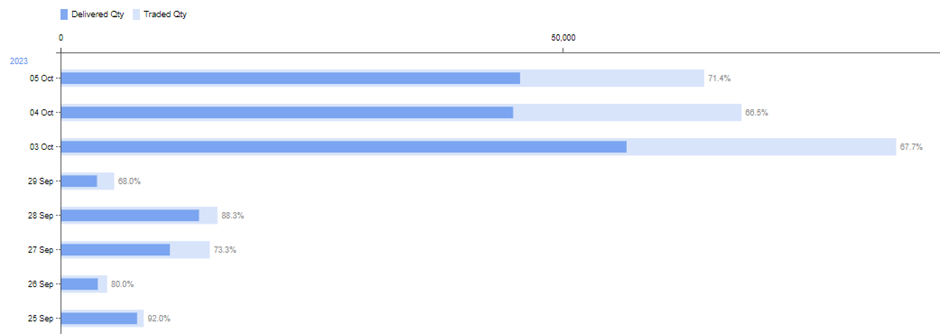

As of writing this article, the stock is trading at Rs 132.69, which is a 19.99% increase from its previous closing price, reaching the upper circuit price limit of 20%. Currently, there are no sellers willing to sell the shares in the market. Moreover, there has been a significant increase in trading volumes in the company’s stock, exceeding 4.6 times the daily average trading volumes.

Furthermore, the stock reached its 52-week high price today, with the 52-week high and low prices at Rs 132.69 and Rs 59, respectively. With a market capitalization of Rs 174 crore, the stock has demonstrated outstanding performance in recent periods, delivering a 95% return in just three months. Moreover, it has generated an impressive multibagger return of 490% over the last three years.

Nagpur Power and Industries Ltd specializes in the extraction of High/Medium /Low Carbon Ferro Manganese and Silico Manganese Slag. The company was incorporated in 1996. It is a key member of the Khandelwal Group of Companies, founded in 1946, with diversified business interests spanning manufacturing and service industries.

The company primarily operates a Metal Recovery Plant, specializing in the production of Low Ferro Manganese (Slag) through an efficient and profitable slag recovery process. However, it’s worth noting that there is no longer any reusable waste of fine particles left in the manganese slag, which had been previously disposed of at various locations within the factory premises and can no longer be recovered.

In the June quarter of FY24, the company’s revenue from operations experienced a decline of 10% YoY, decreasing from Rs 12.25 crore to Rs 10.56 crore. The company reported an operating profit of Rs 0.08 crore, compared to the operating profit of Rs 1.46 crore in the corresponding quarter last year.

Meanwhile, the net profit of the company amounted to Rs 0.97 crore, compared to the loss of Rs 2.33 crore in the corresponding quarter of the previous year. In the last quarter of FY23, the company also reported a net loss of Rs 2.88 crore.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 6, 2023, 1:57 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates