The shares of Prakash Pipes Limited experienced a sharp rise today. The stock opened at Rs 194.25, which was 2.25% higher than the previous day’s closing price of Rs 189.95. During the intraday session, the stock surged by approximately 20% with significant trading volume.

Upon analysing today’s share volumes, it is evident that there has been a substantial increase of more than 4.81 times in volumes than its normal trading volumes on the BSE. As of the current moment, while writing this article, the shares of the company are up by Rs 34.70, trading at Rs 224.65 on the BSE.

The stock’s 52-week highs and lows are recorded at Rs 227.90 and Rs 134, respectively. With a market capitalization of just Rs 537.33 crore, the stock has displayed remarkable performance in recent times, especially when considering short-term durations, delivering a 22.3% return in just a week and an impressive 43% return in the last three months.

Furthermore, in the last three years, it has delivered a multibagger return of 285% for its investors.

It had been trading in a range and consolidating for a long time. Today, with a significant increase in volume, it broke out of the consolidation. Below is the chart presentation of the stock in a weekly time frame.

If we examine the company’s financials, in FY23, revenue from operations experienced an increase of 14.99% YoY, going from Rs 617 crore to Rs 709 crore. The operating profit of the company declined from Rs 77 crore to Rs 58 crore, the operating profit margin also declined from 13% to 8% in FY23.

Whereas, the net profit of the company amounts to Rs 71 crore, which is a whopping 51 % YoY increase from the Rs 47 crore recorded in FY22. The net profit margins stood at 10% in FY23.

The company’s return on capital employed (ROCE) and return on equity (ROE) are at 25.6% and 20.1%, respectively. The Book value of the company is Rs 116, whereas the Price to book value is only 1.93 times. Furthermore, the price-to-earnings ratio is 10.5 times.

Regarding ownership, the promoters hold 44.27% stakes in the company, while both foreign institutional investors (FIIs) and domestic institutional investors (DIIs) hold 0.31% and 0.02% in the company which is significantly low. Public Investors hold 55.39% of the company.

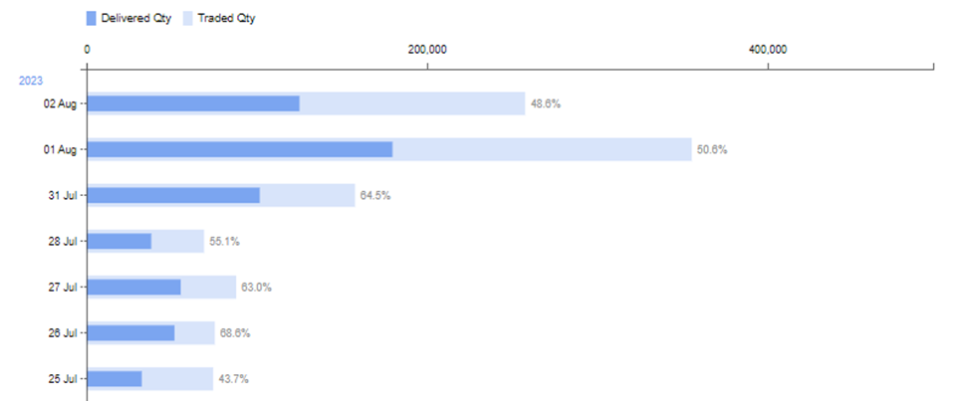

Below is the graphical presentation of the trading volume and delivery volume of the stocks:

In the last three days, there has been a significant surge both in trading volume as well as delivery volumes.

Prakash Pipes Limited, an India-based company, specializes in the manufacturing of polyvinyl chloride (PVC) pipes and fittings. The company operates its PVC business under the Prakash brand. It specializes in the production of PVC pipes, fittings, and packaging products. The company was established in June 2017 post demerger from Prakash Industries Limited.

In the flexible packaging division, the company offers applications for various industries, including fast-moving consumer goods (FMCG), food, beverages, infrastructure, and pharmaceutical products.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 3, 2023, 5:46 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates