The shares of Varanium Cloud Limited experienced a significant surge today. The stock opened trading at Rs 177 per share, representing a substantial 10% increase compared to the previous day’s closing price of Rs 159.65 per share on the NSE.

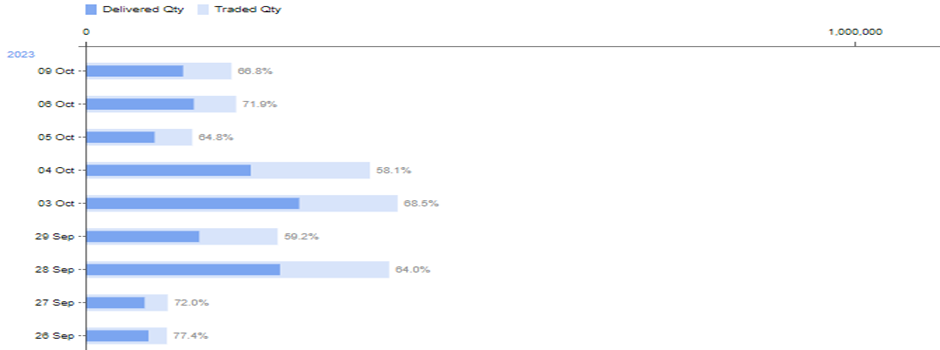

Towards the end of the trading day, the stock settled at Rs 191.55, marking an impressive 19.99% gain from its previous closing price. It reached the upper circuit price limit of 20%, indicating strong demand, with no sellers willing to sell shares during the afternoon trading session. Additionally, there was a significant uptick in the trading volumes of the company’s stock today.

The current market capitalization of the company stands at Rs 847 crore, and the stock has exhibited exceptional performance in recent periods, delivering an impressive multibagger return of 358% over the past year.

Varanium Cloud Limited is an Indian technology company specializing in digital audio and video services and financial blockchain solutions for streaming services (PayFac). The company operates on a software-as-a-service model, providing digital audio and video content streaming services to content owners and telecom operators in India and globally. Their offerings span both B2B and B2C segments and include services such as voice and video over Internet protocol (VoIP) solutions.

It also offers EdTech platforms for delivering low bandwidth digital education content, with a particular focus on non-urban areas, branded as Edmission. Their product portfolio encompasses Edmission (phy-gital) Learning Centre, JumpTalk (VoIP), online payment facilitation (PayFac) services, infrastructure as a service through Hydra Web Solutions, corporate and public Wi-Fi mesh services, and TUG Digital. Additionally, the company provides cable cloud services, delivering white-labeled cloud-based solutions for cable television and data.

In the June quarter of FY24, the company witnessed a substantial YoY increase in its revenue from operations, surging from Rs 71 crore to Rs 171 crore, marking a 227% growth. The company reported an operating profit of Rs 57 crore, which was the same as the operating profit in the corresponding quarter of the previous year. The operating profit margin stood at 34% during the June quarter.

Meanwhile, the company’s net profit for the quarter amounted to Rs 41 crore, a significant improvement compared to the profit of Rs 2 crore in the corresponding quarter of the previous year. In the last quarter of FY23, the company reported a net profit of Rs 29 crore.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 11, 2023, 11:23 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates