Shares of Shalibhadra Finance Ltd experienced a sharp rise today, hitting the upper circuit. It began the day at Rs 157, a flat opening compared to the previous day’s closing price of Rs 156.80. The stock surged by 20% during the intraday session with significant volume. Currently, while writing this article the shares of the company is up by Rs 31.35 and at Rs 188.15 on BSE.

Upon analysing today’s share volumes, there has been a significant increase of more than 2.76 times in volumes on the BSE.

The current market capitalisation of the company is around Rs 118 Crore. Its 52-week highs and lows are Rs 198.80 and Rs 119, respectively. The stock has displayed remarkable performance in recent times, delivering a 34% return in a week and an impressive 130% return in the last two years.

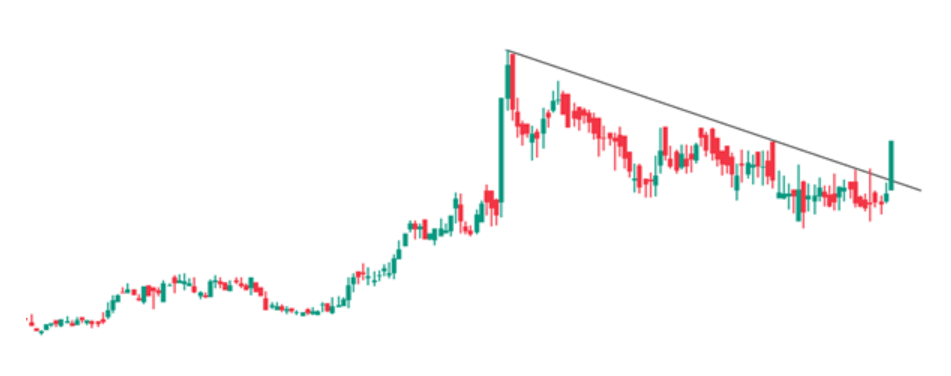

Below is the chat presentation of the stock on a weekly time frame:

If we check the company’s financials, in FY23 annual revenue experienced a substantial increase of 23.71% YoY, rising from Rs 22.31 Crore to Rs 27.60 Crore. The operating profit of the company stands at Rs 18.40 Crore, accompanied by an operating profit margin of 66.67%. Furthermore, the net profit of the company amounts to Rs 8.38 Crore.

The company’s return on capital employed (ROCE) and return on equity (ROE) are at 15.3% and 13%, respectively. The book value of the company is Rs 121, whereas the Price to book value is 1.55 times. Furthermore, the price to earnings is 14.1 times.

Regarding ownership, the promoters of the company possess 55.35% of the company’s shares. Whereas both foreign institutional investors (FIIs) and domestic institutional investors (DIIs) do not hold any stakes in the company. The remaining portion, which accounts for 44.64%, is owned by public investors.

Shalibhadra Finance Limited is a Non-Banking Financial Company listed on the Bombay Stock Exchange. It primarily caters to the rural, semi-urban, and underbanked regions in Gujarat, Maharashtra, and Madhya Pradesh and planning to enter states like Rajasthan, Karnataka, and Goa.

The company provides a diverse range of tailored retail products, including financing options for new and used two-wheelers, auto-rickshaws, four-wheelers, and consumer durables. Their focus lies in offering straightforward and fast small-ticket asset financing solutions, which yield high returns.

With its headquarters situated in Mumbai, the company currently has 42 branches and aims to reach over 100 branches by 2027. Presently, the company manages assets worth approximately Rs 130 Crore. The company is targeting to increase its Assets Under Management (AUM) to Rs 275 Crore by 2027 and currently employs around 170 staff members. Furthermore, it boasts an active customer base exceeding 1,00,000 clients.

As per the company, 75% of purchases in the Indian two-wheeler segment are funded by loans. According to the Statista report, the Indian two-wheeler loan segment is expected to grow at a Compound Annual Growth Rate (CAGR) of 11% annually.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 25, 2023, 3:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates