Shares of Kovilpatti Lakshmi Roller Flour Mills Limited witnessed a significant surge today. The stock opened trading at Rs 158, which was the same as the previous day’s closing price of Rs 158 each. What’s more, the stock hit an upper circuit limit of 20%, and currently, there are no sellers available on BSE.

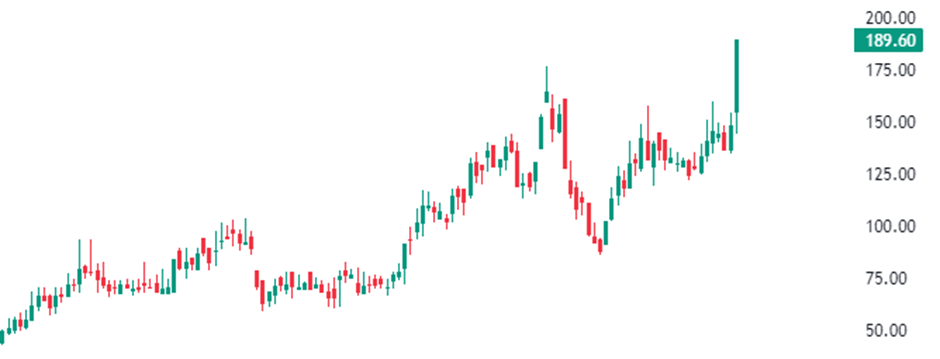

Furthermore, the stock reached a 52-week high today, with its 52-week high and low being Rs 189.60 and Rs 86.50, respectively. With a market capitalization of Rs 105 crore, the stock has demonstrated outstanding performance in recent periods, yielding a 28% return within just one month. Moreover, it has generated an impressive multibagger return of 825% in a decade.

When analysing today’s share volumes, it becomes apparent that there has been a substantial increase of over 8.10 times in trading volumes compared to its average volumes on the BSE. As of the time of writing, it is trading at Rs 189.60 and is locked into the upper circuit limit of 20%.

Kovilpatti Lakshmi Roller Flour Mills Limited, formerly known as KLRF Ltd, was established in 1964 and is one of the pioneers of post-independence industrialisation in India. Today, the company serves millions of customers across the states of Tamil Nadu and Kerala.

From humble beginnings as a flour mill, the company’s business has expanded to include two engineering units, a cast iron foundry, and sheet metal fabrication. In 1995, the company added a renewable energy business unit (KLRF Windmills) to achieve its goal of becoming carbon-neutral soon.

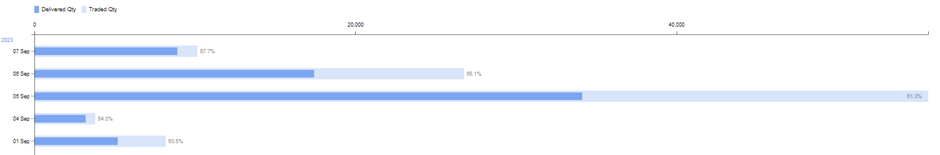

Here are the daily trading and delivery volumes in the company’s stock:

In the June quarter of FY24, the company’s revenue from operations experienced a modest increase of 2.36% YoY, rising from Rs 78 crore to Rs 80 crore. The company reported an operating profit of Rs 5.63 crore, compared to an operating profit of Rs 6.32 crore in the corresponding quarter last year. On a sequential basis, the operating profit increased from Rs 3.01 crore to Rs 5.63 crore.

Meanwhile, the net profit of the company amounted to Rs 2.67 crore, down from a profit of Rs 3.05 crore in the corresponding quarter last year.

Observing some important ratios, ROCE and ROE are 20.2% and 19.3%, respectively. The book value of the company is Rs 105, which means the stock is trading at a price-to-book value of 1.8 times in the market, while the stock is trading at a PE ratio of 10.6 times in the market.

Here is the chart presentation of the company’s shares on the weekly time frame:

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 8, 2023, 3:26 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates