Shares of Total Transport System Limited witnessed a significant surge today. The stock opened trading at Rs 133.05, remaining flat compared to the previous day’s closing price of Rs 132.80 per share. As of writing this article, the stock is trading at Rs 156, which is 17.47% up from its previous closing price. Moreover, it surged by 19.57% during the intraday session.

Its 52-week high price and low price are Rs 202.55 and Rs 116, respectively. With a market capitalization of Rs 251 crore, the stock has demonstrated outstanding performance in recent periods, yielding a 23% return in just one week. Moreover, it has generated an impressive multibagger return of 280% over the last three years.

Total Transport Systems Limited is an India-based company that provides logistics solutions. The company is engaged in the business of cargo consolidation/deconsolidation, freight forwarding, logistics, warehousing, and transportation.

The company has two segments: the multimodal transport operations segment is involved in non-vessel-owning common carrier operations related to less-than-container load consolidation and full container load forwarding activities in India and across the globe. The last mile delivery operations segment is included in the delivery of parcels as per the requirements of the principal.

In the June quarter of FY24, the company’s revenue from operations experienced a significant decline of 35% YoY, decreasing from Rs 176 crore to Rs 114 crore. The company reported an operating profit of Rs 2.64 crore, compared to an operating profit of Rs 5.16 crore in the corresponding quarter last year, resulting in an operating profit margin of 2.32%.

Meanwhile, the net profit of the company amounted to Rs 1.33 crore, which is 46% down compared to the corresponding quarter’s profit of Rs 2.67 crore last year. In the last quarter of FY23, the company reported a net loss of Rs 0.89 crore.

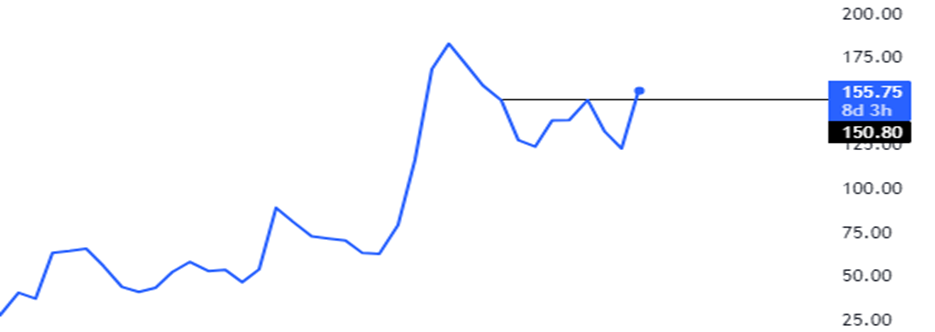

Here is the chart presentation of the company’s shares on the monthly time frame:

After examining the monthly candle on the stock chart, it appears to indicate promising future performance. Additionally, the stock is currently trading at a discount of approximately 25% from its all-time high levels, which could be the best buying area for long-term investors.

Investors should consider keeping a close watch on this stock.

Published on: Sep 21, 2023, 2:19 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates