Shares of DB Realty Limited witnessed a significant surge this month. Today, the stock commenced trading at Rs 140.99, marking a 3.7% increase compared to the previous day’s closing price of Rs 136 each on the BSE. During the intraday session, the stock exhibited a remarkable 8% surge accompanied by significant trading volume.

As of writing this article the shares of the company are up by Rs 5.22 which is 3.85% and are trading at Rs 141.24 each on the BSE.

The stock’s 52-week high and low are Rs 146.70 and Rs 52.50, respectively. Possessing a market capitalization of Rs 4965 crore, the stock has showcased outstanding performance in recent periods, yielding a remarkable 86% return in the last months and an impressive 1800% return in the past three years.

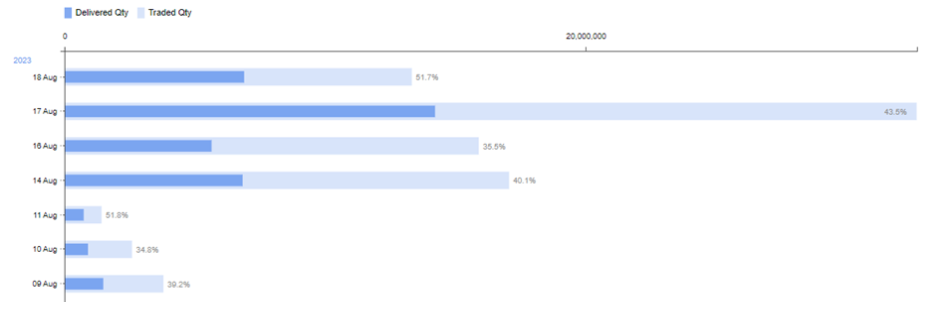

Below are the daily trading and delivery volumes of the shares in both NSE and BSE:

In the June quarter of FY24, the Company’s revenue from operations experienced a decline of 65% YoY, going from Rs 7 crore to Rs 2 crore. The operating loss of the company narrows from Rs 13 crore to Rs 9 crore and on a sequential basis too it declined significantly from Rs 44 crore to Rs 9 crore.

Whereas Company reported a net loss of Rs 26 crore against a net profit of Rs 8 crore in the corresponding quarter last year.

The company’s return on capital employed (ROCE) and return on equity (ROE) are negative as of now. The Book value of the company is Rs 60 which means the stock is trading at a Price to book value of 2.32 times in the market.

Established in 2007, the company primarily operates within the real estate sector, specializing in construction, development, and associated ventures. Its project scope is predominantly situated in the Mumbai region, spanning various phases of planning and construction. With a substantial portfolio, the company oversees more than 100 million sq. ft of premium property. The group’s expertise lies in real estate development encompassing residential, commercial, and retail ventures, including initiatives like mass housing and cluster redevelopment.

Here is the chart presentation of the company’s shares on the monthly time frame:

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 21, 2023, 6:41 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates