In India, technology companies are often known for regularly paying dividends to their shareholders. Companies pay dividends as a way to distribute a portion of their profits to shareholders, serving as a reward for their investment and a means of attracting and retaining investors. Additionally, these dividend payments can signal the company’s financial health and stability, potentially enhancing investor confidence and attracting new shareholders. The timing of dividend payments typically depends on the company’s dividend policy, which is determined by its board of directors. Generally, dividends are paid every quarter, although some companies may choose annual or semi-annual payments.

In this article, we will explore the returns, if any, an investor would have accrued had they invested Rs 1 lakh in TCS a decade ago and what the return would be today. Additionally, we will cover the total amount of dividends the investor would have received during the same period and whether it would have covered the initial investment amount.

According to TCS’s website, the tech giant has been distributing dividends to its shareholders since FY 2004-05. The highest dividend paid by the company was Rs 67 per share, which was a special dividend paid on February 03, 2023. This dividend represents 6700% of its face value.

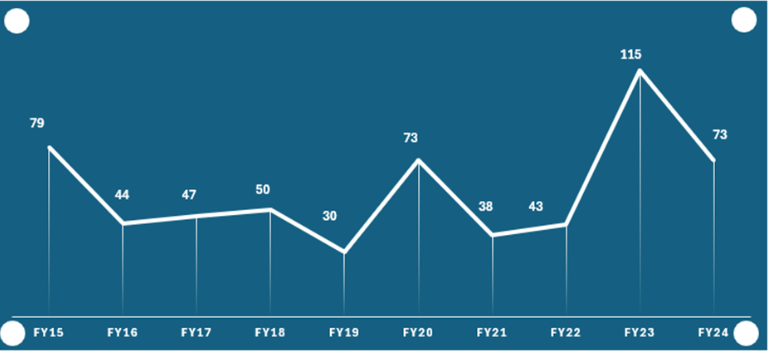

Furthermore, as per the data above, the highest dividend TCS, the tech giant, has paid was in FY2023, amounting to Rs 115 per share. This figure includes interim, final, and special dividends. Conversely, the lowest dividend amount was paid in FY2019, which included both final and interim dividends.

Let’s say someone invested Rs 1 lakh in TCS on April 1, 2014, when the share price was Rs 1088 per share. With this amount, the investor would be able to purchase around 92 shares of TCS. As for today’s closing price, TCS shares are priced at Rs 3870 per share, indicating an impressive growth of over 3.5 times in the past decade, or a rally of around 255% during the same period.

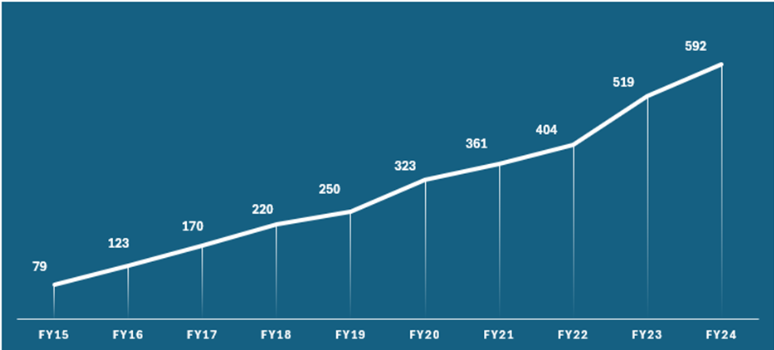

Additionally, the total dividend amount paid by the tech giant TCS is approximately Rs 592 per share during the past decade to every individual investor with investments in TCS shares. According to the above calculations, Rs 592 dividend per share would have resulted in a total dividend income of Rs 54,4646, which is over 50% of the initial capital invested a decade back.

In FY24, TCS reported a revenue of Rs 2,40,893 crore, representing a year-on-year growth of 6.85% from Rs 2,25,458 crore in FY23. The operating profit of the company stands at Rs 64,296 crore, with an operating profit margin of 27%, compared to an operating profit of Rs 59,259 crore during the same period. The net profit of the company stood at Rs 46,099 crore in FY24, compared to a net profit of Rs 42,303 crore during the same period.

The company’s Return on Capital Employed (ROCE) and Return on Equity (ROE) stand at 64.3% and 51.5%, respectively. Additionally, the company’s shares are trading at a Price-to-Earnings (PE) ratio of 30.1 times in the market.

Ownership-wise, the promoters maintain a 71.77% stake in the company, while Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) collectively own 12.70% and 10.61%, respectively. The remaining 4.86% stake is held by public shareholders.

Investors must keep this stock on their radar.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 30, 2024, 1:14 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates