The Gems and Jewellery sector, steeped in a history that dates back 5,000 years to the grandeur of the Indus Valley, now stands as one of the nation’s largest and most impactful businesses. Today, it contributes a dazzling 7% to India’s GDP and shines as a beacon in the realm of merchandise exports. This radiant sector, steeped in tradition and craftsmanship, has not only enriched the nation’s coffers but has also adorned the lives and aspirations of millions.

Let’s embark on a journey to simplify the analysis of the gems and jewellery industry

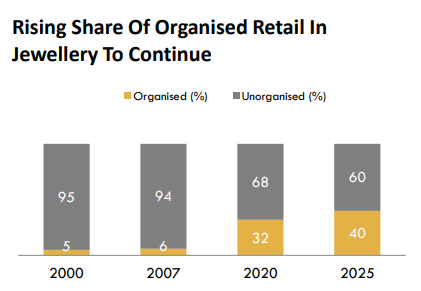

A decade ago, the gems and jewellery sector was predominantly unorganized, commanding an 85% market share. Today, this landscape has shifted significantly, with organized players making substantial inroads, reducing the unorganized sector’s market share to 65%.

In this industry, pricing power remains elusive. Intense competition prompts every player to offer the most competitive prices. Consequently, profit margins often become razor-thin. Moreover, the cyclical nature of gold prices compounds the challenge, as immediate price fluctuations cannot always be passed on to consumers.

The industry grapples with foreign currency exposure, primarily because a significant portion of raw bullion is imported. Compounding this, India’s status as a major global exporter in the industry intensifies the currency risk.

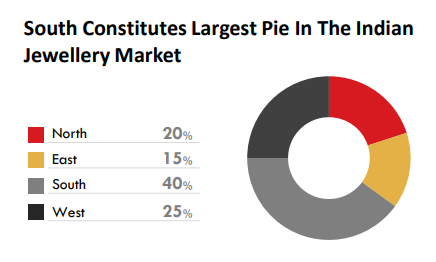

The industry serves a diverse customer base, with rural areas accounting for approximately 60% of clientele, while urban areas make up the remaining 40%. South India emerges as a focal market, representing a substantial 40% of the nation’s demand.

Interestingly, the industry’s fortunes sway with nature. Monsoon patterns, which affect crop yields, significantly influence gold demand. Robust monsoons often translate to increased rural demand. Additionally, the marriage calendar acts as a seasonality factor, with weddings typically commencing in August and continuing through February, shaping demand trends in this glittering realm.

India’s insatiable appetite for gold, coupled with limited domestic production, necessitates substantial gold imports. This hefty import bill exerts pressure on the country’s foreign exchange reserves. In response to this demand-supply conundrum, the Indian government has, at times, implemented regulatory measures to balance the scales. In a notable instance, back in 2014, authorities imposed import duties and mandated the export of a percentage of imported gold. These measures aimed to manage the forex outflows and stabilize the domestic gold market.

The gems and jewellery business thrives on innovation and variety to stay competitive. Consequently, it’s inherently capital intensive, requiring substantial working capital for purchases and inventory management. A crucial metric to watch for here is inventory turnover; higher efficiency in this area often leads to enhanced margins.

The industry is experiencing a transformative shift from being working capital intensive (WC) to increasingly fixed capital intensive (FC). While the former, backed by gold, posed fewer concerns, the latter introduces new risks. In a sector where bigger often means better, companies are expanding rapidly, opening new stores, and integrating vertical segments to capitalize on economies of scale. Investors are cautious due to Corporate Governance issues in the industry.

Companies in the gems and jewellery sector are expanding their horizons by adopting both the Company Owned, Company Operated (COCO) and Franchise Owned, Company Operated (FOCO) models. This diversification strategy allows for greater flexibility in managing capital.

As the proportion of franchise-owned or leased stores increases, the capital burden on the company decreases significantly. This asset-light approach not only conserves capital but also insulates the company from the impacts of lower regional demand.

Capex per Square Foot: Evaluates the capital investment efficiency in retail space.

Debt per Retail Outlet: Measures the financial leverage and debt burden per outlet.

Proportion of Stores to Achieve Breakeven: Identifies the number of stores needed to reach profitability.

Conversion Rate of Customers: Measures the effectiveness of turning visitors into buyers.

Growth in Downturn: Assesses the industry’s resilience during economic downturns.

Average Selling Price: Reveals the pricing strategy and customer preferences.

Revenue from Studded Jewellery: Highlights the contribution of high-value products.

Spending per Customer: Gauges consumer purchasing power and behaviour.

Inventory Turnover: Measures the efficiency of inventory management.

Cash Conversion Cycle: Analyses the cash flow efficiency through the entire sales process.

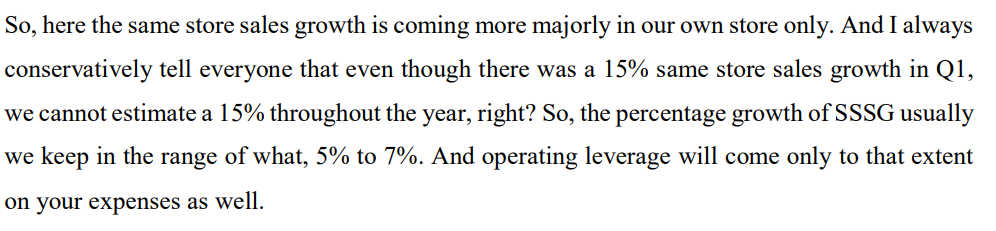

Same Store Sales Growth (SSSG)

In the gems and jewellery industry, same-store sales growth is a vital metric. While overall revenue growth can be misleading due to new store openings, this metric focuses exclusively on existing stores. It reveals the genuine health of a business by highlighting how well-established outlets are performing, allowing investors to gauge a company’s core strength and resilience.

Kalyan Jewellers Management on SSSG

Kalyan Jewellers Management on SSSG

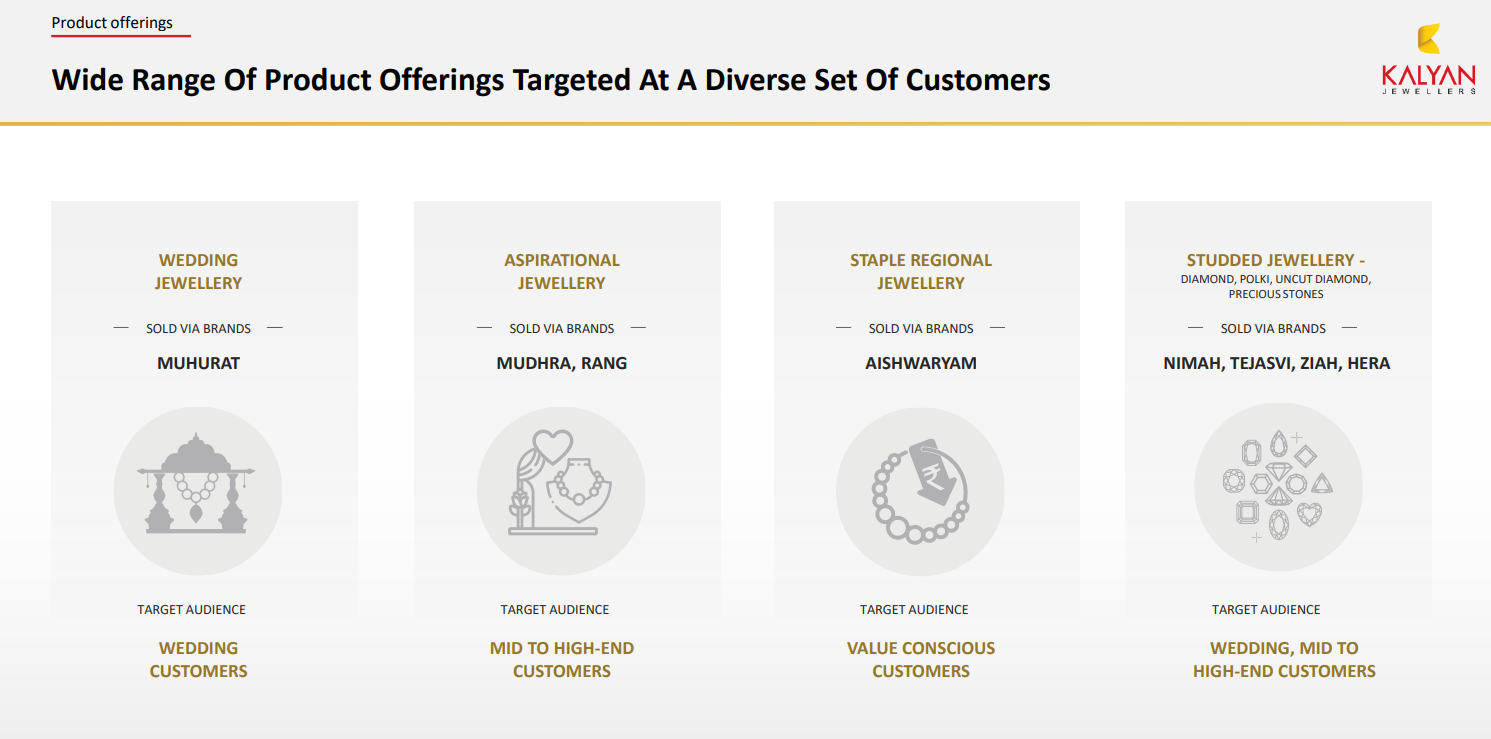

Competitive industry needs product diversification.

In the multifaceted world of gems and jewellery retailing, investors must consider various factors. Fierce price-based competition, earnings volatility, regulatory risks, and capital intensity define the landscape. However, businesses with substantial scale and diversification wield competitive strengths, enhancing their resilience in this glittering industry.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 10, 2023, 11:50 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates