Divi’s Laboratories Ltd. is a holding company, which engages in the manufacture of active pharmaceutical ingredients, intermediates, and nutraceutical ingredients. It also provides manufacturing of generic APIs, nutraceutical ingredients, and custom synthesis for big pharma. The company was founded by Murali Krishna Prasad Divi on October 12, 1990 and is headquartered in Hyderabad, India.

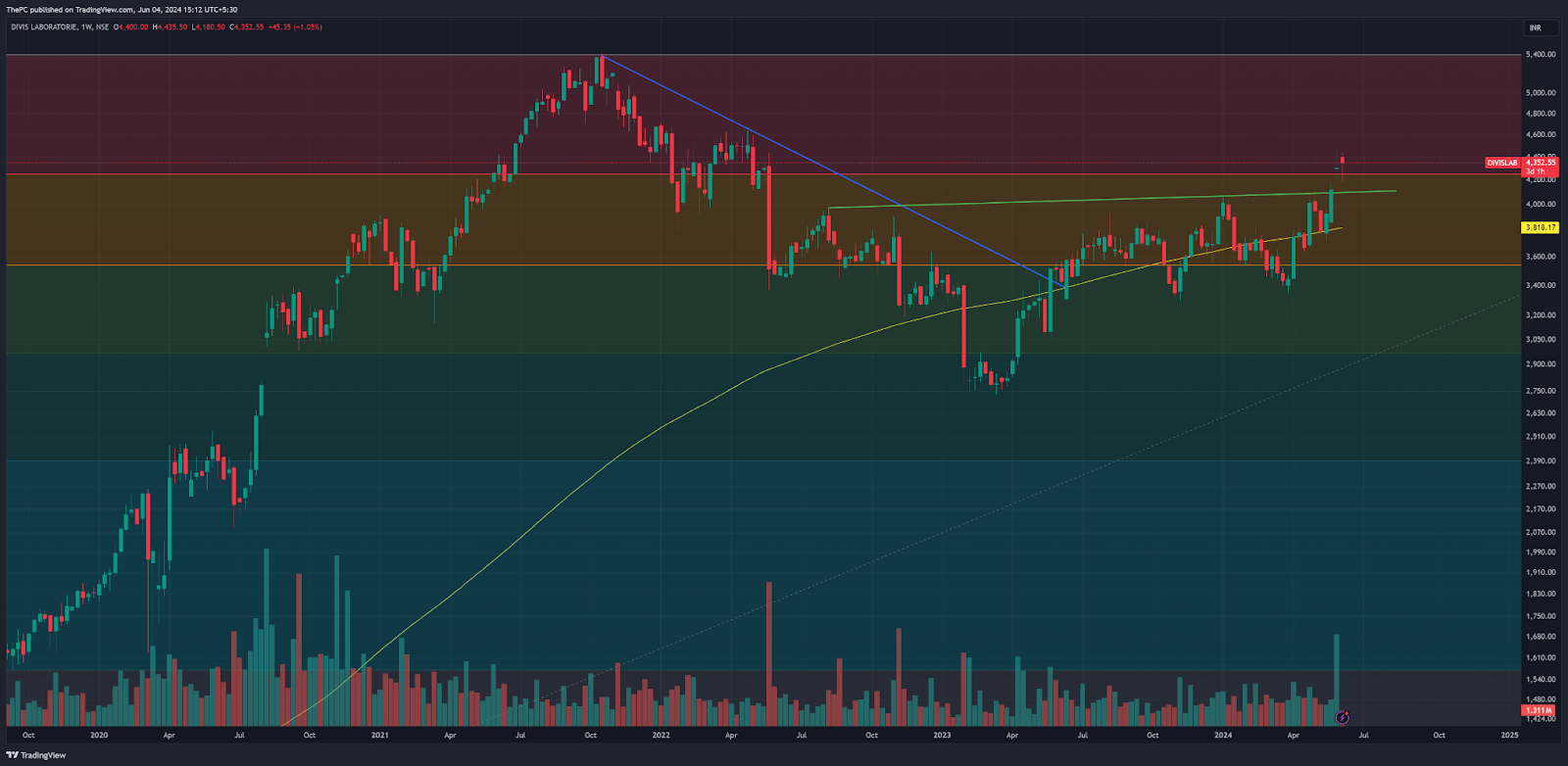

Divi’s Lab’s stock trajectory since mid-October 2021 has been marked by a period of consolidation after reaching a peak of Rs 5425. The stock found solid support at the 50% Fibonacci retracement level, bolstered by the 200-day moving average, suggesting strong underlying market support. This phase has been characterized by a broad trading range, establishing a long term trend reversal pattern known as Inverted Head & Shoulder.

The breakout level for this pattern is set at Rs 4100, a level delineated by connecting the highs from first week of August 2022 and last week of April 2024. Recently stock registered a breakout of this pattern and witnessed a throwback rally in which stock retested the breakout trendline.

Currently, stock is consolidating in a range from last week just above the mentioned breakout level. Move above the recent swing high of Rs 4467.50 level will be the confirmation of trend continuation, setting the stage for a potential upward movement towards Rs 5150, which represents a substantial 25% increase from the breakout point. This bullish scenario is supported by the stock’s strong momentum and defensive nature in the markets correction.

Divi’s Laboratories Ltd. stands out as a potentially lucrative investment opportunity, particularly for those interested in the Defensive pharma sector to hedge their portfolios. The company’s strategic market positioning and strong technical setup in weakened market sentiments indicate a promising outlook. Investors are advised to closely monitor the stock, which could herald a significant growth phase for the stock.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Jun 4, 2024, 6:55 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates