Ujjivan Financial Services is registered with the Reserve Bank of India as an NBFC-MFI under the category of Non-Banking Financial Company Micro Finance Institutions. The company’s stock is one that you should keep on your radar, as a significant name has appeared in the shareholding of the company.

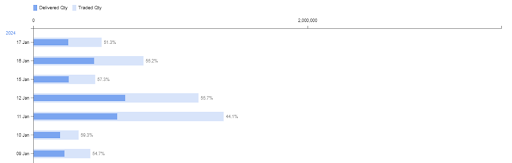

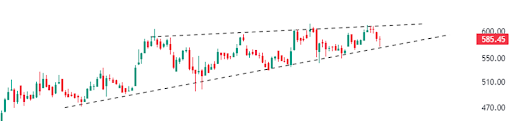

At the start of the day, the stock commenced trading at Rs 585.15 per share, below the previous day’s closing price of Rs 587.15 per share on the BSE. Throughout the trading session, it experienced intraday highs and lows of Rs 590.55 and Rs 571.40, respectively. As of writing the article it is trading at Rs 584.30 per share on the BSE.

Furthermore, the stock is currently trading below its 52-week high of Rs 614.7. Additionally, trading volumes on the BSE have surged, registering 1.06 times increase compared to its average trading volume.

If we analyse the company’s shareholding pattern, in the December quarter of FY24, the FIIs and DIIs hold 34.98% and 7.44% stakes in the company, respectively. The remaining 57.58% is held by public investors.

According to the latest update on the company’s website, the super investor Dolly Khanna purchased 1.13% of the company’s shares during the December quarter of FY24. The total number of shares Dolly Khanna added during the third quarter is around 13,74,146 shares.

The company has not yet announced its December quarter results. In the second quarter of FY24, the company reported revenues of Rs 1496 crore, reflecting a growth of 44% YoY compared to the same quarter in the previous year, when the revenue stood at Rs 1040 crore. The company posted an operating profit of Rs 966 crore for the quarter, in contrast to an operating profit of Rs 754 crore in the corresponding quarter of the previous year. Furthermore, the company reported a net profit of Rs 309 crore, compared to a net profit of Rs 315 crore in the same period last year.

The company’s Return on Capital Employed (ROCE) and Return on Equity (ROE) stand at 10.3% and 32.1%, respectively. Currently, the stock is trading at 8.57 times in the market.

Investors should keep an eye on this stock as it has experienced significant volume activity, and a super investor has entered the company by acquiring a stake.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 18, 2024, 4:55 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates