As the IPO landscape flourishes, DOMS Industries emerges as a highly awaited player. Explore with us as we delve into the key growth factors set to drive DOMS Industries in the forthcoming years. From its inception to strategic partnerships, DOMS Industries is poised for an impactful market debut, and we’re here to navigate through the intricate details.

The company has performed well giving robust CAGR of 72.69% and 73.45% in Gross Product Sales and revenue from operations, respectively, from Fiscal 2021 to Fiscal 2023

Tracing its origins to 1973, the company, founded by the late Rasiklal Amritlal Raveshia and the late Mansukhlal Jamnadas Rajani, began as ‘R.R. Industries,’ a partnership firm engaged in manufacturing pencils and crayons. In 2005, ‘S. Tech Industries’ was established by members of the Promoter Group, specializing in polymer-based scholastic stationery.

The company, then ‘Writefine Products Private Limited,’ strategically acquired both partnerships to streamline operations. In 2012, a pivotal alliance with FILA, a multinational Italian company, marked a significant chapter. FILA’s expertise catalysed international expansion, technological advancements, and global distribution of the flagship ‘DOMS’ brand.

An exclusive tie-up with select FILA entities further solidified the company’s global impact, embodying a commitment to innovation, quality, and sustained growth.

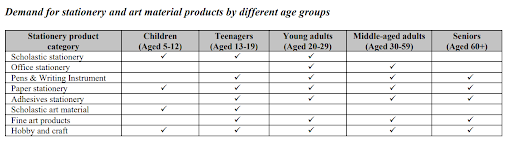

The diverse product portfolio, anchored by the flagship brand ‘DOMS,’ and enriched by sub-brands like ‘C3,’ ‘Amariz,’ and ‘Fixyfix,’ showcases strategic diversification and a customer-centric approach. While the journey started with a focus on wooden pencils, constituting 31.66% of Gross Product Sales, strategic evolution includes writing instruments under ‘DOMS’ in 2023, ‘Amariz’ fine-art products, and ‘Fixy Fix’ adhesive solutions.

Manufacturing excellence is upheld in Umbergaon, Gujarat, and Bari Brahma, Jammu and Kashmir. The Umbergaon facilities cover 34 acres, emphasizing vertical integration, and a recent acquisition of 44 adjacent acres enhances capabilities.

As of March 31, 2023, the extensive multi-channel distribution network spans 40+ countries globally. Domestically, reach extends through general trade, modern trade, e-commerce, and partnerships, with over 100 super-stockists, 3,750 distributors, and a dedicated sales team of 450+, covering 115,000+ retail points in 3,500+ cities and towns.

Demonstrating sustained financial prowess, remarkable growth is evident over the past three fiscal years. Robust CAGR of 72.69% and 73.45% in Gross Product Sales and revenue from operations, respectively, from Fiscal 2021 to Fiscal 2023. Notably, EBITDA Margin surged from 7.45% to 15.40%, and ROCE expanded from 0.36% to an impressive 33.31% over the same period, reflecting a commitment to value delivery and sustainable growth.

With a dedicated commitment to R&D and innovation, the company maintains high-quality standards and integrates technology into operations. Operating from a state-of-the-art facility in Umbergaon, Gujarat, equipped with modern machinery, the R&D team develops, tests, and evaluates products. Supported by an in-house design team, the company creates concept-driven designs catering to evolving consumer choices and trends. As of March 31, 2023, the R&D and design team comprises 45 personnel. This strategic emphasis positions the company at the forefront of technological advancements, ensuring product excellence and responsiveness to market dynamics.

| Revenue ($ billion) | |

| TOP 5 WORLD | |

| Faber-Castell | ~5.63 |

| MUJI | ~4.13 |

| Staedtler | ~0.42 |

| MAPED | ~0.14 |

| F.I.L.A. | ~0.11 |

The DOMS IPO has been met with strong investor demand on its first day of subscription, exceeding the offered shares by a significant margin. As of 11:45 IST, the IPO has received bids for 1,37,71,062 shares against the 87,63,333 shares on offer. This translates to an overall oversubscription of 1.57 times.

Here’s a breakdown of the subscription figures:

These figures highlight the strong interest in the DOMS IPO, particularly from retail investors. While the QIB portion is currently lagging, there is still time for it to pick up in the remaining subscription period.

With strong demand across investor categories, the DOMS IPO is likely to be a success and attract significant investment. The final outcome will be determined on December 15, the last day of subscription.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 13, 2023, 1:24 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates