DSP Mutual Fund is launching the DSP Nifty Bank Index Fund, an open-ended index fund that aims to mirror the performance of the Nifty Bank Index. The scheme invests in the 12 largest and most liquid banking stocks that comprise the Nifty Bank Index. The fund has no entry load and no exit load, with a minimum subscription amount of Rs. 100 and subsequent investments in any amount. The New Fund Offer period is open from May 15th, 2024 to May 27th, 2024. However, it’s important to note that there is no guarantee the fund will achieve its investment objective.

The investment objective of the DSP Nifty Bank Index Fund is to generate returns that are commensurate with the performance of the Nifty Bank Index, subject to tracking error. There is no assurance that the investment objective of the Scheme will be achieved.

This NFO of DSP Nifty Bank Index Fund is suitable for investors who are seeking long-term capital growth and investment in equity and equity-related securities covered by the Nifty Bank Index, subject to tracking error.

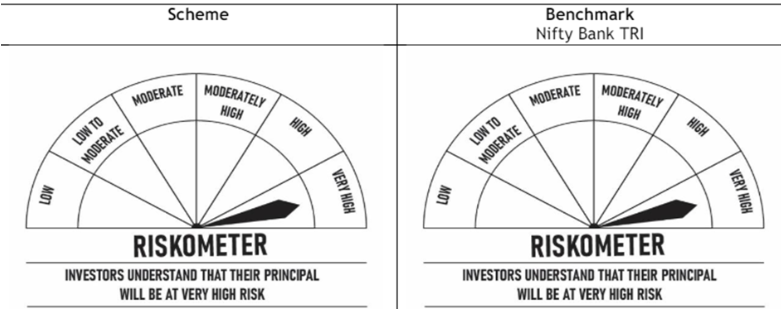

Risk-o-meter:

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and Equity Related Securities of companies constituting the Nifty Bank Index, the Underlying Index | Very High | 95 | 100 |

| Cash and Cash Equivalents | Very Low | 0 | 5 |

The performance of the DSP Nifty Bank Index Fund is benchmarked against the Nifty Bank TRI.

Mr. Anil Ghelani, with over 25 years of comprehensive experience, is a seasoned fund manager known for his astute financial acumen. Holding prestigious qualifications including Chartered Financial Analyst (CFA Institute USA) and Chartered Accountant (ICAI India), Mr. Ghelani brings a wealth of expertise to his role. After graduating from H. R. College, University of Mumbai with a B. Com., he has meticulously managed various schemes over the years.

Mr. Diipesh Shah, aged 44 and boasting over 22 years of rich experience in fund management, is a notable figure in the financial landscape. His educational background includes a B.Com. and ACA qualification, along with being a Level I candidate of the CFA Program by the CFA Institute USA. Mr. Shah’s adeptness in navigating the complexities of the financial markets has been honed over two decades, making him a trusted steward of investment portfolios.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as of – 14-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Motilal Oswal Nifty Bank Index | 05-09-2019 | 566.96 | 0.99 | -0.91 | 12.17 | 20.87 | 12.28 | -3.85 |

| Navi Nifty Bank Index Fund | 31-01-2022 | 537.19 | 0.80 | -0.87 | 11.97 | – | – | – |

| ICICI Prudential Nifty Bank Index Fund | 02-03-2022 | 398.64 | 0.87 | -0.66 | 12.01 | – | – | – |

| Nippon India Nifty Bank Index | 22-02-2024 | 103.53 | 0.83 | – | – | – | – | – |

| All Index Fund | – | – | – | 6.13 | 21.46 | 1.91 | 27.96 | 15.29 |

Data as of May 14, 2024

Elevate your savings strategy with our easy-to-use SIP Return Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 15, 2024, 11:31 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates