DSP Mutual Fund launched a new Exchange Traded Fund (ETF) named DSP S&P BSE Liquid Rate ETF (NFO) on March 15, 2024. This open-ended ETF aims to track the returns of the S&P BSE Liquid Rate Index, subject to minor variations. There is no entry load, and exit load is applicable only if redeemed in units other than the creation unit size. The minimum investment amount is Rs. 5,000. The offer closes on March 20, 2024.

The DSP S&P BSE Liquid Rate ETF seeks to provide returns before expenses that correspond to the returns of S&P BSE Liquid Rate Index, subject to tracking errors. There is no assurance that the investment objective of the Scheme will be achieved.

This NFO of DSP S&P BSE Liquid Rate ETF is suitable for investors who are seeking current income with high degree of liquidity, investment in Tri-Party REPO, Repo in Government Securities, Reverse Repo and similar other overnight instruments.

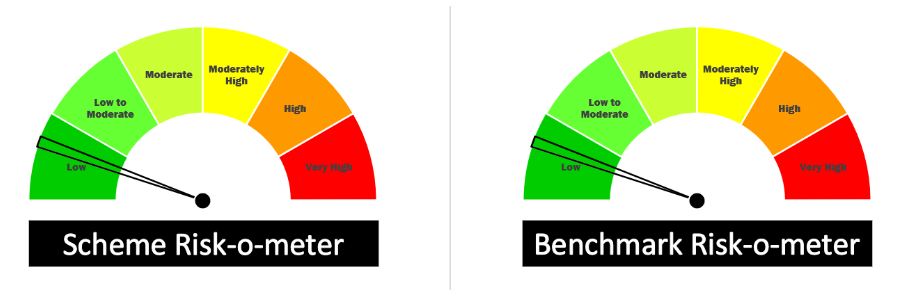

Potential Risk Class: it’s a close ended scheme, relativelylow interest rate risk and relatively low credit risk (A – I).

| Investments | Indicative Allocation | Risk Profile |

| Tri-Party REPOs, Repo in Government Securities, Reverse Repos and any other similar overnight instruments as may be provided by RBI and approved by SEBI | Minimum 95% – Maximum 100% | Low Risk |

| Cash and Cash Equivalents | Minimum 0% – Maximum 5% | Low Risk |

DSP S&P BSE Liquid Rate ETF will benchmark against S&P BSE Liquid Rate Index.

Anil Ghelani, age 44, with financial background, holding credentials as a Chartered Financial Analyst from the CFA Institute in the USA and a Chartered Accountant from ICAI in India. He earned his B.Com. degree from H.R. College, University of Mumbai. With over 25 years of experience, Ghelani is a seasoned expert in fund management.

Similarly, Mr. Diipesh Shah, age 45, brings over 22 years of experience to the table. He holds a B.Com. degree and is an Associate Chartered Accountant. Shah is also a candidate of the CFA Program, having cleared Level I.

| Scheme Name | NAV (Rs per Unit) | AUM (Rs. Cr) | Returns in %, As on March 15, 2024 | |||

| 1M | 1Y | 3Y | 5Y | |||

| Mahindra Manulife Liquid Fund Regular -Growth | 1,551.87 | 1,229.00 | 0.59 | 7.22 | 5.36 | 5.24 |

| Canara Robeco Liquid Regular Plan-Growth | 2,869.32 | 3,648.76 | 0.59 | 7.22 | 5.33 | 5.03 |

| Bank of India Liquid Fund Regular-Growth | 2,744.08 | 1,361.36 | 0.61 | 7.28 | 5.38 | 5.16 |

| Axis Liquid Fund-Growth | 2,653.79 | 33,841.39 | 0.6 | 7.24 | 5.36 | 5.22 |

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Mar 15, 2024, 12:40 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates